Submitted:

24 March 2025

Posted:

25 March 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

1.1. Open Banking in the Platform Economy: A Catalyst for Financial Innovation

1.2. Korea’s Open Banking: Quantitative Achievements and Qualitative Concerns

1.3. The Imperative of Data-Driven Governance Innovation

- Research Question 1: What factors contribute to the divergence between the quantitative growth in API call volume and the deceleration of qualitative growth in registered accounts and users in Korea’s Open Banking platform?

- Research Question 2: What factors constrain new user inflow and user base expansion?

- Research Question 3: How can data-driven governance foster innovation and address these imbalances?

2. Theoretical Background

2.1. Platform Ecosystem Volatility and Sustainable Growth

- Nonlinearity: Small changes can trigger disproportionately large and unpredictable outcomes. Minor initial variations can amplify over time, exhibiting properties akin to chaos theory.

- Self-organization: Platform ecosystems develop order through decentralized interactions among participants, lacking central control. This reduces predictability and generates volatility that resists top-down management.

- Complexity: Platform ecosystems comprise intricate webs of stakeholders, technologies, services, rules, and policies. This complexity makes system behavior prediction challenging and partial changes can create unforeseen ripple effects.

- Unpredictability: Platform ecosystems are highly sensitive to external environmental changes and involve numerous interacting uncertain variables. This makes even short-term predictions difficult, with long-term forecasts becoming increasingly uncertain.

2.2. Rethinking Platform Growth Metrics: From ’Quantitative’ to ’Qualitative’ Indicators

2.2.1. Number of Registered Accounts

2.2.2. Number of Users

2.2.3. User-to-Account Ratio

2.2.4. Additional Qualitative Indicators

3. Research Design and Methodology

3.1. Research Data

- Registered accounts (FI): Number of accounts registered by financial institutions on the Open Banking platform.

- Subscribers (FI): Number of users who subscribed to Open Banking services through financial institutions.

- Registered accounts (FinTech): Number of accounts registered by FinTechs on the Open Banking platform.

- Subscribers (FinTech): Number of users who subscribed to Open Banking services through FinTechs.

