1. Introduction

Gender-based entrepreneurship is a critical global issue within the framework of the Sustainable Development Goals (SDGs). At the global level, gender inequality in Indonesia can be observed through the Global Gender Gap Index (GGGI). In 2021, according to the Global Gender Gap Report, Indonesia ranked 101st out of 156 countries, with a GGGI score of 0.688 or 68.8 percent, indicating that gender equality in Indonesia has reached only 68.8% (Indonesia, 2021).

In today’s digital era, women’s entrepreneurship plays a crucial role in driving economic growth. For women entrepreneurs in particular, the digital revolution provides greater access to markets, knowledge, and flexible work arrangements (Suseno & Abbott, 2021). It not only facilitates the establishment of new businesses but also transforms how entrepreneurs manage their enterprises. Many mompreneurs are able to establish businesses from home using technology (Ughetto et al., 2020). However, they continue to face significant challenges, including financial constraints, limited knowledge and experience, work–life balance issues, gender discrimination, sociocultural barriers, and inadequate government support (Irwin et al., 2025).

Over the past few decades, numerous studies have consistently shown that the number of female entrepreneurs remains lower than their male counterparts. Thus, research on entrepreneurship from a female perspective is essential (Darnihamedani & Terjesen, 2022). This phenomenon can be seen as a form of modern feminism, providing opportunities for mothers to achieve financial independence and personal growth while managing family responsibilities (Dhaliwal, 2021). Yet, patriarchal norms in Indonesia often hinder women’s participation, as their voices are underrepresented in decision-making processes. Men are frequently considered a decisive factor in entrepreneurial success due to their roles as heads of households or successors (Love et al., 2024). Furthermore, traits such as confidence, independence, and ambition are often associated with masculine orientations, reinforcing doubts about women’s entrepreneurial abilities.

In many developing countries, women’s education is often not prioritized (Rubio-Bañón & Esteban-Lloret, 2016). Nevertheless, women entrepreneurs in Indonesia are heavily engaged in Micro, Small, and Medium Enterprises (MSMEs), which enable them to withstand economic crises. Mompreneurs typically participate in fashion, beauty, and the culinary industries. Decision-making skills are crucial for success, directly affecting business outcomes. Despite facing unique challenges such as balancing business demands with family responsibilities and societal expectations, mompreneurs also possess significant potential to drive economic growth and innovation, particularly when provided with sufficient support (Laguía et al., 2022). Recognizing and supporting their role is therefore imperative.

One of the essential dimensions of entrepreneurship is understanding its psychological, sociological, and financial aspects. Behavioral finance examines how psychological phenomena influence individuals’ financial behavior (She et al., 2022), particularly in decision-making, including investment choices. Many factors influence investment decisions, such as financial knowledge, investment goals, risk tolerance, and market conditions. For sustainable business growth, measuring and evaluating each business activity through effective recordkeeping systems is crucial. Female entrepreneurs differ from male entrepreneurs in terms of characteristics, backgrounds, motivations, entrepreneurial skills, and the challenges they face (Gupta et al., 2019).

These differences underscore the importance of entrepreneurial literacy, particularly for women entrepreneurs, as foundational knowledge and skills are essential to navigate both psychological and financial challenges. Entrepreneurial literacy encompasses knowledge aspiring entrepreneurs should acquire, including creativity, social, technical, management, leadership, and conceptual skills (Arnila & Hilmiyatun, 2020). Key dimensions of entrepreneurial competence include financial skills, management skills, start-up business skills, operational skills, marketing skills, communication, and information management skills. Entrepreneurial literacy represents the fundamental understanding required to establish and grow a business. According to (Alfionita et al., 2020) entrepreneurial literacy refers to individual knowledge combined with a positive, creative, and innovative personality aimed at achieving well-being through business development. Furthermore, (Fatimah & Kartikasari, 2018) argues that entrepreneurial education equips individuals with knowledge of entrepreneurial concepts, shaping their attitudes, behaviors, and mindsets as entrepreneurs.

