1. Introduction

Entering the era of digital evolution characterized by rapid advances in information technology and increasingly developing lifestyles causing changes in people's lives. The ease and speed of access to information such as social media with various positive and negative things in it can have an influence on its users. Social media users compete to show off their lives, causing other users to share their high standard of living. The high standard of living resulting from the bad influence of social media should be responded to properly by having a policy regarding finances. Young people, especially students, have the nature of being receptive to new things and are easily influenced by luxurious styles and lifestyles . Students tend to allocate their funds more often to fulfill what they want rather than what they need . Consumptive behavior carried out by students continuously causes Personal financial management is not an easy thing to do.

Financial budgets and recording expenses can help students evaluate whether they have managed their finances well or not. Thus, from the results of the survey conducted by researchers, it can be concluded that the majority of Surabaya State University Accounting Education students who have taken financial management courses are still unable to manage their personal finances well. Personal financial management is an art and science in managing individual and household finances (Gitman & Zutter, 2012). Personal financial management is an important thing to do for a person's well-being in the future , because a person can get used to being thrifty in finances . The component of society that has quite a big influence on the economy of the city of Surabaya is students (Chotimah & Rohayati, 2015) . Students who are not equipped with financial knowledge have the possibility that students will have difficulty managing their personal finances. Someone who If you are not used to managing your finances then what will happen is that there will be more and more uncontrolled spending which can be detrimental to yourself. From the explanation of the variables above, there is a research gap as stated by Atika and Rohayati (2017) , Yushita (2017) and Laily (2013) that financial literacy has a significant effect on personal financial management, while research by Maulita and Mersa (2017) states that there is no effect. towards personal financial management. Research by Wulandari and Hakim (2015) and Chotimah and Rohayati (2015) states that financial education in the family has a positive and significant influence on personal financial management, while research by Maulita and Mersa (2017) states that there is no influence on personal financial management. Research conducted by Chotimah and Rohayati (2015) , Wulandari and Hakim (2015) and Hidayat (2018) states that peers have a positive and significant influence on personal financial management, while in Putra's research (2013) there is a significant perception of social influences such as friends, parents, office colleagues and others have no influence on personal financial management. Putra (2013) indirectly stated that there was no influence. Research conducted by Herlindawati (2015) and Apsari (2013) states that self-control has a positive and significant effect on personal financial management, while research by Aliffarzani (2015) states that there is no influence of self-control on personal financial management. The objectives of this research include: 1. Analyzing the influence of financial literacy, financial education in the family, peers and self-control on personal financial management. 2. Analyze the influence of financial literacy on management finance personal. 3. Analyze the influence of financial education in the family on financial management. 4. Analyze the influence of peers on personal financial management. 5. Analyze the influence of self-control on personal financial management.

2. Literature Review

2.1. Self Control

fourth factor plays a role in increasing Personal financial management is self-control. Otto, et al (2007) say that self-control is an activity that can encourage individual behavior to take savings and suppress impulsive purchases. Putri and Susanti (2018) in their research said that the importance of self-control in a person when they want to make decisions before behaving. A person's psychological factors are important for controlling oneself and managing one's finances as well as possible by restraining uncontrolled spending before making financial decisions . Naomi and Mayangsari (2008) stated that the factor that can cause someone to make consumptive purchases is a lack of self-control. Impulsive purchases can be restrained if a person has the capacity to restrain the desire by considering the conditions that are likely to occur. Students with good self-control will make it easier for students to manage their finances to meet their needs. In this way, students can minimize consumptive actions by implementing good self- control.

Based on the differences in research results, the researchers studied further regarding personal financial management among students. The author wants to conduct research with the title "The Influence of Financial Literacy, Financial Education in the Family, Peers and Self-Control on Personal Financial Management of Accounting Education Students, Faculty of Economics, Surabaya State University" simultaneously and partially.

2.2. Financial Education

second factor is thought to play an increasing role Personal financial management is financial education in the family. Widayati (2014) said that family financial management education contributes to shaping students' attitudes by providing an example given by parents to foster a positive attitude regarding finances, so that it is easier for students to manage their personal finances. Supported by research by Jorgensen (2007) , students who learn a lot about managing finances from their parents tend to have a better attitude towards finances than those who do not learn how to manage finances from their parents. Family plays an important role in children's learning process about all things, one of which is finance. Developing financial management behavior is something that is done intentionally or not through learning in the family. The important role of parents to be a role model for their children in their development towards adulthood . Education in the family environment is also important to realize that by giving an example of children's attitudes towards their finances through pocket money . Providing pocket money can show parents' trust in their children to have financial responsibility so that children can manage their own finances when they want to spend them. Financial education will shape children to have financial literacy so that children are able to manage finances independently. Parents who teach their children from a young age to be frugal and wise with the money they have, the habit will form in a child to be frugal and wise with personal finances.

2.3. Peers Factor

Third factor is thought to play an increasing role Personal financial management is that of peers. Lusardi and Mitchell (2010) said that one of the providers of financial information and advisors to children is their peers. The student socialization process that is most often carried out and plays a very important role is with peers. Students tend to be easily influenced by the social environment outside the family and school with influence from their closest friends. Students who live far away or apart from their families will spend a lot of time with peers who are relatively the same age, so friends have a strong influence because they have more free time together. In children's development, peers play an important role, one of which is providing information about the world outside the family. Children receive feedback regarding abilities or self-evaluation from peers regarding good and bad things. One of the most important functions of a peer group is to provide information about all things both in the surrounding environment and outside the family environment. According to Piaget and Sullivan (in Santrock, 2007: 205) through peer groups, adolescents have a positive positive from Friend they about ability they. In friendship, children can express themselves their opinions regarding standards of social behavior between friends. The peer environment provides support For Study And ask about various things that are not understood. Through interaction with peers, children will be able to learn to interact with the environment outside the family.

Good relationships between peers will be able to help teenagers socialize well (Santrock 2007:225). Less children socialize And No near with Friend peers will risky suffer depression. Importance Friend Peers for students can have both negative and positive impacts because of the many activities with friends such as schools, home environments, organizations and social media that can connect interaction and communication between peers. According to Wulandari and Hakim (2015), relationships can experience important changes during adolescence, because since childhood, friendships have been connected to games or the environment, but during adolescence, friendships become more dominant and few but closer to each other. m Peers contain a desire to join involved in world group peer such as dressing the same as friends and spending time together with friends. Peer support is an important role in socializing.

2.4. Financial Literacy

The first factor is thought to play an increasing role Personal financial management is financial literacy. According to Nababan and Sadalia (2012) financial literacy is a person's efforts and skills in managing finances to improve their welfare. Laily (2013) states that financial literacy is a skill that a person has to avoid financial problems because people are often faced with situations where they have to sacrifice one another's interests. Difficulties also arise when errors occur in financial management such as lack of planning, lack of financial knowledge, and consumerism, thus financial literacy is needed to make it easier for someone to prepare financial plans and get greater profits by maximizing the value of money to improve the standard of living. . Financial literacy is related to financial management, if the higher the level of financial literacy, the better a person's financial management will be (Atika & Rohayati, 2017). Widayanti (2014) said that decision finance Which taken by individual covers amount Money Which must consumed in each period, whether there is a surplus and how the excess is invested as well how to finance investment and consumption. Whether personal financial management is wise or not is related to an individual's knowledge and ability to manage their finances. Chinen and Endo (2012) say that every individual has the ability to make decisions about finance No will have financial problems in the future and financial behavior shows healthy behavior and can determine priorities for needs rather than desires.