3.2. Utilization of API Call Count Data

3.3. Time Series Analysis Methodology

3.3.1. Descriptive Statistics Analysis

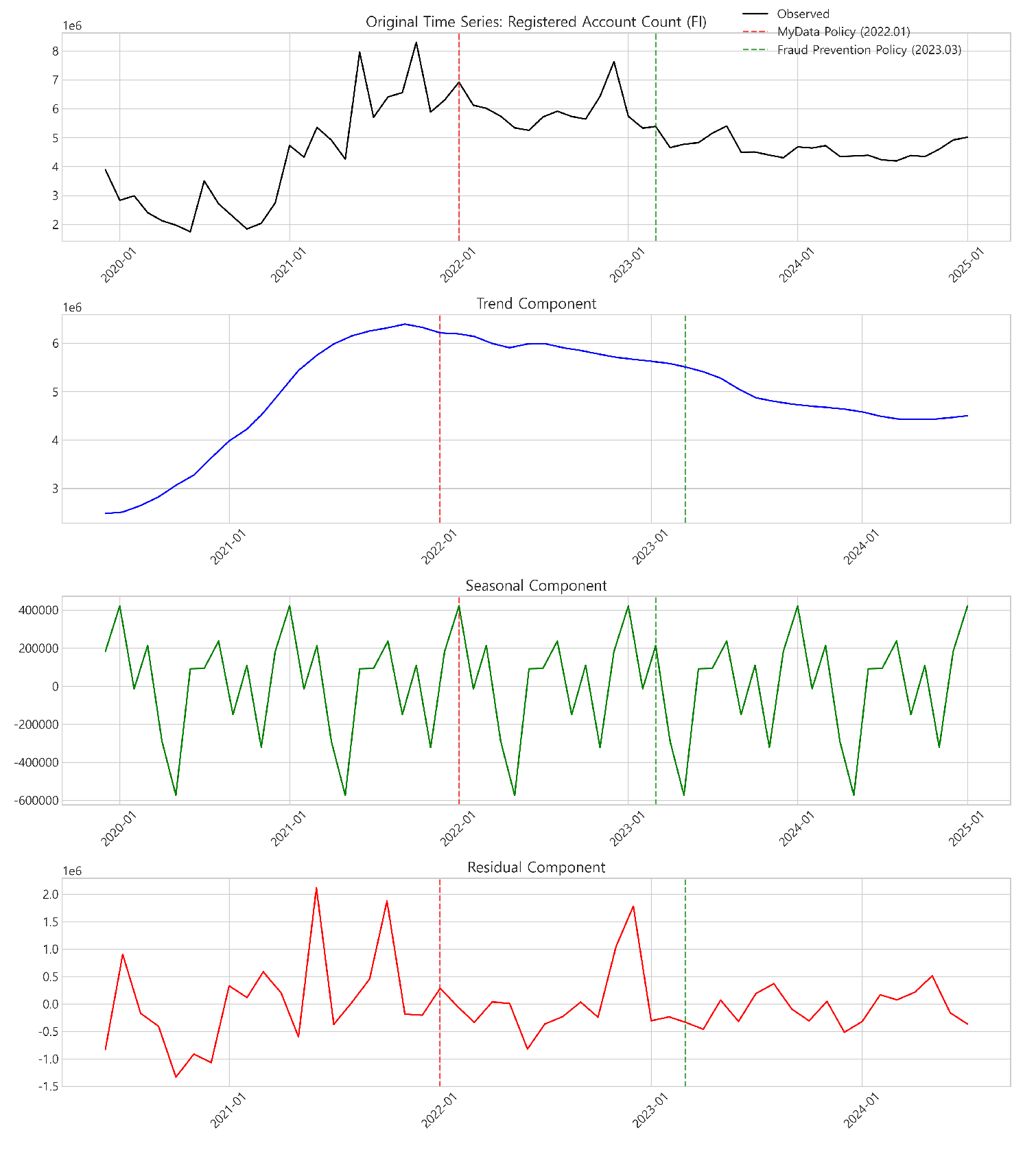

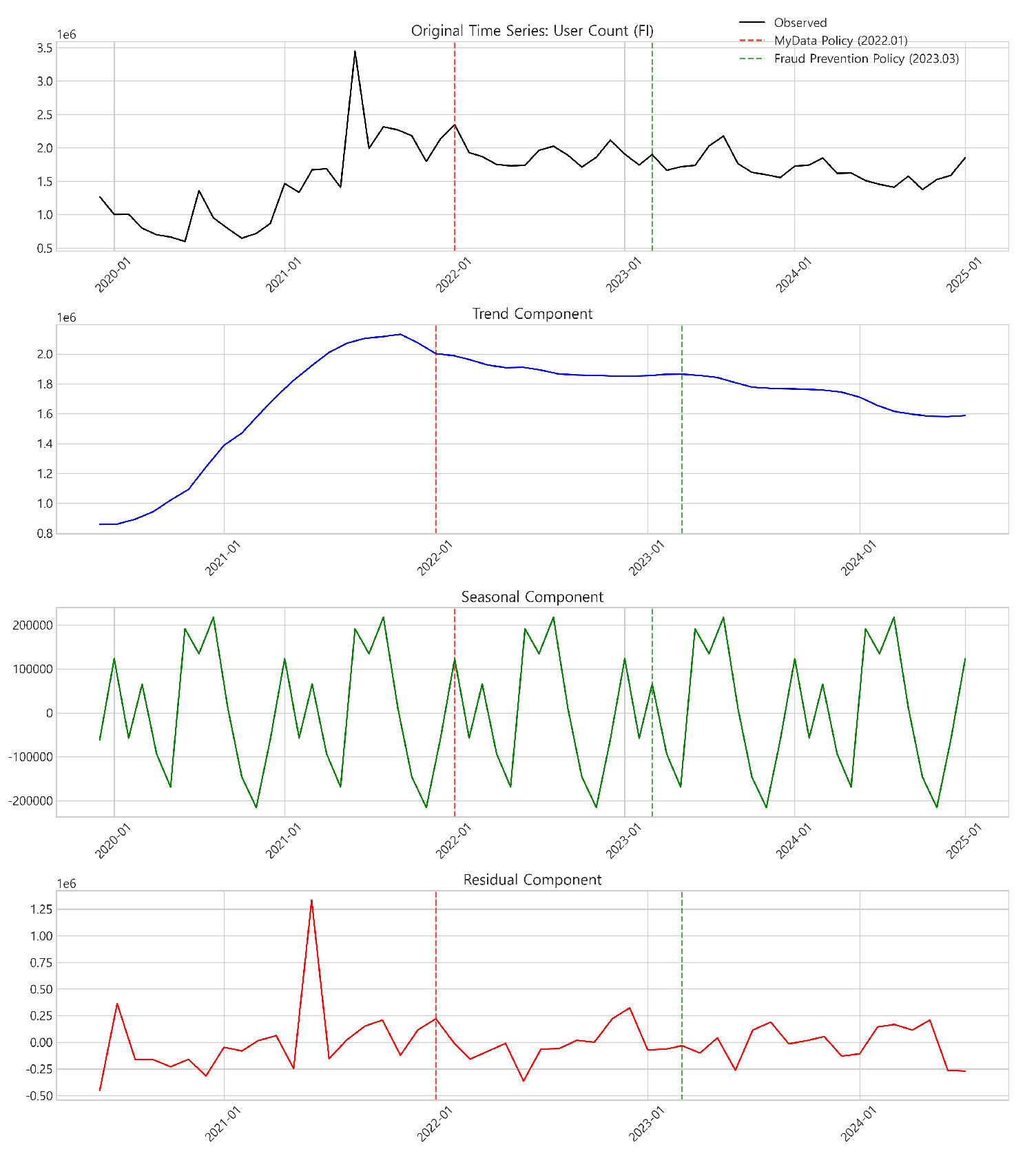

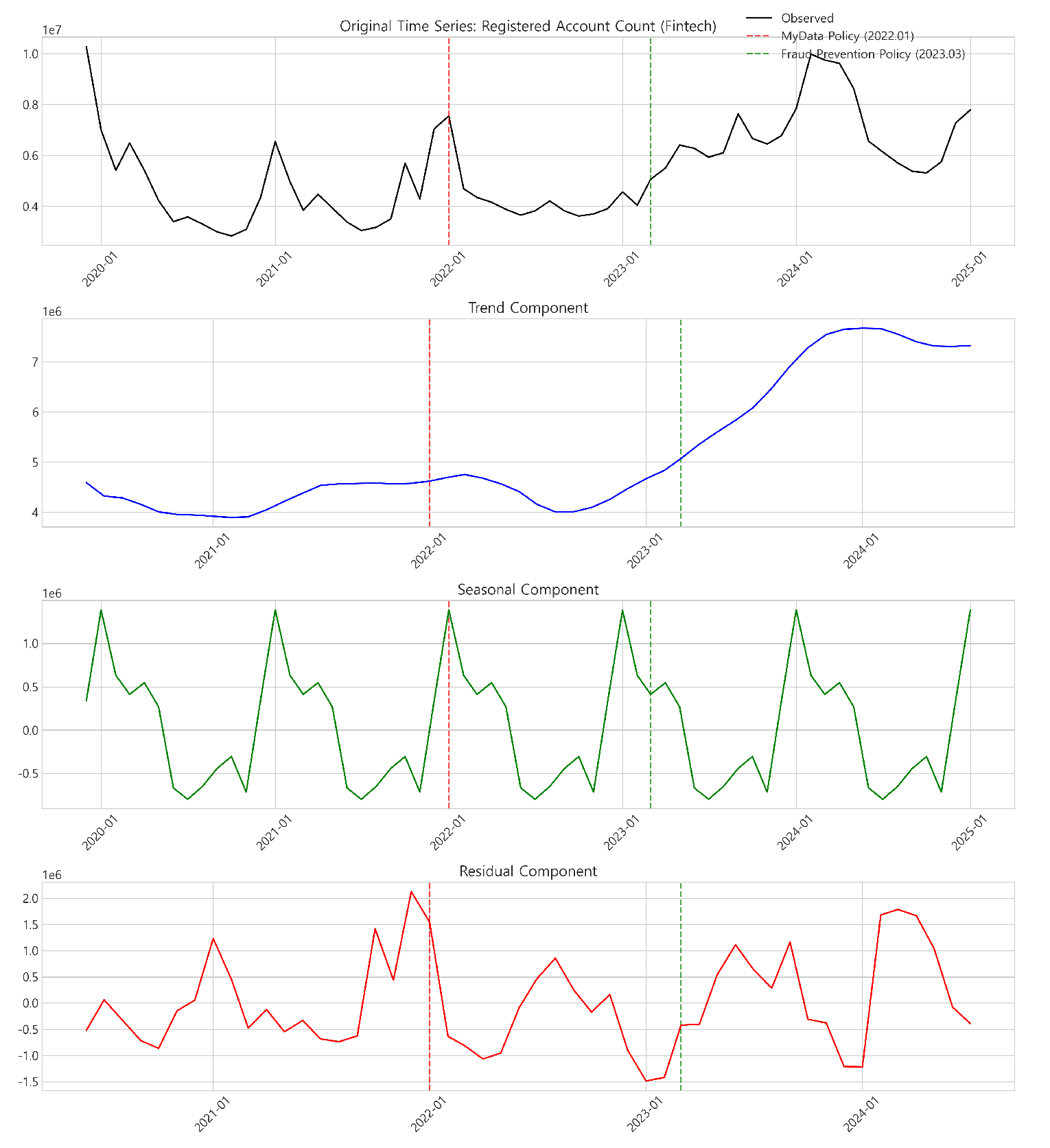

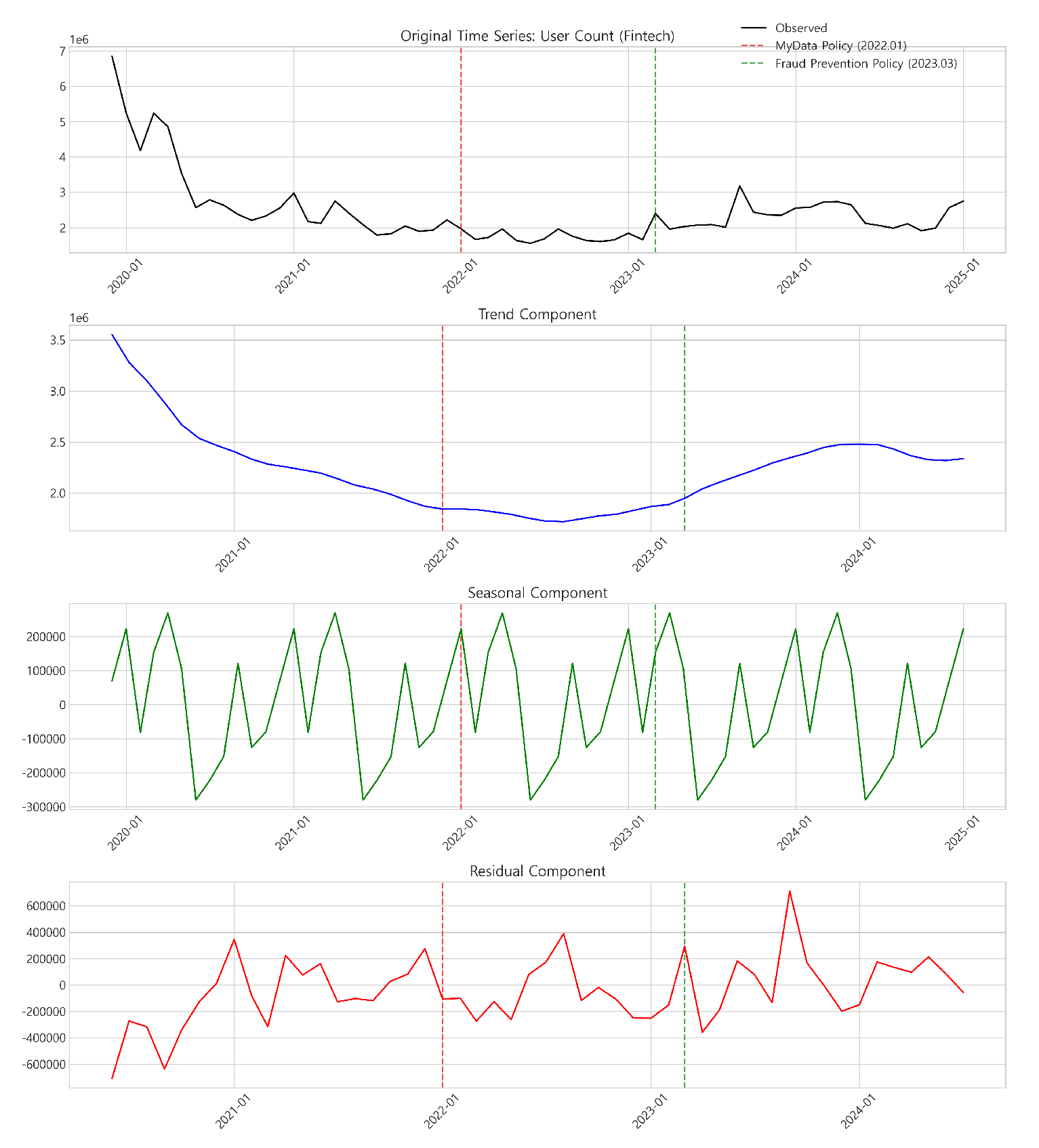

3.3.2. Time Series Decomposition

3.3.3. ARIMA Model

3.3.4. Prophet Model

3.4. Volatility Measurement Indicators

3.4.1. Coefficient of Variation (CV)

3.4.2. Standard Deviation (SD)

3.5. Policy Change Impact Analysis

3.5.1. Changepoint Analysis

3.5.2. Policy Effect Analysis

4. Research Results

4.1. Descriptive Statistics Analysis Results

4.2. Time Series Analysis Results

4.2.1. Time Series Decomposition Results

4.2.2. ARIMA Modeling Results

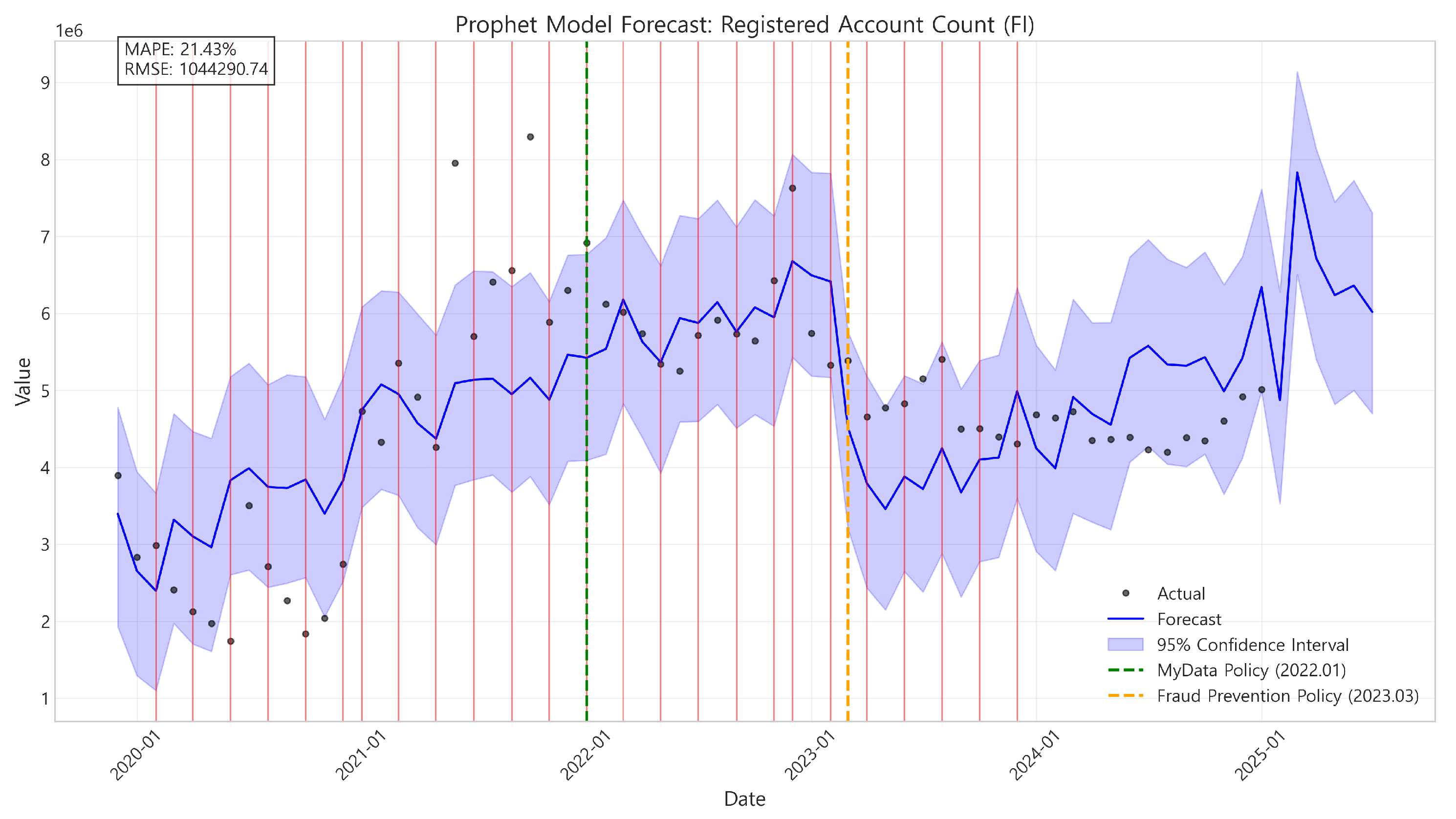

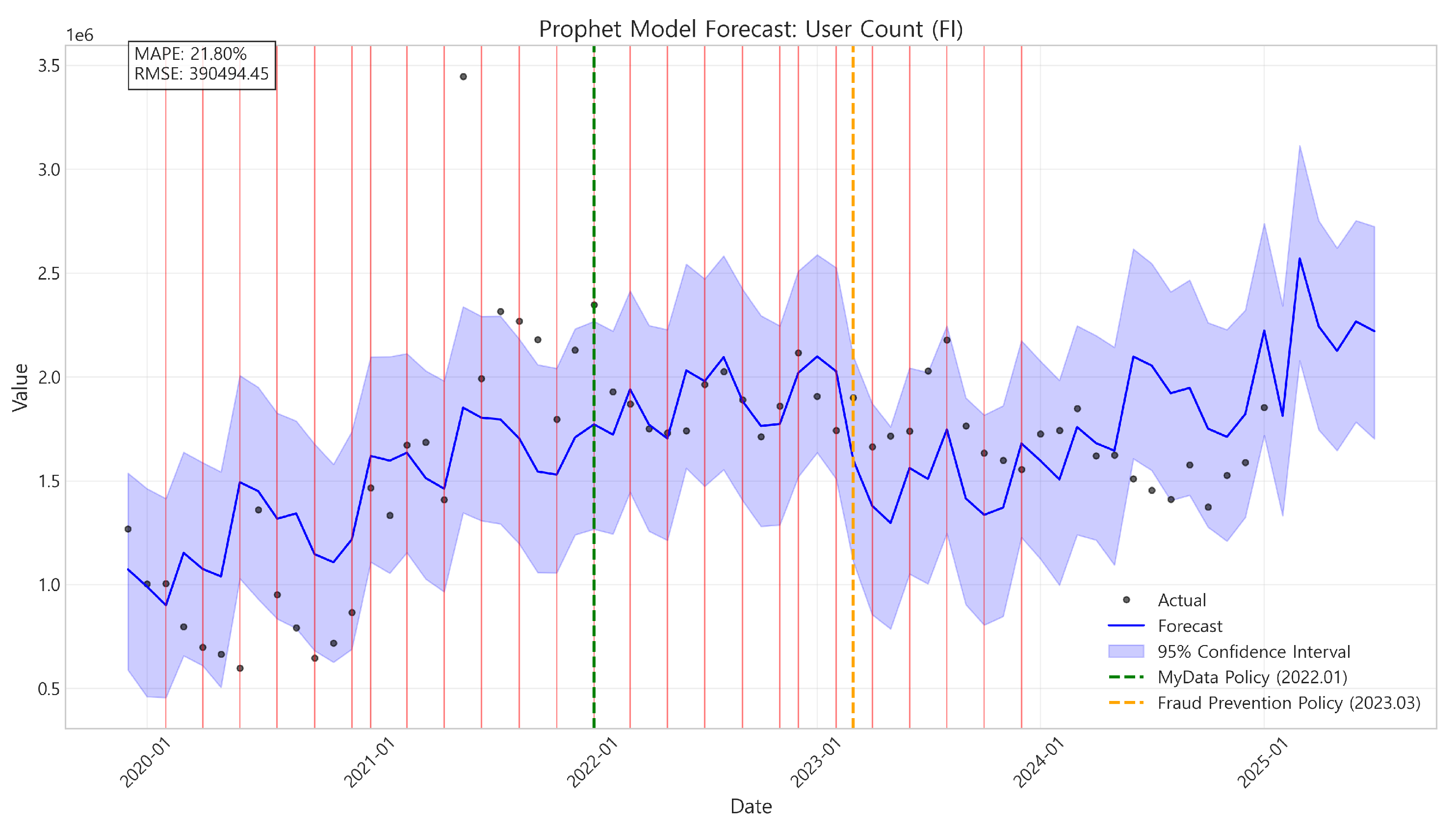

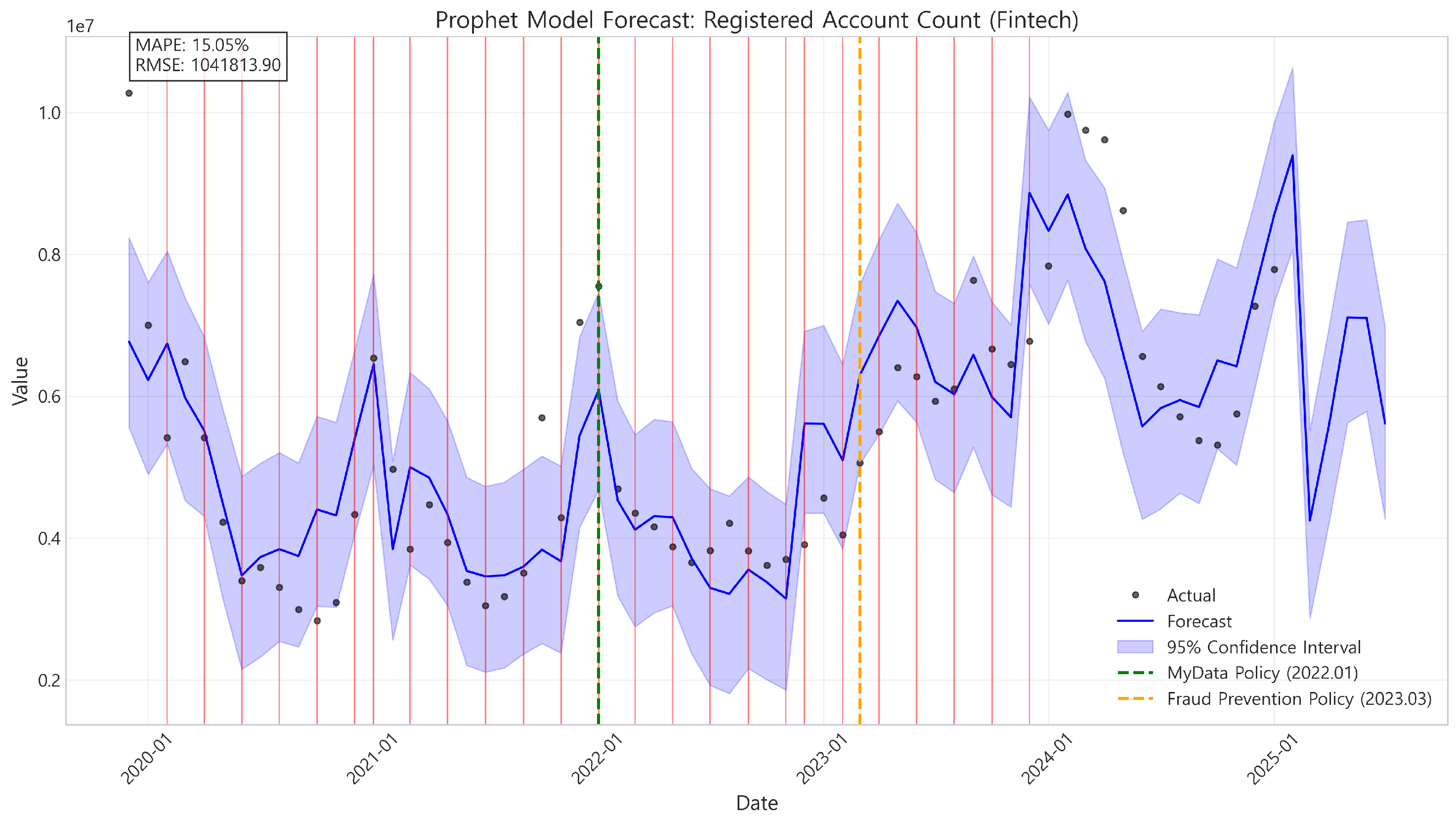

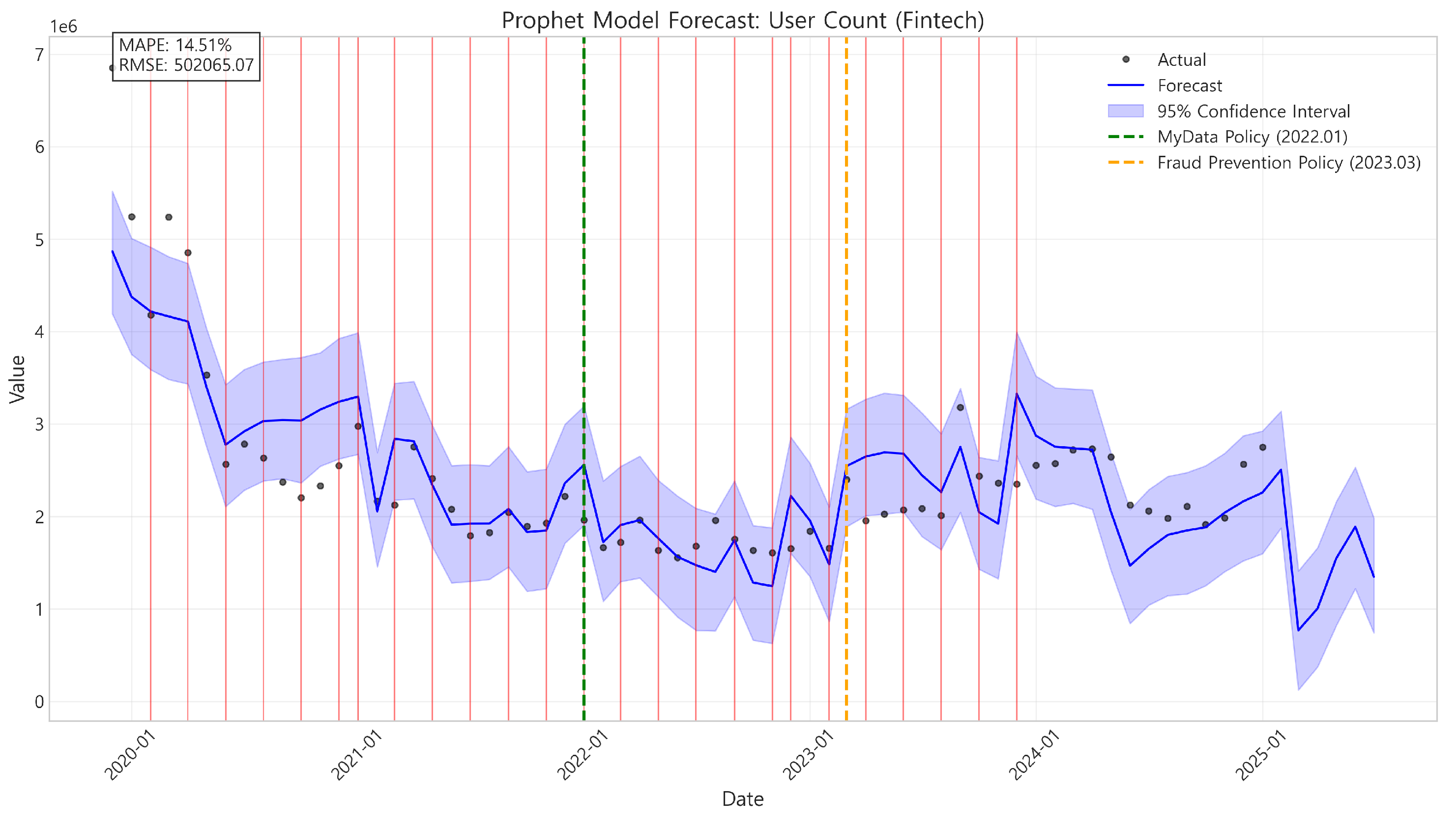

4.2.3. Prophet Modeling Results

4.2.4. Model Prediction Performance Comparison

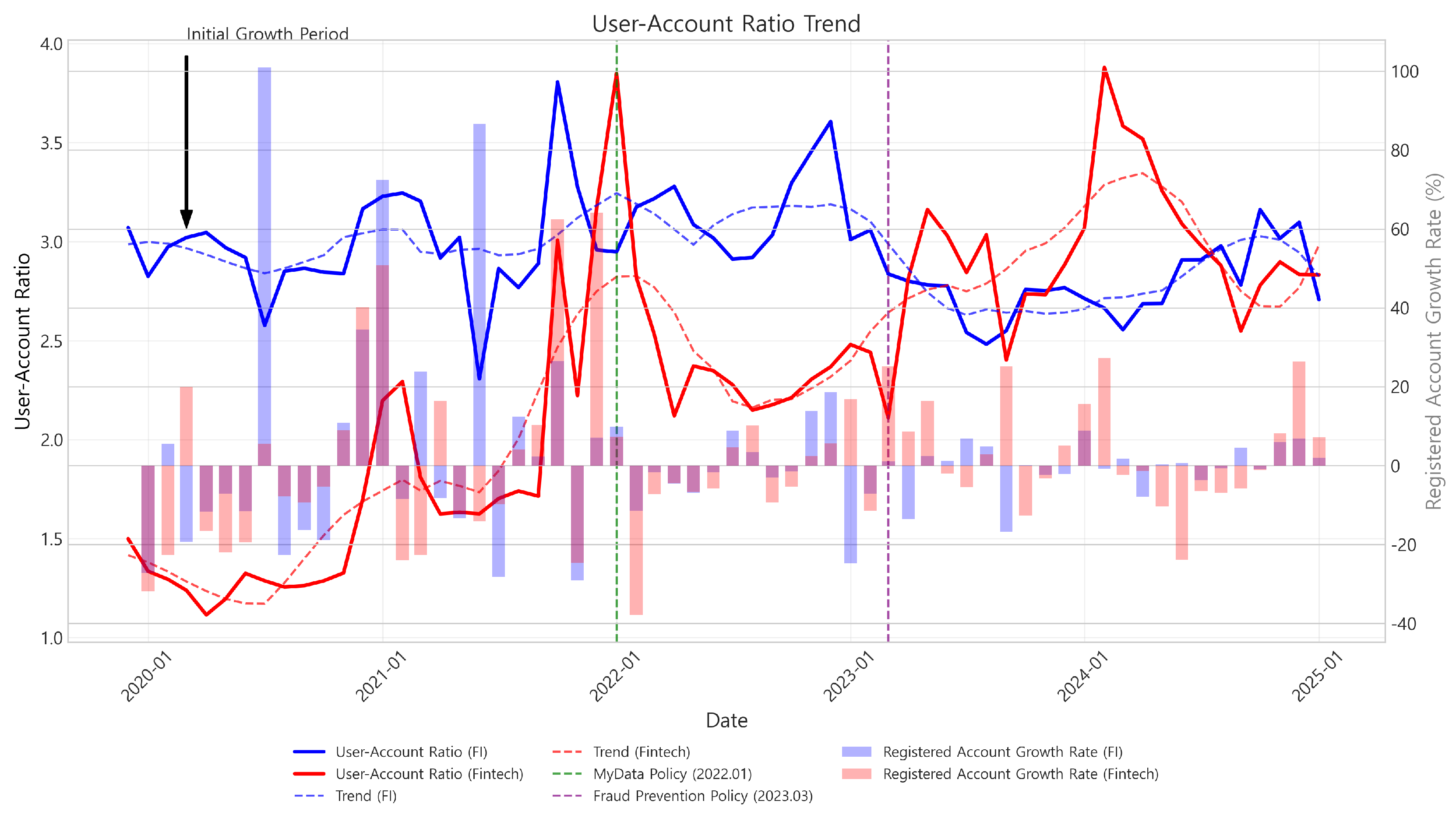

4.3. User-to-Account Ratio Analysis Results