Nonetheless, while entrepreneurial literacy is recognized as a critical foundation for aspiring entrepreneurs, in practice, significant disparities remain between male and female entrepreneurs. Such disparities are often rooted in limited knowledge and entrepreneurial literacy, posing particular challenges for mompreneurs (Ilie et al., 2021). These limitations include restricted access to resources, infrequent participation in entrepreneurship training programs (Theunissen, 2022), and organizational cultural barriers. In many MSMEs, knowledge, skills, and insights are primarily acquired through personal experience, knowledge that is often undocumented or informally transmitted, commonly referred to as tacit knowledge (Sun et al., 2024)).

This study addresses these gaps by contributing a new perspective to entrepreneurship and behavioral finance literature, particularly within the context of mompreneur innovation. It applies the Knowledge-Based Innovation Theory, first developed by Ikujiro Nonaka and Hirotaka Takeuchi in 1995, to explain how mompreneurs develop innovations through entrepreneurial literacy and financial behavior. This theory encompasses tacit knowledge (experience and expertise) and explicit knowledge (data and information), which interact and transform into innovation. , , This process is highly relevant in the context of women’s entrepreneurship, particularly among mompreneurs in Makassar City. These women rely heavily on practical experience and training-derived knowledge to manage micro-businesses innovatively and sustainably.

This study offers a deeper exploration of how entrepreneurial literacy is formed, internalized into financial behavior, and converted into knowledge-based innovation. Unlike previous studies that mainly examined the relationship between entrepreneurial literacy and business performance, this research systematically investigates four key questions that map how literacy develops, transforms, and influences innovation. The study was conducted in Makassar City, a region that has experienced rapid MSME growth and strong government support for the creative economy. This context provides a solid foundation for advancing theoretical contributions to developing a literacy-based innovation model while reinforcing the relevance of accounting approaches in entrepreneurship.

The findings are expected to contribute to the literature on knowledge-based entrepreneurial innovation and the Theory of Planned Behavior. Moreover, this study offers practical implications for policymakers and entrepreneurship training practitioners. It further strengthens the narrative of entrepreneurship as a tool for women’s social and economic empowerment, while promoting gender equality through the enhanced capacity of mompreneurs in business management and innovation.

2. Materials and Methods

Research Design

This study employed a qualitative approach using a case study method to examine entrepreneurial literacy and financial behavior from an accounting perspective among mompreneurs in Makassar City. Data analysis was carried out using a spiral model with the assistance of NVivo 12 software, which facilitated systematic data organization, coding, theme identification, and visualization of analytical results.

Sample/Respondents

The primary informants consisted of 15 mompreneurs, supported by 50 additional informants. They were selected through theoretical sampling based on their capacity to address the research questions and contribute to theoretical development (Higginson & Nancy, 2009). Informant selection was guided by specific characteristics: female gender with children, marital status (married, widowed, or single parent), educational background ranging from elementary to higher education, and varying levels of financial recordkeeping, from basic to comprehensive. The study was conducted across various MSMEs located in 13 districts of Makassar City. Primary data were obtained through in-depth interviews with the main informants, while supporting informants enriched and validated the findings. All interview processes were audio-recorded and transcribed verbatim for each informant, enabling more detailed and systematic analysis.

Data Analysis

Data analysis followed several stages of the spiral model. First, interview transcripts were organized, reduced, and validated for credibility through triangulation before being stored in NVivo 12. The transcripts were then reread to identify themes and subthemes relevant to the research focus, which were subsequently arranged into nodes in NVivo 12. Informant statements were coded into these nodes, including the use of automatic coding features provided by the software. The next stage involved analyzing the coded data through various analytical features of NVivo 12, which enabled a visual representation of findings for clearer interpretation. Data from supporting informants was integrated by comparing and validating across multiple sources. This triangulation process ensured the credibility of findings by confirming inter-informant consistency and examining relationships among emerging themes, resulting in more robust and in-depth conclusions.