Planning, management and control activities finance Which Good can show healthy financial behavior. Good financial behavior can be seen from a person's attitude in managing money going in and out, credit management, savings and investment (Hilgert & Hogarth, 2002). Financial literacy is must for somebody so that can spared from financial problems. Individuals are often faced with situations where one has to sacrifice interests one after another interest other Which called trade off . Trade off often happen on somebody Which limited by his income For obtain goods which is cool. Literacy finance This almost affecting all aspects related to finance such as planning And expenditure, use card credit, savings, financial management and financial decisions. On circles student low literacy finances also occur, as Chen and Volpe point out (1998) low literacy finance students happen consequence lack education finance personal at university. Nidar And Bestary (2012) stated that literacy finance Which owned student Still in category low.

2.5. Financial Management

According to Kasmir (2010:7), financial management is an activity that is closely related to management finance company including institution which are related tightly with source funding And financial investments and financial instruments. Not only is it important for companies, financial management is also important for individuals and family environments. According to Yulianti and Silvy (2013), managing finances well starts with applying attitude good finances. Financial management according to Sina and Noya (2012) regulates budget sources of funds and allocation of funds which are directed according to plans to obtain maximum wealth. By implementing good financial management for each individual can avoid unlimited consumerist behavior. Financial management is a decision in managing funds with a financial planning and control process. One form of financial management is personal finance, which is the process of planning, implementing and evaluating the finances of individuals and families (Sina & Noya, 2012). According to Senduk (2004) personal financial management includes decisions about buying and owning as many productive assets as possible, managing personal spending funds and being careful about taking on debt. With financial management, it is hoped that individuals will be wiser in finance Which owned. Gitman And Zutter (2012:4) say that financial management is a process of planning, analyzing and controlling financial activities. Personal financial management is an application of management concepts at the individual level. With financial management, it is hoped that individuals will be able to manage their wealth to meet current and future life needs future (Atika & Rohayati, 2017). Personal financial management is one application of the concept of individual level financial management.

Financial management includes planning, managing and controlling financial activities to achieve financial prosperity. These activities include activities to plan income allocation Which will used For interest as well as expenses. There is an element that is included in personal financial management, namely the budget. Financial budgets and recording expenses can help students evaluate whether they have managed their finances well or not. In managing finance needed A planning in order to ensure that individuals are able to manage finances appropriately so that they can achieve short-term and long-term goals. For To achieve this goal, activities such as saving, investing and allocating funds are carried out. The increasing need is balanced by the preparation process plan finance Which appropriate. So It is very important for someone to have good financial management in order to achieve financial prosperity.

2.6. Hypothesis

Hypothesis is a temporary answer to the research problem, until proven through the collected data". In relation to the problem in this study, namely regarding the influence of financial literacy, financial education in the family, peers and self-control on students' personal financial management, the hypotheses proposed in this study are:

H1:

It is suspected that there is an influence of self-control on students' personal financial management.

H2:

It is suspected that there is an influence of financial education in the family on students' personal financial management.

H3:

It is suspected that there is an influence of friendship on students' personal financial management.

H4:

It is suspected that there is an influence of financial literacy on students' personal financial management.

H5:

It is suspected that there is an influence of financial literacy, financial education in the family, peers and self-control on students' personal financial management.

3. Method

3.1. Research Design

The aim of the research is to analyze the influence of independent variables, namely self-control variables, financial education variables, friendship variables and financial literacy variables simultaneously and partially on the dependent variable, namely personal financial management. The population is active accounting education students. This type of research is quantitative research because this research uses numerical data that will later be analyzed with statistics aimed at testing the specified hypothesis. In quantitative research that is based on an assumption that a symptom can be classified and is causal, researchers can conduct research by focusing on several variables.Sampling used a purposive sampling technique with the criteria of students who had taken introductory accounting, financial accounting and financial management courses totaling 150 students.

3.2. Research Data

In this study, the type of data used is quantitative data. Quantitative data is data information expressed in the form of numbers or figures that can be calculated and measured directly. In this study, primary data sources are used, primary data sources are data sources that directly provide data to researchers. Primary data sources are taken by researchers using tests and questionnaires to samples. Tests are used to measure financial literacy variables, while questionnaires are used to measure financial education variables in family, peers, self-control and personal financial management. The research instrument consists of questions on the financial literacy variable, statements on the family financial education variable, statements on the peer variable, statements on the self-control variable, and statements on the personal financial management variable.

3.3. Data Analysis Techniques

The measurement scale in this study is the Guttman scale and Likert scale. The Guttman scale is used on the financial literacy variable, where the score results will then be grouped based on criteria according to Chen and Volpe (1998) . The Likert scale is used on the variables of financial education in family, peers, self-control and personal financial management. The data analysis technique uses multiple linear regression analysis.

4. Results and Discussion

4.1. Results

Talking about financial management, especially personal finance, of course cannot be separated from lifestyle management. Like the previous example of employees and farmers, the lifestyle of an employee in urban areas is certainly different from the lifestyle of a farmer in rural areas. Apart from the fact that the cost of living in urban areas tends to be more expensive, the needs of an employee and a farmer cannot be the same. A farmer certainly doesn't need to buy formal clothes for work, nor does he need complete gadgets such as laptops, smartphones and others. However, this is not solely the cause of employees having far fewer assets than farmers. With greater income, employees should be able to optimize their income more. This is why it is important for every individual to understand how to manage finances. There are also quite a few cases of people who have more income but also have more consumer debt. Researchers carry out classical assumption tests before hypothesis testing with regression is carried out. The normality test uses the Kolmogorov Smirnov test as follows:

Based on

Table 1 above, it can be seen that the value of the Kolmogorov Smirnov test results for the self control variable is 0.154, the financial education variable is 0.103, the friendship variable is 0.138, the financial literacy variable is 0.094 and the financial management variable is 0.070, all showing greater than alpha α>0.05, so overall data is normally distributed . Next, a molticollinearity test is carried out to determine whether there is a relationship between the independent variables:

The multicollinearity test can be seen from the VIF value. The VIF value based on