| Classification | Pre-MyData (P1) | Post-MyData (P1) | Change (%) | Post-Fraud Reg. (P2) | Change (%) |

|---|---|---|---|---|---|

| API call volume (Millions) | 24.46 | 111.02 | 353.94 | 637.71 | 474.40 |

| Reg. accounts (FI) (Millions) | 4.15 | 5.97 | 43.73 | 4.64 | -22.20 |

| Subscribers (FI) (Millions) | 1.40 | 1.90 | 35.38 | 1.68 | -11.55 |

| Reg. accounts (FinTech) (Millions) | 4.65 | 4.29 | -7.87 | 6.89 | 60.84 |

| Subscribers (FinTech) (Millions) | 2.94 | 1.73 | -41.03 | 2.33 | 34.30 |

| UTA ratio (FI) | 2.98 | 3.14 | 5.57 | 2.78 | -11.62 |

| UTA ratio (FinTech) | 1.67 | 2.46 | 46.90 | 2.95 | 19.98 |

5. Discussion and Conclusion

5.1. Discussion of Research Results

- Intensified Usage by Existing Users (Intensive Margin Growth): The surge in API call volume is primarily fueled by increased engagement from existing users, not a proportional influx of new users. This ’intensive margin growth’ means current users are making more API calls, utilizing a wider range of services and accessing data more frequently. Time series analysis confirms decelerating new user growth, supporting this mechanism. This trend inflates API call volumes without a corresponding expansion of the user base.