3. Results

3.1. Development of Entrepreneurial Literacy Among Mompreneurs

Entrepreneurial literacy refers to an individual’s ability to understand, apply, and develop entrepreneurial knowledge and skills to create, manage, and expand a business. Developing entrepreneurial literacy involves several key aspects that shape the mindset and competencies required for success in the business world. Individuals with strong entrepreneurial literacy are better prepared to identify business opportunities, innovate, and adapt to the dynamic nature of markets, as reflected in the interview findings with respondents presented in

Table 1.

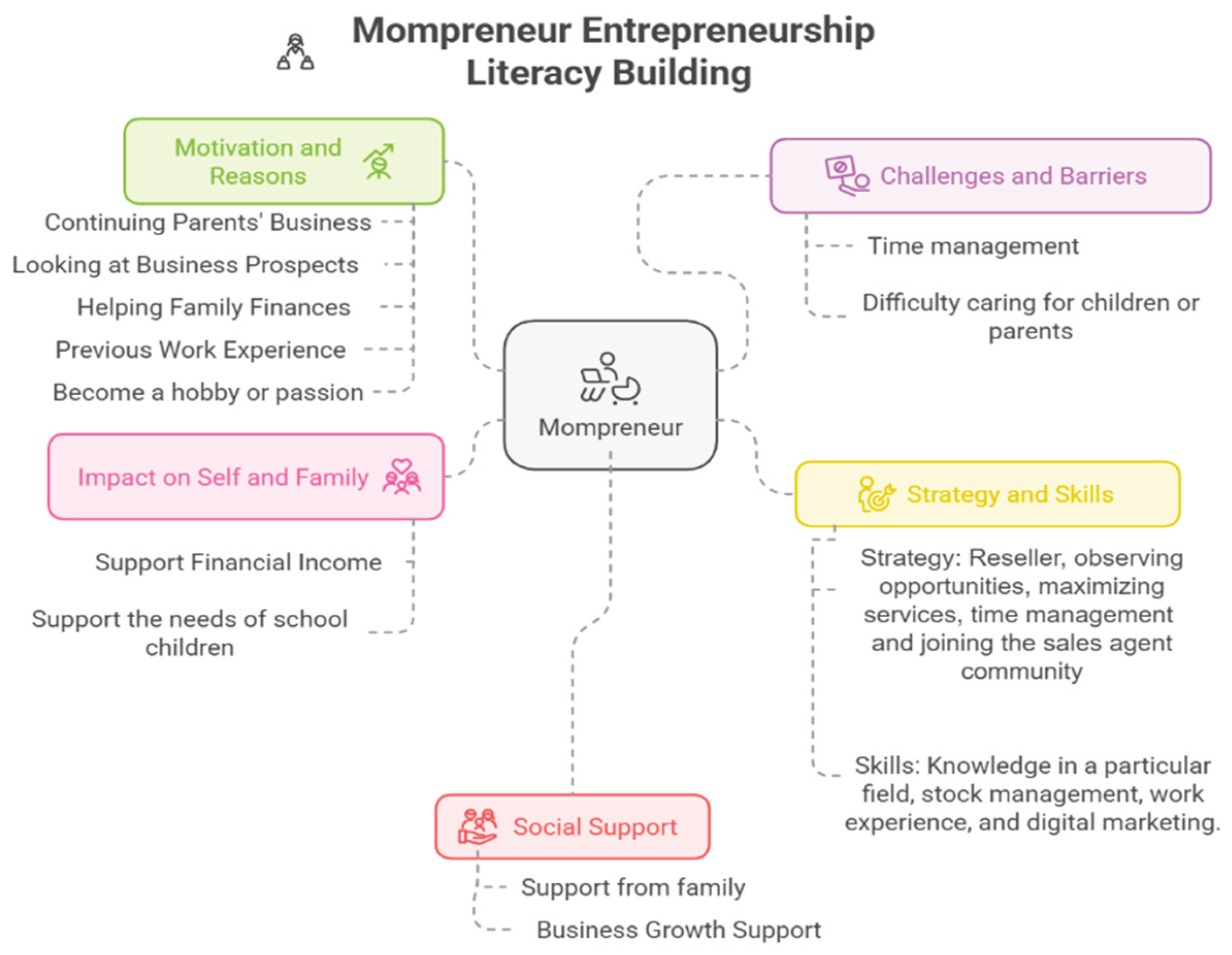

Based on the interviews, the motivations of mompreneurs to engage in business include continuing family enterprises, identifying profitable opportunities, contributing to household income, utilizing previous work experience, and turning hobbies into businesses. The challenges they encounter include managing time while caring for children and elderly family members. To overcome these barriers, they adopt strategies such as effective time management, becoming resellers, improving service quality, and joining sales communities. They also use various skills, including inventory management, digital marketing, and domain-specific knowledge. Their entrepreneurial activities not only increase household income but also support their children’s education. Moreover, support from family members and the surrounding community boosts their confidence and resilience in managing their enterprises. Overall, entrepreneurship enhances economic and household well-being while contributing to mompreneurs' personal growth. The five dynamic elements of mompreneurs in initiating their businesses, namely (1) motivations and reasons for entrepreneurship, (2) challenges and obstacles, (3) strategies and skills, (4) impact on self and family, and (5) social, networking, and government support, are illustrated in

Figure 1.