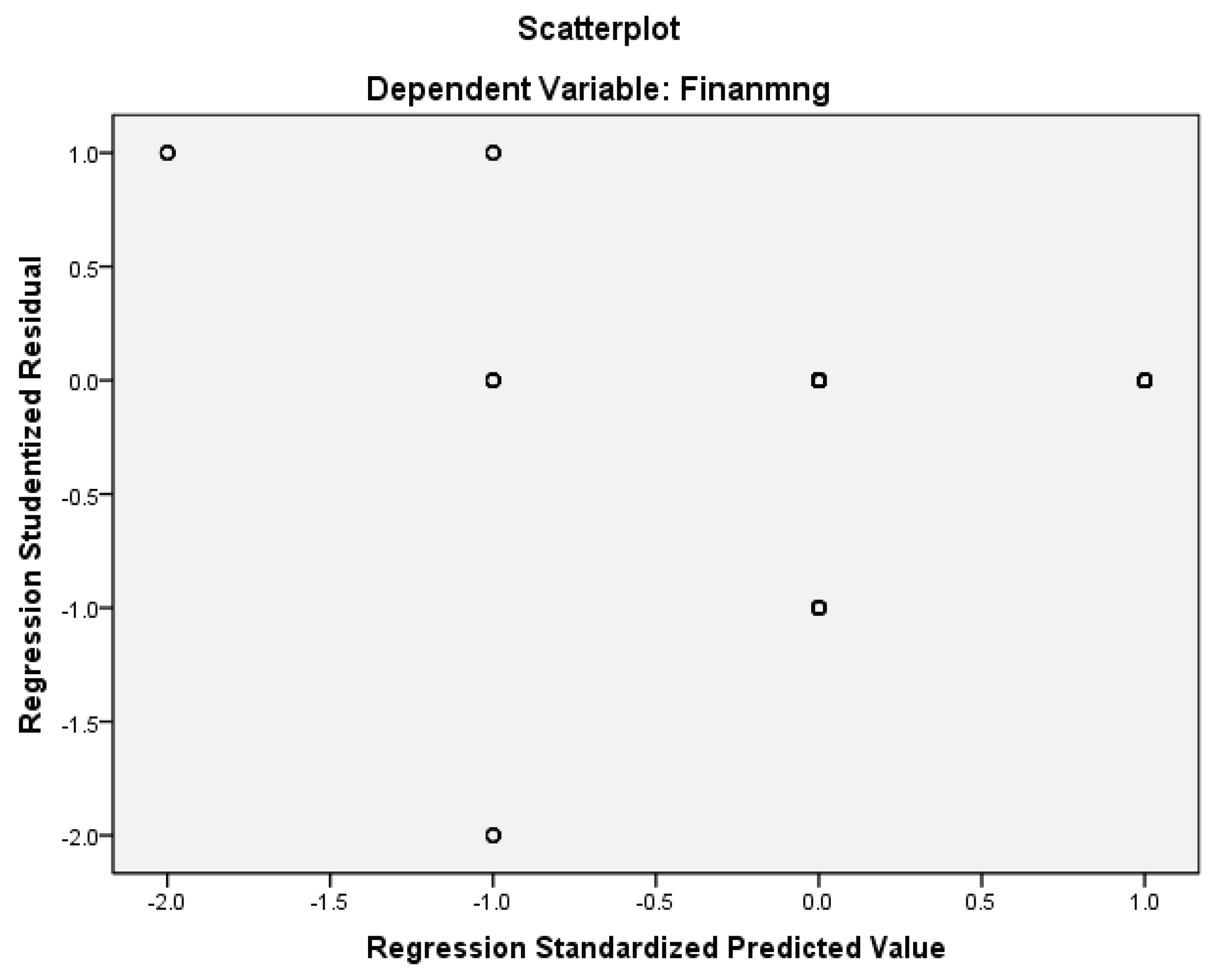

Table 2 above can be seen that the VIF test result value for the self control variable is 1.660, the financial education variable is 1.374, the friendship variable is 1.127, the financial literacy variable is 1.604, all show a smaller VIF value <10, it is concluded that each independent variable is free from m o lticolinearity. The heteroscedasticity test using a scatterplot graph obtained the following results:

Based on

Figure 1 above, it can be seen that the data is spread below and above the number 0 on the Y axis and the data points as a whole are spread out without forming a particular pattern , thus it can be concluded that there is no heteroscedasticity in the data . The heteroscedasticity test aims to test whether in the regression model there is an inequality of variance from the residuals of one observation to another. If the variance from the residual from one observation to another observation remains or is the same, it is called homoscedasticity and if it is different it is called heteroscedasticity. A good regression model is one with homoscedasticity or no heteroscedasticity. Next, the data will be tested for autocorrelation as follows:

Table 3.

Durbin Watson Test.

Table 3.

Durbin Watson Test.

| Model |

Change Statistics |

Durbin-Watson |

| R Square Change |

F Change |

df1 |

df2 |

Sig. F Change |

| dimension0 |

1 |

.194 |

8.737 |

4 |

145 |

.000 |

1.905 |

The autocorrelation test can be seen from the du value 1.9 05 < DW value < 2.095 ( 4 – ai du value), so it is known that the regression is free from autocorrelation. Thus it can be concluded that each independent variable has a linear pattern towards the dependent variable with a significance value of 0.000. Next, to find out the equation formed, the Unstandardized Coefficients test will be carried out:

From

Table 4 of the regression equation that is formed, it can be explained as follows: Value (a) = constant, which is 26.633. This shows the magnitude of the self control variable -0.438, the financial education variable -0.424, the friendship variable 0.730, the financial literacy variable 1.446. So the regression equation formed is Y = 26, 633 – 0.438X1 – 0.424X2 + 0.730X3 + 1.446X4. The equation above results in a constant value of 4.901 indicating that the variables financial literacy, financial education in the family, peers, and self-control are assumed to be 0, so the predicted personal financial management is 26.633.

The results of the T test in

Table 4, namely a partial test, hypothesis H1 show that: there is no significant influence between the self control variable and financial management, this is because α > 0.05, namely 0.085 > 0.05. The financial education variable hypothesis H2 does not have a significant effect on financial management because α > 0.05, namely 0.065 > 0.05. The friendship variable hypothesis H3 has a significant effect on financial management, because α < 0.05, namely 0.004 < 0.05. The financial literacy variable hypothesis H4 has a significant effect on financial management because the α value < 0.05, namely 0.00 < 0.05. To find out whether there is a simultaneous influence between the independent variable and the dependent variable, the F test is used as follows:

Based on the

Table 5 above, the F result

hitung is 8.737 , while the value

< 0.05, namely 0.000 < 0.05 with a mean square of 3039 , the alternative hypothesis H5 which reads: there is a significant influence between the self control variable, the financial education variable, the friendship variable and the financial literacy variable on the financial management variable is accepted . So it can be concluded that financial management is influenced simultaneously (simultaneously) by the self control variable, financial education variable, friendship variable and financial literacy variable.

Table 5.

Anova F test b.

| Model |

Sum of Squares |

df |

Mean Square |

F |

Sig. |

| 1 |

Regression |

12157.950 |

4 |

3039.488 |

8.737 |

.000a

|

| Residual |

50442.050 |

145 |

347.876 |

|

|

| Total |

62600.000 |

149 |

|

|

|

Table 6.

Koefisien Determinasi.

Table 6.

Koefisien Determinasi.

| Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

| dimension0 |

1 |

.441a

|

.194 |

.172 |

18.65144 |

|

From the table above, the coefficient of determination ( Adjusted R Square) shows the number 0.172. This means that personal financial management is influenced by the self control variable, financial education variable, friendship variable, financial literacy variable, simultaneously / together the influence is 17.2% , while the remaining 82.8 % is influenced by other factors . .