- Efficiency Bias in API Call Volume Metrics: The disproportionate increase in API call volume may also be attributed to an ’efficiency bias,’ where the metric is heavily influenced by specific types of API calls that are inherently high-volume, even if they do not necessarily reflect diverse platform utilization or value creation. Services such as balance inquiries, transaction history retrievals, and real-time data updates, while valuable, generate significantly higher API call frequencies compared to less frequent but potentially more value-added services like sophisticated financial planning tools or complex transaction executions. A concentration of platform usage in these high-frequency but potentially lower value-added services can inflate API call volume without reflecting a commensurate qualitative expansion of platform utility or user engagement.

- System-Driven and Non-User Initiated API Calls: A further contributing factor to the divergence may be the presence of system-driven and non-user initiated API calls. Some FinTechs may implement automated processes that generate API calls for system maintenance, data synchronization, or proactive service monitoring, which are not directly initiated by active user engagement. These system-driven calls contribute to the overall API call volume but do not represent active user-driven platform utilization or qualitative growth in the user base. While the exact proportion of system-driven calls is difficult to quantify with publicly available data, their potential contribution to the observed divergence cannot be discounted.

- Increased User Experience Complexity and Friction: The introduction of enhanced security measures and stricter regulatory compliance, particularly following the financial fraud prevention regulations in March 2023, has likely increased user experience complexity and friction. Strengthened identity verification processes, additional transaction authorization steps, and more stringent data access protocols, while crucial for security and regulatory compliance, can create barriers to entry and negatively impact user convenience, especially for new or less tech-savvy users. The Prophet model’s changepoint analysis, showing a deceleration in user growth coinciding with the policy implementation timing, supports this interpretation, suggesting that increased user experience complexity may be dampening new user inflow.

- Weakening Differentiation and Value Proposition for Mass-Market Adoption: Following the initial wave of early adopters who were quick to embrace Open Banking’s novel functionalities, the platform may be facing challenges in articulating a compelling and differentiated value proposition to attract mass-market users. The initial novelty effect may be waning, and the platform may lack "killer applications" or services that resonate strongly with a broader user base beyond early tech enthusiasts and financially sophisticated individuals. The observed stagnation in the user-to-account ratio, particularly for FIs after the initial surge, may indicate a plateauing of user engagement and a need for renewed efforts to enhance the platform’s value proposition and attract a wider spectrum of users.