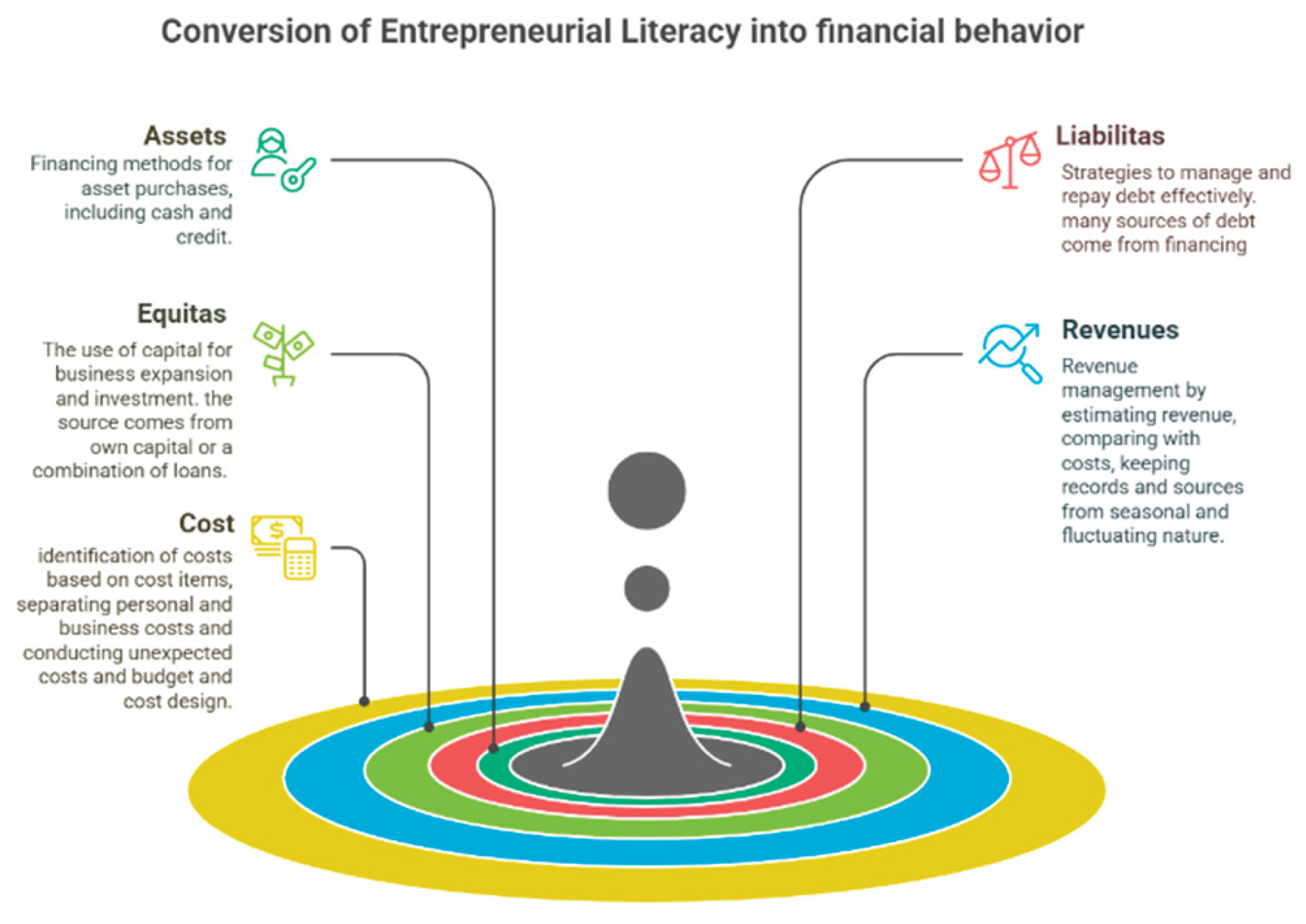

3.2. Converting Entrepreneurial Literacy into Financial Behavior

The conversion of entrepreneurial literacy into financial behavior refers to how mompreneurs’ understanding of entrepreneurship shapes their ability to manage finances effectively, particularly in terms of planning, managing, and reporting assets, liabilities, capital, revenues, and expenses in running their businesses, as summarized in

Table 2.

The interviews revealed that mompreneurs in Makassar demonstrate financial management practices characterized by both independence and prudence. Business assets are generally acquired using business revenues, while a smaller proportion relies on loans. The range of managed assets, including buildings, gold, vehicles, and production machinery, indicates a long-term investment orientation. Debt management strategies vary: some informants avoid borrowing to minimize risk, while others utilize loans as leverage for business expansion. Most working capital originates from personal funds, with a few cases combining personal and borrowed capital, reflecting reliance on self-financing and limited opportunities for business scaling.

Regarding revenues and expenses, varying levels of financial literacy were observed among informants. Some mompreneurs conduct structured income analyses, compare them with expenses, and even perform internal audits, while the majority still rely on manual and inconsistent recordkeeping. Seasonal fluctuations in revenue increase business vulnerability, although many reinvest earnings into capital or long-term investments. Expense management, however, is generally more systematic, involving separating personal and business expenses, budget preparation, operational cost control, and allocation of emergency funds.

Overall, mompreneurs display a good level of financial awareness, but as illustrated in

Figure 2, further improvement is needed in consistent recordkeeping, the use of digital financial tools, and access to external financing to strengthen business sustainability and growth.