4.2. Discussion

4.2.1. Influence of Financial Literacy, Financial Education in the Family, Peers, and Self-Control on Personal Financial Management

Financial literacy is a person's ability to manage finances, formed from knowledge of financial concepts and information so that a person is able to manage their finances healthily in order to achieve prosperity (Fatimah & Susanti, 2018). In line with Yushita's research (2017), financial literacy will help individuals organize personal financial planning, so that they can maximize the value of money and the profits obtained will be greater and improve the individual's standard of living. Apart from that, Putri and Susanti (2018) said that by being equipped with knowledge about financial accounting, financial management and banking, students have high financial literacy so they can manage their finances more precisely and well.

Parents have the task of teaching children how to manage their lives, one way parents can do this is teaching children money management through the example set by parents. Chotimah And Rohayati (2015). Widayati (2014) in his research revealed that the family is the most dominant place in children's socialization regarding financial matters, in essence the family environment contributes more to the formation of student attitudes such as self-confidence. Alone For capable manage his finances in future. Besides That Hidayat (2018) say the more The more financial education the family provides, the better the student's financial management behavior, conversely the less financial education the family provides, the worse the student's financial management behavior.

Peers are one of the keys to providing information and acting as financial advisors (Lusardi & Mitchell, 2007). Chotimah and Royahati (2015) said that students who live far from their families will spend more time with their peers, so that the intensity of communication with friends becomes the main thing when studying, thus peers can have an influence on students' lives in managing finance.

Self-control is a skill possessed by individuals in managing financial attitudes according to their own circumstances and the environment around them (Nasihah & Listiadi, 2019). Apart from that, Nofsinger (2005) said that someone controls their finances by fighting the desire to spend and use money excessively without taking it into account or spending based on desires, not needs, so that self-control is related to better financial management. In line with Putri and Susanti (2018) revealed that students who able to control self in If you manage your finances, you tend to save money and prioritize purchases based on your needs, whereas students who manage their finances poorly will have difficulty managing them Money And can do purchase Which not controlled leading to the emergence of high consumer behavior .

The results of this research show that financial literacy, financial education in the family, friendship, and self-control simultaneously have a significant effect on students' personal financial management. The results of data analysis using multiple linear regression analysis in the ANOVA table obtained an f test of 0.000. If the probability value is less than 0.05, it can be concluded that the four independent variables have a simultaneous influence on personal financial management variables. The research results are supported by the Adjusted R Square result of 0.172 , namely 17.2% of students' personal financial management is influenced by financial literacy variables, financial education in the family, peers, and self-control. The remaining 82.8 % is influenced by other variables which were not mentioned in this study.

The factors in this research that influence personal financial management are financial literacy, financial education in the family, peers, and self-control. Students who are equipped with good financial literacy and family financial education help students in managing their personal finances. Atika and Rohayati (2017) in their research said that financial literacy is also determined by families in providing financial education in the family to their children. Students' knowledge of finance is also supported by the surrounding environment and themselves which can influence students' attitudes towards their personal finances. Peers can influence students' attitudes towards their finances because they spend a lot of time together . If students have the ability to control themselves well then students will be wise in managing their personal finances.

4.2.2. The Influence of Financial Literacy on Personal Financial Management

The results of the regression test carried out, namely the t test on the financial literacy variable, obtained a result of 5.518 with a significance of 0.000 . If the results of the significance of the financial literacy variable are smaller than 0.05, it is said that rejected and accepted. The test results concluded that financial literacy had a partial effect on students' personal financial management.

Financial literacy is a person's knowledge and ability in the financial sector to improve financial management skills so that a person avoids financial problems and thus increases prosperity in life. Students who have good financial literacy can make it easier for students to make financial decisions, and the application of financial literacy to personal financial management makes students wiser in dealing with personal finances. In line with Yushita's (2017) research , financial literacy makes it easier for someone to make financial plans, so that optimizing the value of money and profits will be greater and the standard of living can increase. Chen and Volpe (1998) said that financial literacy is a science of managing finances which aims to improve the welfare of individuals' lives in the future. Someone who is able to make financial decisions and behave well towards finances shows healthy behavior and can prioritize needs (Chinen & Endo, 2012) .