- Ecosystem Imbalances and Differential Policy Impacts: The analysis reveals ecosystem imbalances and differential impacts of policy changes on financial institutions and FinTechs, which may indirectly constrain overall user base expansion. As shown in Table 4, policy changes like MyData and Fraud Prevention Regulations have had contrasting effects on FI and FinTech growth indicators, leading to shifts in competitive dynamics and ecosystem power balances. While MyData initially benefited FIs, Fraud Prevention Regulations seemed to favor FinTech growth, potentially reflecting adaptation strategies and varying compliance capabilities across different player types. Such imbalances and regulatory uncertainties can create an uneven playing field, potentially hindering overall ecosystem stability and dampening user confidence in the platform’s long-term viability, thereby indirectly constraining user base expansion.

- Complementary Use of Predictive Models: Employing an ensemble of predictive models, combining the strengths of ARIMA for short-term forecasting and pattern extraction with Prophet’s capabilities in changepoint detection and long-term trend analysis, can provide a more robust and comprehensive understanding of platform dynamics. The unexpected outperformance of ARIMA in this study highlights the importance of model selection based on data characteristics and specific analytical goals.

- Focus on Qualitative Growth Indicators in Governance Metrics: Data-driven governance should shift its focus from solely monitoring quantitative metrics like API call volume to actively tracking and managing qualitative indicators such as registered accounts, active users, user-to-account ratios, service utilization diversity, and user satisfaction. Performance evaluation frameworks and incentive mechanisms should be redesigned to prioritize qualitative growth and balanced ecosystem development, moving beyond a narrow focus on API transaction volumes.

- Data-Driven Policy Simulation and Impact Assessment: Establishing a ’Data-Driven Policy Simulation Platform,’ as proposed in Section 5.2.2, is crucial for proactively evaluating the potential impacts of policy changes and regulatory interventions on platform growth and ecosystem dynamics. Utilizing models like Prophet, with its changepoint detection capabilities and policy regressors, can enable policymakers to simulate policy scenarios, assess potential unintended consequences, and make more informed, evidence-based decisions. Institutionalizing ’Evidence-Based Policy Evaluation’ with mandated data-driven impact assessments before and after policy implementations can further enhance the effectiveness and responsiveness of platform governance.

- Open Banking Data Analysis Center for Collaborative Governance: Creating an ’Open Banking Data Analysis Center,’ involving stakeholders from regulatory bodies, financial institutions, FinTechs, and academia, can foster collaborative data-driven governance. Such a center can serve as a hub for data sharing (within privacy and security constraints), joint analysis, and collective intelligence gathering, enabling a more holistic and ecosystem-wide perspective on platform governance and innovation strategies. This collaborative approach can facilitate data-driven policy adjustments, identify emerging challenges and opportunities, and promote a more balanced and sustainable innovation ecosystem within Korea’s Open Banking platform.

5.2. Implications and Recommendations

5.2.1. Academic Implications

- Multi-dimensional Growth Framework: We introduce a novel analytical framework that emphasizes the balance between qualitative and quantitative growth in platform research, expanding beyond traditional quantitative-focused metrics. By highlighting qualitative indicators like registered accounts, user numbers, and the user-to-account ratio, we provide a more holistic and balanced approach to diagnosing platform growth. This framework advances platform growth research by considering evolutionary stages: quantitative growth → qualitative growth → sustainable growth, systematically outlining core drivers and challenges at each stage.

- Methodological Advancement in Data-Driven Platform Research: This study expands the methodological toolkit for data-based platform research by applying time series analysis to empirically assess ecosystem volatility and policy impacts. The comparison of ARIMA and Prophet models demonstrates Prophet’s effectiveness in handling platform data volatility and prediction uncertainty. The use of Prophet’s changepoint analysis to quantify structural shifts in platform growth due to policy changes enhances the scientific rigor of policy effect analysis. This contributes to the broader applicability of time series analysis in platform research and diversifies methodological approaches in data-driven platform studies.

- Empirical Evidence and Generalizability through Case Study: The Korea Open Banking platform case study provides empirical evidence for platform qualitative growth and data-driven governance research, enhancing the generalizability and practical relevance of the findings. By balancing perspectives on the platform’s successes and challenges, diagnosing qualitative imbalances through data analysis, and proposing data-driven governance as a solution, this study offers insights and policy lessons applicable to similar platform ecosystems beyond Korea.

5.2.2. Policy Recommendations

- Construct ’Open Banking Quality Growth Dashboard’: Develop a real-time dashboard integrating key qualitative metrics: API call volume, registered account numbers, user numbers, user-to-account ratio, active user ratio, new user inflow rate, and user distribution by region and age.

- Publish Quarterly ’Open Banking Quality Growth Report’: Issue regular reports providing in-depth analysis of user behavior patterns, service utilization, and account activation rates, moving beyond simple growth rate reporting.

- Reform Financial Institution and FinTechs Evaluation System: Transition from the current API processing volume-centric evaluation to a multidimensional system incorporating user satisfaction, service diversity, and account activation rates.

- Introduce Performance-Based Incentive System: Implement differentiated incentives, such as API fee reductions, policy finance support, and priority access to regulatory sandboxes, for companies demonstrably contributing to qualitative indicator improvements.

- Link to International Standards: Actively participate in the development of international standards for Open Banking qualitative growth evaluation in collaboration with organizations like the OECD and BIS, enabling global benchmarking.

- Construct ’Open Banking Integrated Data Lake’: Build a centralized data lake for collecting and managing API call data, transaction data, user behavior data, and error/failure logs.

- Construct Real-time Data Pipeline: Establish a real-time data collection and processing system enabling data updates within 30 minutes.

- Establish Data Standardization and Quality Management System: Develop standardized protocols for data provision across all participating institutions, ensuring consistent formats and data quality.

- Establish ’Open Banking Data Analysis Center’: Create a dedicated analysis organization with participation from the FSC, KFTC, academia, and industry experts.

- Develop Prediction Model Ensemble System: Develop ensemble prediction models, combining the strengths of ARIMA and Prophet models, with monthly verification of prediction accuracy and continuous model improvement.

- Construct AI-based Early Warning System: Implement an AI-driven warning system to proactively detect potential risks such as volatility spikes, user churn, and error rate increases.

- Develop ’Data-based Policy Simulation Platform’: Create a policy experimentation environment for pre-simulating the impacts of regulatory changes, fee adjustments, and new service introductions.

- Regularize ’Open Banking Dashboard Meeting’: Institutionalize quarterly data-centered decision-making meetings with key stakeholders, including the FSC, Financial Supervisory Service, KFTC, FIs, and FinTechs.

- Institutionalize Evidence-based Policy Evaluation: Mandate data-based effect analysis at 3-month, 6-month, and 1-year intervals before and after all major policy changes.