3.3. Developing Entrepreneurial Literacy and Financial Behavior for Innovation

The development of entrepreneurial literacy fosters innovation among mompreneurs, which manifests in four main areas: creative promotion and marketing, relationship building, product development, and service enhancement. These forms of innovation are crucial for differentiating businesses from competitors, attracting consumers, addressing market needs, and improving efficiency and customer experience.

Table 3 presents the interview findings related to the development of entrepreneurial literacy and financial behavior for innovation.

The interviews highlighted that mompreneurs in Makassar exhibit creativity in promotion and marketing by leveraging social media platforms such as Instagram, Facebook, and TikTok. These platforms are used not only to showcase products but also to build interactions and stronger connections with consumers. Promotional strategies such as discounts and free delivery services are widely employed to attract new customers and boost sales. These findings indicate that mompreneurs are capable of adapting to digital technologies and understanding modern consumer behavior, which is often sensitive to price and value-added services. However, such strategies also risk reduced profit margins if not balanced with cost efficiency and careful planning.

Regarding product development, informants emphasized the importance of product quality in maintaining customer trust and building business reputation. Consistency in quality was seen as essential for sustaining long-term customer loyalty. At the same time, efforts to innovate by introducing new product variations, both food and non-food, were evident as responses to market dynamics and changing consumer demands. This dual strategy of maintaining existing customer bases through quality consistency while expanding into new segments via product differentiation demonstrates mompreneurs' adaptive capacity and entrepreneurial resilience in increasingly competitive markets.