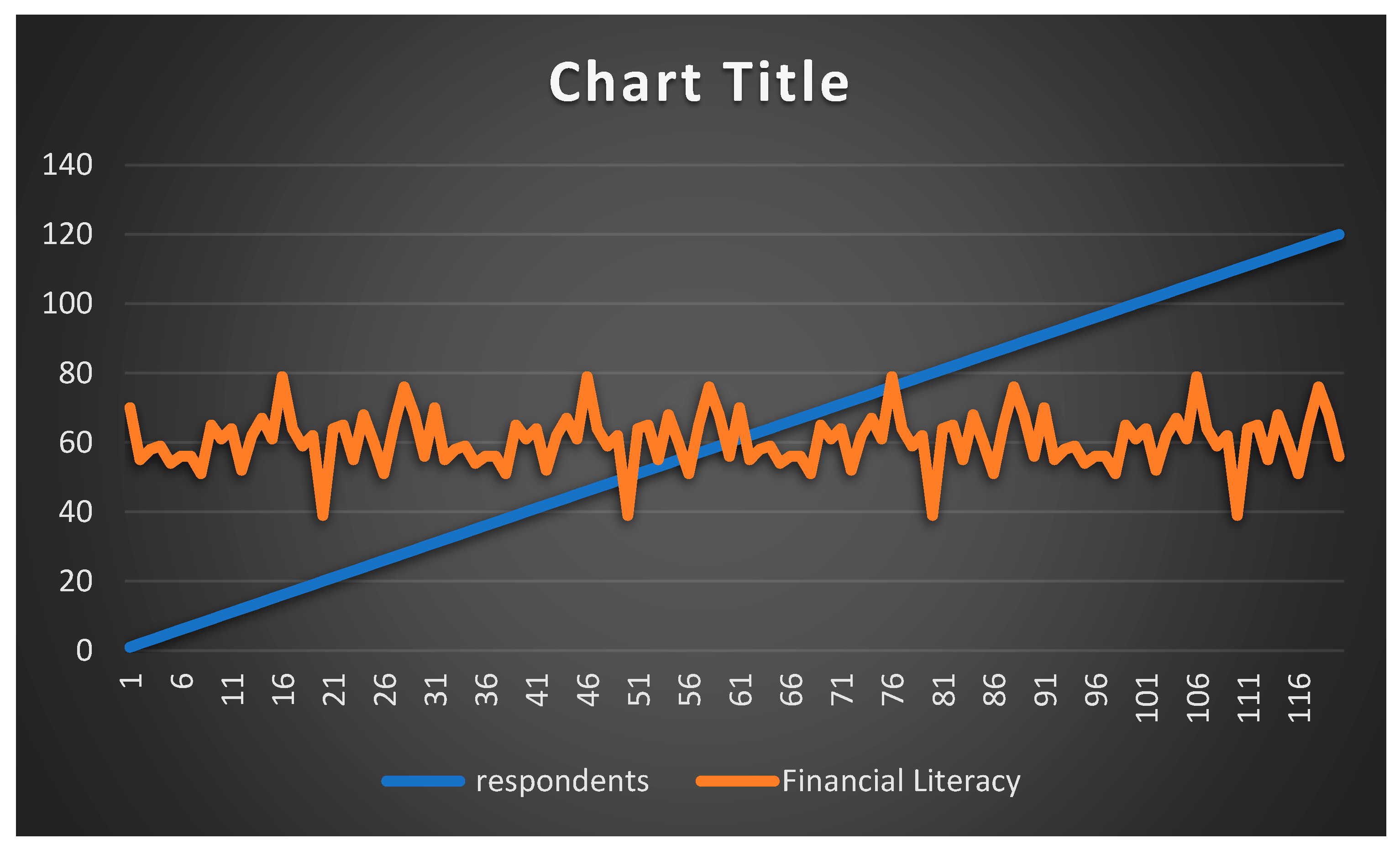

Based on

Figure 2, the average financial literacy volatility score is around 60.7. This means that 53% of respondents have above-average financial literacy mastery. This research showed that the higher the financial literacy of students, the better their personal financial management will be. Financial literacy in this research is needed by students because it makes it easier to deal with finances through the application of financial management to students' personal finances. The results of this research are in line with Laily (2013) in his research who said that financial literacy is related to financial management. If financial literacy is good then financial management will improve. Putri (2018) said that students equipped with financial knowledge will have high financial literacy so that financial management will be more precise.

Financial literacy is knowledge about finances that can be applied in everyday life with the aim of achieving prosperity. Financial literacy is knowledge for managing finances with the aim of making an individual's life more prosperous in the future. Apart from that, financial literacy is a person's ability to manage finances, formed from knowledge of financial concepts and information so that a person is able to manage their finances healthily in order to achieve prosperity. Financial literacy uses learning theory as a theoretical basis for financial behavior. Financial literacy is related to financial management, if the higher the level of financial literacy, the better a person's financial management will be. Financial literacy will help individuals organize personal financial planning, so that they can maximize the value of money and the profits obtained will be greater and improve the individual's standard of living. Apart from that, based on financial knowledge, individuals will find it easy to manage finances correctly and can make healthy financial decisions to achieve a prosperous life. Every individual who has the ability to make financial decisions will not have financial problems in the future and financial behavior shows healthy behavior and can determine priorities for needs rather than desires. By being equipped with knowledge about financial accounting, financial management and banking, students have high financial literacy so they can manage their finances more precisely and well. Apart from that, students are a fairly large component of society in contributing to the economy because in the future students will enter the world of work and be independent in managing finances.

4.2.3. The Influence of Financial Education in the Family on Personal Financial Management

The results of the regression test in this study, namely the t test on the financial education variable in the family, were obtained at 1.862 with a significance of 0.0 65 . If the significance value of the financial education variable in the family is greater than 0.05, it is said that accepted and rejected. The test results can be concluded that financial education in the family has no partial effect on students' personal financial management.

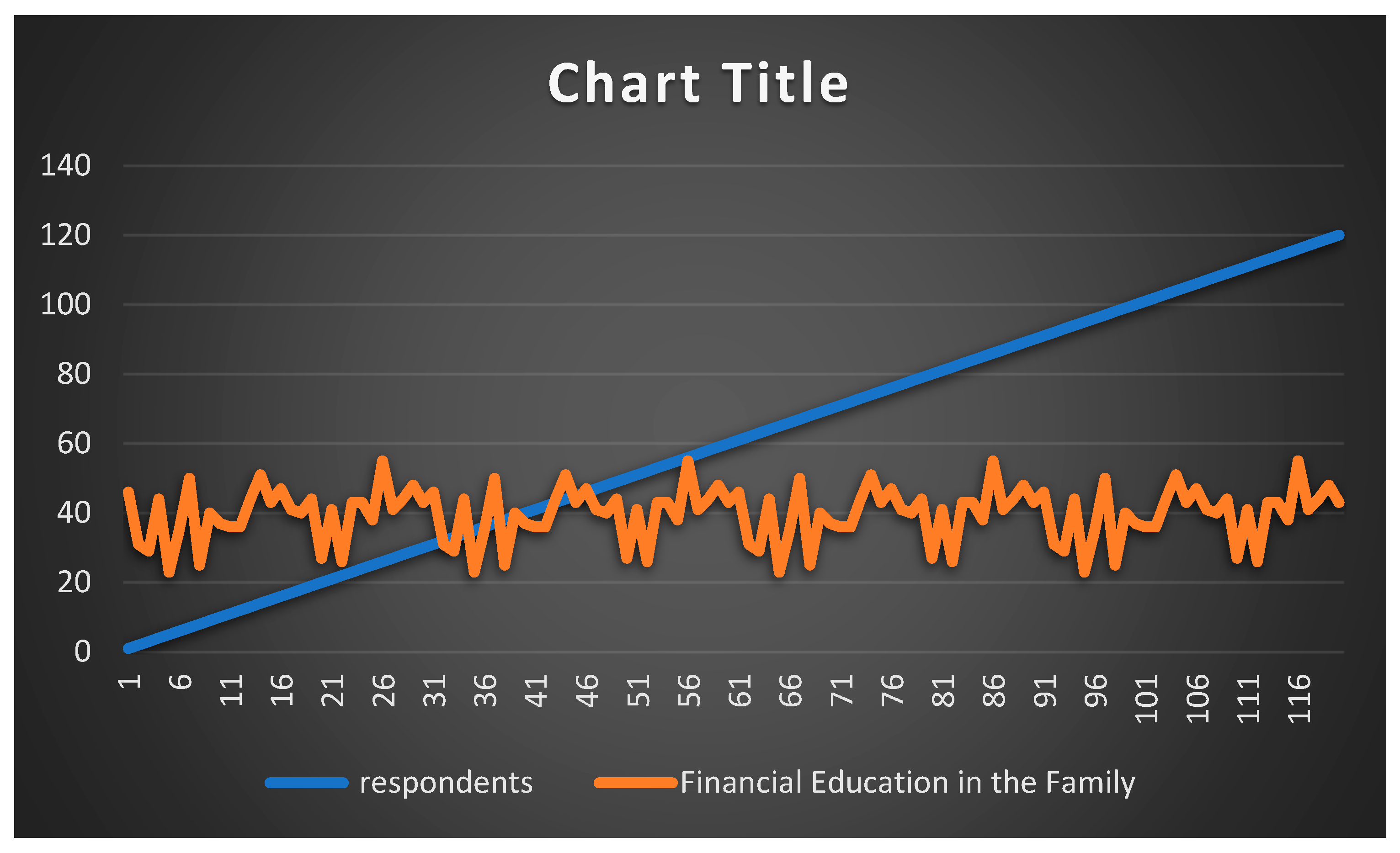

Based on

Figure 3, the average volatility value of The Influence of Financial Education in the Family is around 40. This means that the number of respondents who are above the average of The Influence of Financial Education in the Family is 68%. If students are given an example regarding finances by their parents from a young age, students will become accustomed to being disciplined in managing their personal finances. The exemplary attitude taught by parents can equip children to be wise in everything they do, including finances. The family is the place where children are most socialized regarding financial matters, in essence the family contributes more to shaping student behavior so that they are able to manage their finances in the future (Widayati, 2014) . Chotimah and Rohayati (2015) revealed that the higher the intensity of the family's role in providing children with financial education, the better students will be at managing their finances. Bowen (2002) stated that financial education is needed in the family to educate children to be smart in managing their pocket money and also to get used to not being wasteful. The family is the main place for socializing children to learn and develop financial management (Wulandari & Hakim, 2015) . Financial education in the family prioritizes giving children role models regarding finances, so that children will learn to manage and also make good use of the value of the money they have.