5.3. Limitations and Future Research Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| CV | Coefficient of Variation |

| SD | Standard Deviation |

| AIC | Akaike Information Criterion |

| BIC | Bayesian Information Criterion |

| MAE | Mean Absolute Error |

| MAPE | Mean Absolute Percentage Error |

| KFTC | Korea Financial Telecommunications and Clearings Institute |

| FI | Financial Institution |

| FinTech | financial technology company |

| EU | European Union |

| PSD2 | Payment Services Directive 2 |

References

- Parker, G. G.; Van Alstyne, M. W.; Choudary, S. P. Platform revolution: How networked markets are transforming the economy—and how to make them work for you; WW Norton & Company, 2016.

- Cusumano, M. A.; Gawer, A.; Yoffie, D. B. The business of platforms: Strategy in the age of digital competition, innovation, and power; Harper Business, 2019; Volume 320.

- Gomber, P.; Koch, J. A.; Siering, M. Digital Finance and FinTech: Current research and future research directions. J. Bus. Econ. 2017, 87, 537–580. [CrossRef]

- Accenture. Open banking: Opening the door to the platform economy. 2022. Available online: https://www.accenture.com/us-en/insights/banking/open-banking (accessed on 26 February 2025).

- European Commission. Directive (EU) 2015/2366 of the European Parliament and of the Council of 25 November 2015 on payment services in the internal market. 2015. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32015L2366 (accessed on 26 February 2025).

- Open Banking Implementation Entity. The Open Banking Standard. 2016. Available online: https://standards.openbanking.org.uk/ (accessed on 26 February 2025).

- Kwon, H. J. Performance and development direction of open banking adoption. Korea Institute of Finance, 2020. Available online: https://www.kif.re.kr/kif4/publication/pub_detail?mid=20&nid=189&sid=188&vid=6178&cno=276428&pn=1 (In Korean) (accessed on 26 February 2025).

- Financial Services Commission. Financial Payments Innovation Initiative. 2019. Available online: http://www.fsc.go.kr:8300/v/plZFjTJIphE (In Korean) (accessed on 26 February 2025).

- Kim, G. R.; Cho, M. J. Open banking, the prelude to changes in the financial industry landscape. Samjong KPMG Economic Research Institute, 2019. Available online: https://assets.kpmg.com/content/dam/kpmg/kr/pdf/2019/kr-issuemonitor-open-banking-20190524.pdf (In Korean) (accessed on 26 February 2025).

- Oh, S., Chung, G., & Cho, K. (2024). New sustainable fintech business models created by open application programming interface technology: A case study of Korea’s open banking application programming interface platform. Sustainability, 16(16), 7187. [CrossRef]

- Financial Services Commission. (2024). Entities can now view all their accounts at once with Open Banking. [Press Release]. Retrieved from http://www.fsc.go.kr:8300/v/ppVuKt8TKcB (In Korean, accessed on 26 February 2025).

- Tiwana, A. Platform ecosystems: Aligning architecture, governance, and strategy; Newnes, 2013.

- Gawer, A.; Cusumano, M. A. Industry platforms and ecosystem innovation. J. Prod. Innov. Manag. 2014, 31, 417–433. [CrossRef]

- Boudreau, K. J. Open platform strategies and innovation: Granting access vs. devolving control. Manage. Sci. 2010, 56, 1849–1872. [CrossRef]

- De Reuver, M.; Sørensen, C.; Basole, R. C. The digital platform: A research agenda. J. Inf. Technol. 2018, 33, 124–135. [CrossRef]

- Eisenmann, T.; Parker, G.; Van Alstyne, M. Platform envelopment. Strateg. Manage. J. 2011, 32, 1270–1285. [CrossRef]

- Zhu, F.; Iansiti, M. Entry into platform-based markets. Strateg. Manage. J. 2012, 33, 88–106. [CrossRef]

- Ghazawneh, A.; Henfridsson, O. Balancing platform control and external contribution in third-party development: The boundary resources model. Inf. Syst. J. 2013, 23, 173–192. [CrossRef]

- Wareham, J.; Fox, P. B.; Cano Giner, J. L. Technology ecosystem governance. Organ. Sci. 2014, 25, 1135–1156. [CrossRef]

- Belleflamme, P.; Peitz, M. Industrial organization: Markets and strategies; Cambridge university press, 2015. [CrossRef]

- European Banking Authority. Report on the Use of Digital Platforms in the EU Banking and Payments Sector. EBA, 2021. Available online: https://service.betterregulation.com/document/530614 (accessed on 26 February 2025).

- FSC. (2022, January 4). [Press Release] You Can Manage Your Scattered Financial Information More Safely, Quickly, and Conveniently - Full Implementation of MyData (Personal Credit Information Management Business) [Press release]. Retrieved from http://www.fsc.go.kr:8300/v/pvmFJTZC3c7 (In Korean, accessed on 26 February 2025).

- FSC. (2022, September 29). [Joint Ministries] Announcement of Telecommunications and Financial Sector Measures to Eradicate Voice Phishing Crimes [Press release]. Retrieved from http://www.fsc.go.kr:8300/v/pZ6tbuZCRTA (In Korean, accessed on 26 February 2025).

| Indicator | Mean | Std. Dev. | CV | Min | Max |

|---|---|---|---|---|---|

| Reg. accounts (FI) | 4,742,924 | 1,469,587 | 0.31 | 1,744,957 | 8,297,763 |

| Subscribers (FI) | 1,617,175 | 502,845 | 0.31 | 597,629 | 3,446,612 |

| Reg. accounts (FinTech) | 5,400,402 | 1,883,014 | 0.35 | 2,838,381 | 10,274,366 |

| Subscribers (FinTech) | 2,442,606 | 972,868 | 0.40 | 1,556,897 | 6,852,283 |

| Indicator | Optimal ARIMA | AIC | BIC | Ljung-Box p-value |

|---|---|---|---|---|

| Reg. accounts (FI) | ARIMA(0,1,1) | 1837.39 | 1841.62 | 0.89 |

| Subscribers (FI) | ARIMA(0,1,1) | 1730.15 | 1734.37 | 0.58 |

| Reg. accounts (FinTech) | ARIMA(2,1,2) | 1867.21 | 1877.76 | 0.98 |

| Subscribers (FinTech) | ARIMA(2,1,2) | 1737.66 | 1748.22 | 0.99 |

| Indicator | RMSE | RMSE | MAE | MAE | MAPE | MAPE |

|---|---|---|---|---|---|---|

| - | ARIMA | Prophet | ARIMA | Prophet | ARIMA | Prophet |

| Reg. accounts (FI) | 291,349 | 2,035,233 | 211,770 | 1,894,492 | 4.48% | 42.25% |

| Subscribers (FI) | 147,970 | 698,066 | 121,376 | 627,391 | 7.61% | 40.77% |

| Reg. accounts (FinTech) | 2,157,530 | 2,425,787 | 1,631,883 | 1,973,020 | 19.15% | 24.44% |

| Subscribers (FinTech) | 334,886 | 551,018 | 304,933 | 469,380 | 12.54% | 19.85% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).