4. Discussion

Conversion of Entrepreneurship Literacy into Financial Behavior

The conversion of entrepreneurship literacy into financial behavior among mompreneurs is reflected in their ability to plan finances, save, and manage assets, debts, and capital. Mompreneurs with stronger entrepreneurship literacy tend to practice healthier financial management (NJ & Vethirajan, 2024). hey use cash or credit financing to acquire assets, manage debt by setting aside part of their income, and often prefer loans from formal financial institutions (Mazeed* et al., 2019). Business capital is sourced from personal funds or a mix of personal funds and loans, highlighting both reliance on self-financing and constraints in scaling their businesses. Maintaining a balanced capital structure between debt and equity is critical for business sustainability (Malinowska & Seretna-Sałamaj, 2017).

In terms of income management, mompreneurs analyze, rotate, and reinvest profits, although their financial record-keeping remains mostly manual and inconsistent (Suaza Arcila, 2021). On the expenditure side, they separate household and business expenses, prepare budgets, and establish emergency funds to ensure financial stability (Adebiyi, 2025). This process can be explained through the Theory of Planned Behavior (TPB), which posits that attitudes toward finance, social norms, and perceived behavioral control influence mompreneurs’ financial decision-making. Furthermore, the Knowledge-Based Innovation Theory emphasizes that financial literacy, , gained through formal and informal learning, , enables the development of effective financial strategies such as debt management and the separation of personal and business finances. The integration of these theories explains how mompreneurs build financial practices that support stable business growth and enhance family economic well-being.

Development of Entrepreneurship Literacy and Financial Behavior for Innovation

Creativity in promotion, marketing, and product development is central to mompreneurs’ entrepreneurship literacy. They leverage social media platforms such as Instagram, Facebook, and TikTok by producing engaging visual content and applying strategies such as discounts and free delivery to attract customers (Malaquias et al., 2023),(Maula et al., 2021). Positive customer relationships are cultivated through friendliness and collaboration, which enhance loyalty and satisfaction (Gil-Gomez et al., 2020). Product development focuses on maintaining quality and introducing innovations to remain relevant in the market. Service improvements, , particularly in responsiveness and digital adoption, , help strengthen competitiveness (Elmobayed et al., 2024).

Mompreneurs’ approaches to promotion and innovation can be explained through the Theory of Planned Behavior (TPB), which highlights how attitudes toward innovation, social norms, and perceived behavioral control influence decisions to adopt digital marketing and build strong customer relationships. The Knowledge-Based Innovation Theory further underscores the importance of knowledge gained through experience, communities, and technology in fostering innovative strategies. The integration of these theories offers a comprehensive explanation of how entrepreneurship literacy enables mompreneurs to adapt to market dynamics and effectively grow their businesses.

Implications of the Study

The findings indicate that entrepreneurship literacy influences mompreneurs’ financial behavior by enhancing their ability to manage assets, capital, and income, thus enabling more effective financial decision-making that supports business sustainability. Sound financial behavior, in turn, creates space for innovation, for example, through profit reinvestment, product diversification, and digital marketing technologies. In other words, entrepreneurship literacy enhances mompreneurs’ financial management skills, which subsequently foster innovative behavior. This supports constructivist theory and the theory of planned behavior. The study suggests the importance of training, mentoring, support networks, and access to finance. Theoretically, it contributes by strengthening constructivist perspectives that literacy and entrepreneurial skills are built through experience and social interaction, while enriching planned behavior theory by showing how entrepreneurship literacy and financial behavior shape attitudes, intentions, and innovative actions.

Limitations

This study has several limitations. First, the sample only included mompreneurs in SMEs in Makassar City, making the findings difficult to generalize across different cultural, economic, and social contexts. Second, the data collection method relied on interviews, which may be subject to bias as respondents might provide more favorable responses. Third, the study’s focus was limited to motivations, entrepreneurship literacy, resources, and financial behavior, without exploring external factors such as technology, policy, or market conditions. Finally, variations in knowledge and experience among mompreneurs may have influenced their understanding of entrepreneurial strategies, meaning the findings may not fully capture their actual potential.