This research showed that students who were provided with good financial education in their families became better at managing their personal finances. Aspects of financial education provided by the family have a big influence on students' behavior and progress towards prosperous adulthood. The results of this research are in line with Jorgensen (2007) who said that children who learn about managing finances from both parents will behave better regarding finances than children who do not learn about managing finances from both parents. It is important for parents to teach their children about financial literacy so that when they grow up, their children can be wiser in their finances.

4.2.4. The Influence of Peers on Personal Financial Management

The results of the regression test in this research, namely the t test on the peer variable, obtained a result of 2.907 with a significance of 0.0.04 . If the significance value of the peer variable is less than 0.05, it is said that rejected and Haaccepted. The test results can be concluded that peers have a partial influence on students' personal financial management.

Hidayat (2018) in his research said that peers influence a person in managing their finances, the better the interactions with friends, the better their behavior in managing finances and vice versa. Peers are one of the providers of information and financial advisors to a person (Mitchell et al., 2010) . Students do socialization other than with family, including with their surrounding environment, one of which is their peers. Yin, Buhrmester and Hibbard (in Hidayat, 2018) in their research said that young people interact an average of 103 minutes a day with peers compared to only 28 minutes of interaction with their parents so that peers have a social and financial influence on students. Students who live far from their families will have more free time with their peers, so that communication becomes more frequent during the lecture period, so peers can have an influence on students' lives in managing their finances (Chotimah & Rohayati, 2015) .

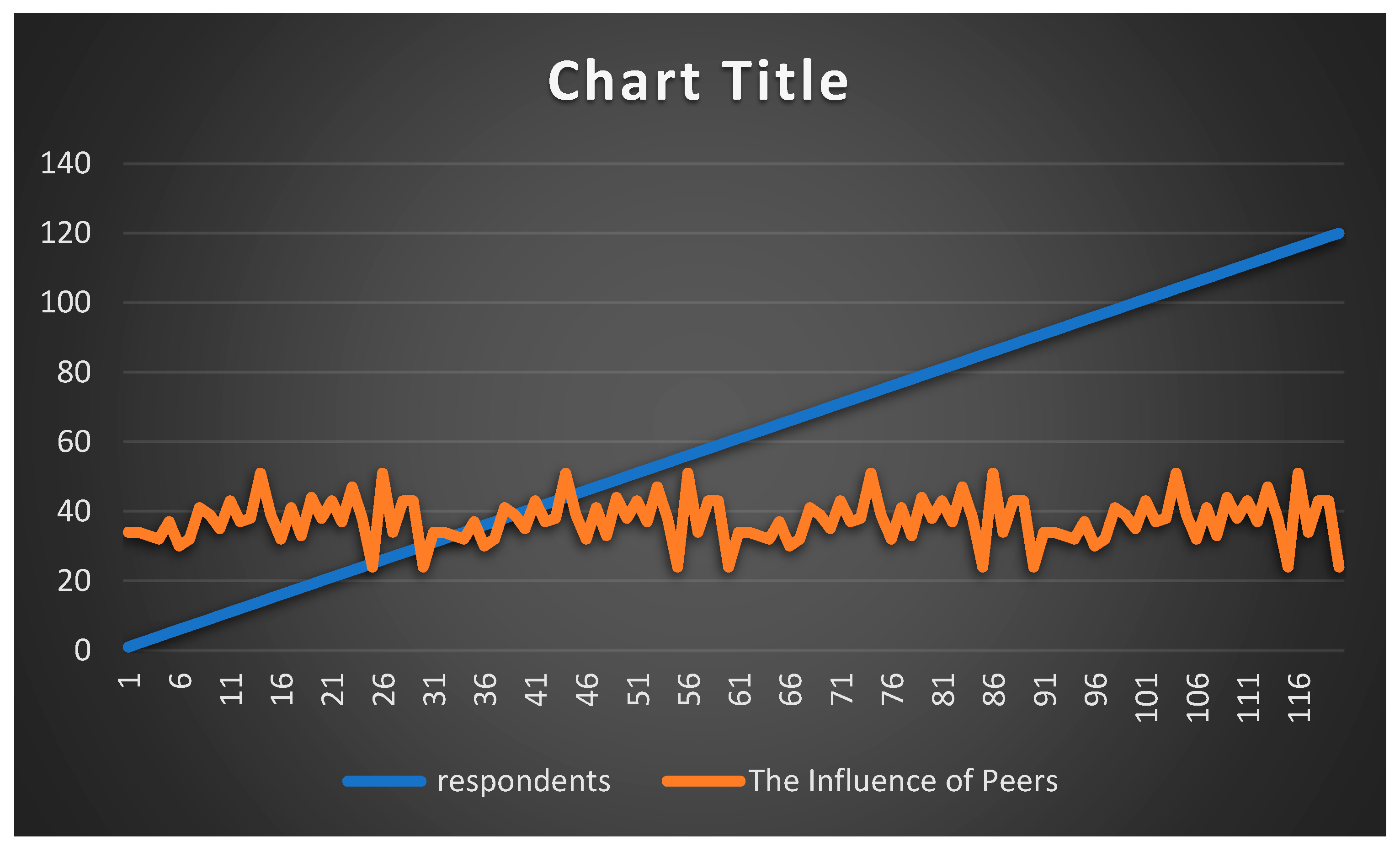

Figure 4.

The Influence of Peers Volatilitas.

Figure 4.

The Influence of Peers Volatilitas.

Based on

Figure 3, the average volatility value of The Influence of Peers is around 40. This means that the number of respondents who are above the average of The Influence of Peers is 60%. This research showed that students who have good peer relationships will tend to have frequent discussions and carry out activities together, so that peers can influence students' attitudes and behavior towards their personal financial management. In contrast, when students lack intensity with their peers, students tend to engage in less socialization such as discussions, so that students lack encouragement from the surrounding environment regarding financial problems. Discussions in friendships are important because they serve as a means of self-evaluation regarding financial problems. Wulandari (2015) said that the peer environment provides support or encouragement to students, such as asking questions about how to manage finances well.

4.2.5. The Influence of Self-Control on Personal Financial Management

The results of the regression test in this research, namely the t test on the self-control variable, obtained a result of 1.736 with a significance value of 0.0 85 . If the significance of the self-control variable is greater than 0.05, it is said that accepted and processed . The test results can be concluded that self-control has no partial effect on students' personal financial management.

Students need to take strategic steps by controlling themselves and managing their attitudes towards finances in allocating finances, so that it is easier for students to achieve success in personal financial management for future prosperity. Self-control in managing finances is an activity that makes a person frugal by stopping impulsive purchasing activities (Otto et al, 2007) . Putri (2018) said that self-control is a skill in guiding oneself to form positive behavior so that one is able to pay attention to financial decisions based on the individual's needs. In line with Herlindawati's (2015) research , self-control can improve students' financial management. If students' self-control is good, their personal financial management will be better too.

