Submitted:

14 May 2025

Posted:

15 May 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

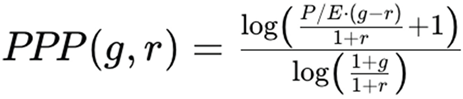

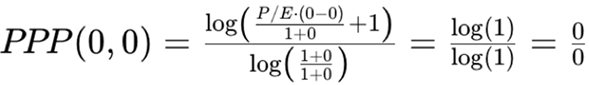

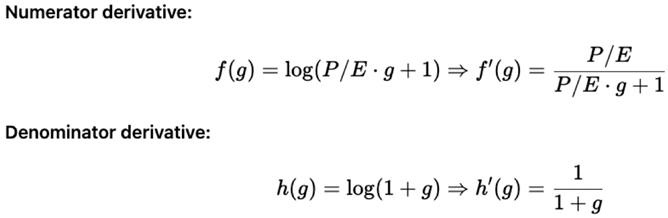

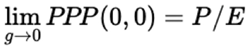

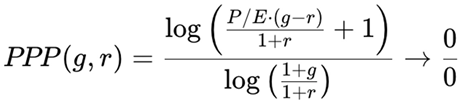

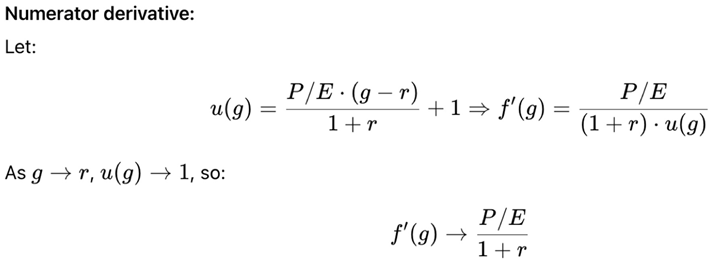

2. The PPP Formula and the Limiting Case: When g = r = 0

- P/E is the price-to-earnings ratio.

- g is the expected annual earnings growth rate.

- r is the discount rate, reflecting the time value of money and risk.

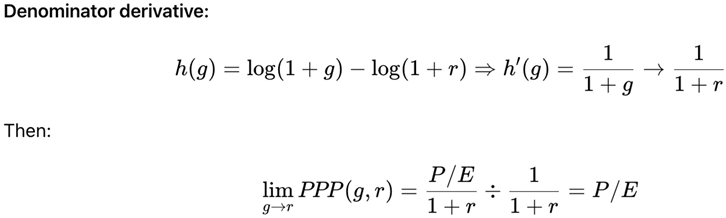

- Numerator → P/E

- Denominator → 1

3. Secondary Case: When g = r ≠ 0

4. Far-Reaching Implications for Stock Valuation

- Unified Valuation Tool: PPP provides a seamless valuation method that applies both to static, no-growth contexts (where it aligns with the P/E ratio) and to dynamic contexts involving positive growth, discounting, and risk. This unification brings consistency and analytical clarity to financial modeling.

- Time-Sensitive Insight: By measuring how long it takes to potentially recover the price paid for a stock through discounted future earnings, PPP introduces a temporal dimension that the P/E ratio entirely overlooks. This makes the PPP far more informative for long-term investors.Bridge Between Stocks and Bonds: The PPP, through its embedded discounting mechanism, aligns stock valuation closer to bond valuation principles. This allows investors to compare expected returns across asset classes more precisely, particularly through the PPP-derived Stock Internal Rate of Return (SIRR).

- Risk-Adjusted Valuation: Unlike the P/E ratio, which ignores volatility and market risk, the PPP can incorporate a discount rate that reflects the stock’s risk profile (e.g., via the CAPM framework). This makes PPP particularly powerful for cross-company or cross-sector comparisons.

- Applicability to All Companies: The PPP can be applied even to companies with low or negative earnings, high-growth startups, or turnaround stories — cases where the P/E ratio becomes meaningless or misleading. This extends the analytical universe available to investors and analysts.

- Strategic Insights in Global Investing: By calculating PPP values across markets and comparing implied SIRRs to local interest rates, investors can identify undervalued regions or sectors. This opens up new frontiers in global asset allocation and equity screening.

5. Conclusion

References

- L’Hôpital, G. de (1696). Analyse des Infiniment Petits pour l’Intelligence des Lignes Courbes. Paris: Imprimerie Royale.— The original work where L’Hôpital’s Rule was formulated, laying the foundation for limit-based calculus.

- Stewart, J. (2015). Calculus: Early Transcendentals (8th ed.). Boston: Cengage Learning.— Widely used textbook covering calculus principles including L’Hôpital’s Rule and limits.

- Damodaran, A. (2012). Investment Valuation: Tools and Techniques for Determining the Value of Any Asset (3rd ed.). Wiley Finance.— Provides foundational understanding of the P/E ratio and introduces dynamic valuation tools.

- Sam, R. (2023). StockInternalRateOfReturn.com. Retrieved from https://www.stockinternalrateofreturn.com — Authoritative source on the development and application of the Potential Payback Period (PPP) methodology.

- Brealey, R. A., Myers, S. C., & Allen, F. (2020). Principles of Corporate Finance (13th ed.). McGraw-Hill Education. — Key reference for understanding discount rates, the time value of money, and capital asset pricing model (CAPM).Graham, B., & Dodd, D. L. (2009). Security Analysis (6th ed.). McGraw-Hill. — Classic reference discussing intrinsic value and the limitations of static valuation metrics like the P/E ratio.

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).