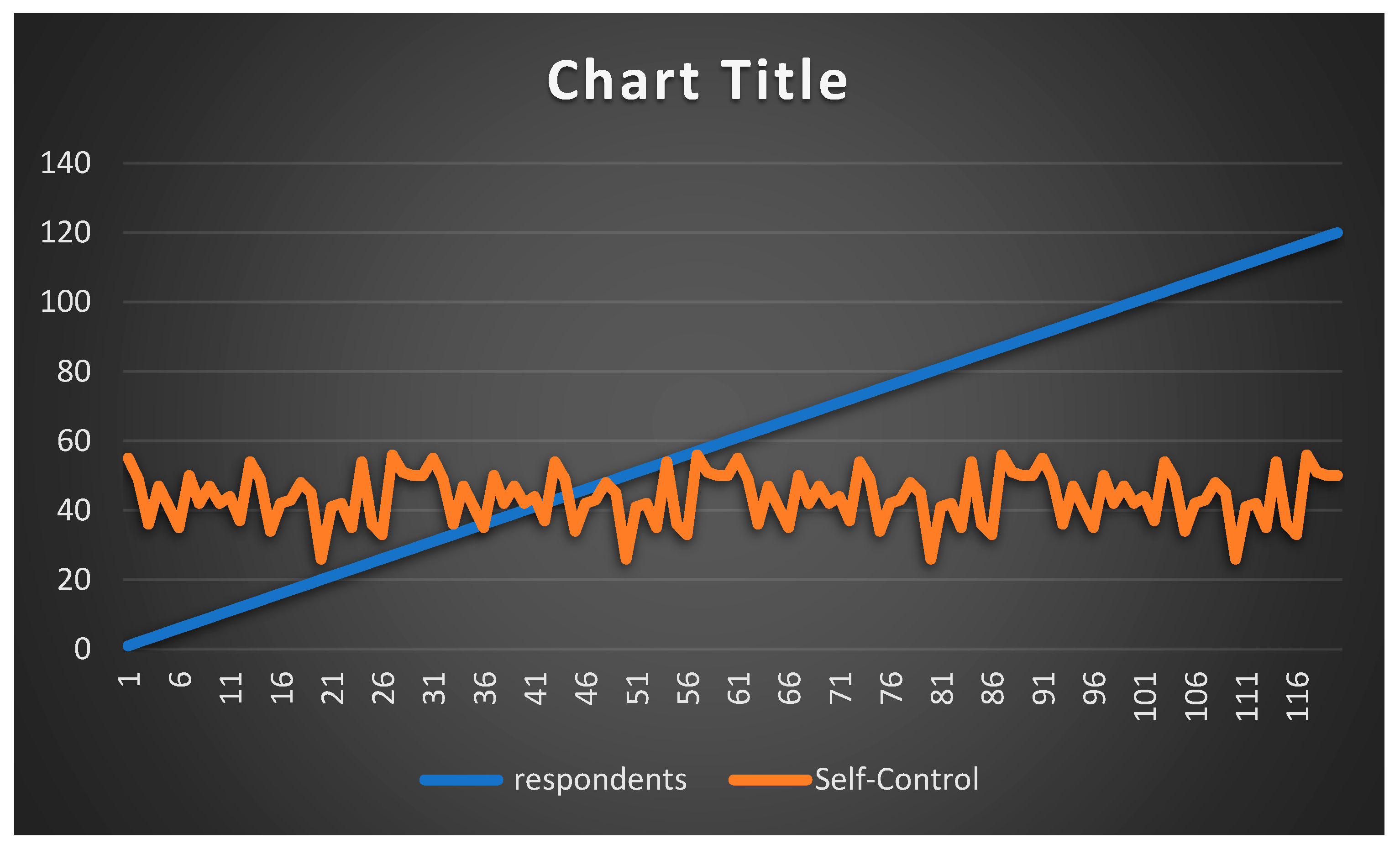

Based on

Figure 5, the average volatility value of The Influence of Self-Control is around 44. This means that the number of respondents who are above the average The Influence of Self-Control Volatility is 60%. This research showed that students who have self-control in managing their personal finances tend to think before making financial decisions by saving and prioritizing needs over desires. It's different when students who don't have good self-control will be vulnerable to acting without thinking, what happens is that students often waste money and make consumer purchases. Students who have self-control in their finances will be accustomed to paying attention and thinking about the impacts that arise before making expenditures, so that self-control influences student behavior in managing their personal finances. Nofsinger (2005) said that someone who is used to controlling their finances by resisting the urge to spend and use money excessively without taking it into account, then that person can manage their finances well. Self-control in financial management is an activity that encourages a person to save by reducing impulsive purchasing activities. Apart from that, self-control is an individual's ability to guide and regulate themselves in the form of behavior that leads the individual in a positive direction so that he can consider the decisions he wants to take based on the individual's desires. Self-control is the skill possessed by individuals in managing financial attitudes according to their own circumstances and the environment around them.

Someone who controls their finances by fighting the desire to spend and use money excessively without taking it into account or spending based on desires, not needs, so that self-control is related to better financial management. In his research, he said that self-control in managing finances is a strategy used by individuals. to prevent wasteful attitudes in allocating finances. With good self-control they tend to save money regularly, which means that individuals are better prepared to manage unexpected expenses and have good financial management. Students who are able to control themselves in managing their finances tend to be thrifty and prioritize purchases based on their needs, while students who manage their finances poorly will have difficulty managing their money and can make uncontrolled purchases, causing high consumer behavior. Apart from that, self-control has a positive influence on student financial management. It can be concluded that the better the student's self-control, the better the student's personal financial management.

5. Conclusions

The results of this research analysis show that financial literacy, financial education in the family, peers, and self-control simultaneously have a positive and significant effect on the personal financial management of Accounting Education students. The results of the analysis show that financial literacy partially and peers partially influence personal financial management. Self-control and family financial education do not partially influence the personal financial management of Accounting Education students. Based on the results of this research, the researcher provides suggestions to interested parties as follows: (1) It is hoped that seminar activities will be held regarding the importance of student personal financial management to foster positive behavior towards finances, especially students who are not used to managing personal finances; (2) Students further improve and apply financial knowledge to personal financial management attitudes by carrying out financial budgets, recording expenses, setting aside emergency funds and saving in each predetermined period; (3) Future researchers should be able to develop research by further examining other variables that can influence personal financial management, as well as expanding the scope of research.

6. Implications

Based on the results of the research and discussion, the following theoretical and practical implications can be put forward: Theoretical Implications, from the results of the study on the influence of financial literacy and priority scale on planning to buy a first home, it can be seen that there is a positive impact of financial literacy and the choice of priorities themselves. Discipline in financial management and implementation of needs based on their urgency scale is the right step in realizing financial freedom in the future. Practical Implications, this study is a reference for all groups, especially for the younger generation, to be wiser in managing finances in everyday life and can be used as a guideline in determining strategies when realizing the dream of buying the desired asset for the first time. For students of the Accounting Education study program, they should increase their awareness of financial literacy for the future, because they have been equipped with economic knowledge, it would be better to implement this knowledge into everyday life. So that future ideals are easier to achieve by implementing appropriate and optimal financial management. The analysis in this study was carried out using a regression approach, this approach allows researchers to test the validity of the construct through observations of the correlation between constructs dimensionally. In the future, further Tukey tests need to be conducted to test the findings in this study. So that individuals will find it easier to achieve their vision in the future with financial freedom conditions.

7. Limitations

Managing finances well is very useful to help achieve every individual's desired goals. In order to manage finances properly, each individual must record their finances, including income and expenses. One application that can meet these user needs is a personal financial recording application using Android-based notifications and infographics. In the past, to be able to access a personal financial recording application, a computer was needed that had a special application to calculate daily income and expenses. With the existence of a personal financial recording application using Android-based notifications and infographics, it is hoped that it will be able to help users to manage their personal finances. The limitations of the problem in building a personal financial recording application using Android-based notifications and infographics include: a. This application is used for individuals (personal). b. This application is used for simple financial recording, including income, expenses, and personal financial reports. This application is used offline

References

- Aliffarzani, M. The Influence of Self-Control, Financial Knowledge, and Materialist Values on the Financial Management Behavior of Public Middle School Teachers in Gresik. Perbanas E-Prints Scientific Articles 2015, 1–13. [Google Scholar]

- Apsari, N.P. The Influence of Self-Control and Materialist Values on Student Financial Management. Perbanas E-Prints Scientific Articles 2013, 1–10. [Google Scholar]

- Atika, R.D.; Rohayati, S. The Influence of Financial Literacy, Love of Money and Financial Management Learning Outcomes on Personal Financial Management of UNESA Accounting Education Study Program Students. Journal of Accounting Education 2017, 5, 1–8. [Google Scholar]

- Bowen, C. F. Financial Knowledge Of Teens And Their Parents. Financial Counseling and Planning Volume 2002, 13, 93–102. [Google Scholar]

- Chen, H. , & Volpe, R. P. An Analysis of Personal Financial Literacy Among College Students. Financial Services Review 1998, 7, 107–128. [Google Scholar]

- Chinen, K. , & Endo, H. Effects of Attitudes and Background on Personal Financial Ability : A Survey in the United States Effects of Attitude and Background on Students ’ Personal Financial Ability : A United States Survey. International Journal of Management 2012, 29, 778–791. [Google Scholar]

- Chotimah, C. , & Rohayati, S. The Influence of Financial Education in the Family, Parental Socioeconomics, Financial Knowledge, Spiritual Intelligence, and Peers on the Personal Financial Management of Undergraduate Accounting Education Students, Faculty of Economics, Surabaya State University. Journal of Accounting Education 2015, 3, 1–10. [Google Scholar]

- Gitman,; Zutter. Principles of Managerial Finance; Addison-Wesley Publishing Company Hilgret, 2012. [Google Scholar]

- Herlindawati, D. The Influence of Self-Control, Gender, and Income on Personal Financial Management of Postgraduate Students at Surabaya State University. Journal of Educational Economics and Entrepreneurship 2015, 3, 158–169. [Google Scholar]

- Hidayat, V.A. The Influence of Financial Education in Family and Peers on Student Financial Management Behavior. Perbanas E-Prints Scientific Articles 2018, 1–17. [Google Scholar]

- Hilgert, Marianne A. and Jeanne M. Hogarth. Household Financial Management : The Connection between Knowledge and Behavior. Federal Reserve Bulletin 2002, 106, 309–22. [Google Scholar]

- Jorgensen, B.L. Financial Literacy of College Students: Parental and Peer Influences, 2007. Master of Science in Human Development, Thesis Not Publication Virginia.

- Cashmere. Introduction Management Finance; Jakarta: Kencana, 2010. [Google Scholar]

- Prenada Media Group.

- Layly, N. The Influence of Financial Literacy on Student Behavior in Managing Finances. Journal of Accounting and Business Education 2013, 1. [Google Scholar] [CrossRef]

- Lusardi, Annamaria and Olivia S. Mitchell. “Financial Literacy and Retirement Planning : New Evidence from the Rand American Life Panel Financial Literacy and Retirement Planning. 2007. [Google Scholar]

- Maulita,; Mersa, NA. The Influence of Financial Literacy on Students' Personal Financial Management at the Samarinda State Polytechnic. SNITT POLTEKBA Journal 2017, 2, 136–143. [Google Scholar]

- Mitchell, O.S. , Lusardi, A., & Curto, V. Financial Literacy Among the Young: Evidence and Implications for Consumer Policy. SSRN Electronic Journal 2010, 44, 1–35. [Google Scholar] [CrossRef]

- Nababan, D. , & Sadalia, I. Analysis of Personal Financial Literacy and Financial Behavior of Undergraduate Students, Faculty of Economics, University of North Sumatra. Journal of Management Information 2012, 1, 1–16. [Google Scholar]

- Naomi, P. , & Mayangsari, I. Factors that Influence High School Students in Compulsive Buying Behavior: Psychological Perspective. Abmas Journal 2008, 8. [Google Scholar]

- Nofsinger, J.R. Social Mood and Financial Economics. Journal of Behavioral Finance 2005, 6, 144–160. [Google Scholar] [CrossRef]

- Otto, P. E. , Davies, G. B., & Chater, N. Note on ways of saving: Mental mechanisms as tools for self-control? Global Business and Economics Review 2007, 9, 227–254. [Google Scholar] [CrossRef]

- Putra, A. , Handayani, S., & Pambudi, A. Self-Control Behavior in Personal Financial Management Behavior Based on the Theory of Planned Behavior Using the Partial Least Square Approach. UNSOED FEB Journal & Proceedings 2013, 3. [Google Scholar]

- Putri, T.P.; Susanti. The Influence of Self-Control, Financial Literacy, and Financial Inclusion on the Saving Behavior of Accounting Education Students, Faculty of Economics, Surabaya State University. Journal of Accounting Education 2018, 6, 323–330. [Google Scholar]

- Santrock, John W. Child Development: Eleventh Edition Volume Two; Jakarta: Erlangga, 2007. [Google Scholar]

- Senduk, S. 2004. In Who Says Being an Employee Can't Be Rich; Five Practical Tips Managing Salary So You Can Be Rich; Jakarta: Elex Media Komputindo.

- Sina, Peter Garlans and Andris Noya. The Influence of Spiritual Intelligence on Personal Financial Management. Journal Management 2012, 11, 171–88. [Google Scholar]

- Widayati, I. The Influence of Parental Socioeconomic Status, Family Financial Management Education, and Learning in Higher Education on Student Financial Literacy. Journal of Humanities Education 2014, 2, 176–183. [Google Scholar]

- Wulandari,; Hakim, L. The Influence of Love of Money, Financial Education in the Family, Financial Management Learning Outcomes, and Peers on Students' Personal Financial Management. Journal of Accounting Education 2015, 3, 1–6. [Google Scholar]

- Yulianti, Norm and Meliza Silva. Attitude Financial Management and Family Investment Planning Behavior in Surabaya. Journal of Business and Banking 2013, 3, 57–68. [Google Scholar]

- Yushita, A.N. The Importance of Financial Literacy for Personal Financial Management. Nominal Journal 2017, VI, 11–26. [Google Scholar]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).