5. Conclusions

This study confirms that mompreneurial entrepreneurship literacy is shaped through formal pathways, such as training, and informal pathways, such as personal experiences, social media, and social interactions. These, in turn, form financial behavior in sustainably managing assets, capital, income, and expenditures. Sound financial behavior drives innovation through reinvestment, product diversification, and service quality improvement. The main contribution of this study lies in explaining the mechanism linking entrepreneurship literacy, financial behavior, and innovation in the context of mompreneurs in Indonesia. Practically, these findings recommend integrated entrepreneurship training, policies that expand access to financing and digital training, the role of NGOs in mentoring and community support, as well as the strengthening of educational programs and business incubation for women entrepreneurs to enhance capacity, innovation, and SME sustainability.

Author Contributions

FA contributed to Writing – Original Draft, Conceptualization, and Project Administration (40%); TT contributed to Writing – Review & Editing and Validation (20%); MS contributed to Writing – Original Draft and Methodology (20%); MA contributed to Formal Analysis and Data Curation (10%); and MH contributed to Visualization and Investigation (10%).

Funding

I, Fajriani Azis, as the corresponding author, on behalf of all manuscript authors, declare that this research was funded and supported by DRTPM Diktiristek, Indonesia, through the Decree of the Directorate General of Higher Education, Research, and Technology Number: 0667/E5/AL.04/2024.

Institutional Review Board Statement

I, Fajriani Azis, as the corresponding author, on behalf of all submitting authors, declare that this research is our original work and has not been submitted for review or published elsewhere.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

Data are not publicly available due to privacy and ethical restrictions.

Acknowledgments

The authors would like to express their sincere gratitude to all co-authors for their valuable contributions during the research process. Special thanks are extended to the Faculty of Economics and Business, Universitas Negeri Makassar, Indonesia, for their academic support. This study was self-funded by the authors. Ethical approval for this research was granted by the Institute for Research and Community Service, Universitas Negeri Makassar (LP2M UNM), under approval letter number 3053/UN36.11/TU/2024. This study used no artificial intelligence (AI) software for content analysis, data processing, or result interpretation.

Conflicts of Interest

I, Fajriani Azis, as the corresponding author, on behalf of all authors, declare that there are no financial or personal relationships with other people or organizations that could inappropriately influence (bias) the work reported in this manuscript.

References

- Adebiyi, R. (2025). Understanding Rural Women’s Economic Role in Kwara State, Nigeria. SSRN Electronic Journal. [CrossRef]

- Agarwal, S., & Agrawal, V. (2023). Female entrepreneurship motivational factors: analysing effect through the conceptual competency-based framework. International Journal of Entrepreneurship and Small Business, 49(3), 350–373. [CrossRef]

- Akullo, G., Aracil, E., Mwaura, S., & McMillan, C. (2024). Beyond teaching: the extended role of informal entrepreneurship education and training in challenging contexts. International Journal of Entrepreneurial Behavior & Research. [CrossRef]

- Alfionita, F., Hasan, M., Nurdiana, N., Tahir, T., & Dinar, M. (2020). Pengaruh Literasi Kewirausahaan Terhadap Perilaku Berwirausaha Mahasiswa Pelaku Usaha Pada Program Studi Pendidikan Ekonomi Fakultas Ekonomi Universitas Negeri Makassar. Indonesian Journal of Social and Educational Studies, 1(2).

- Ameen, N., Hoelscher, V., & Hughes, M. (2025). Mumpreneurs’ decision-making when facing uncertainty and competing goals. International Journal of Entrepreneurial Behavior & Research, 31(4), 976–998. [CrossRef]

- Arnila, R. A., & Hilmiyatun, H. (2020). Peningkatan Skills Berwirausaha Siswa SMA Sullamulmubtadi Anjani Melalui Penerapan Model Experiential Learning Berbasis Kreativitas. Ekuitas: Jurnal Pendidikan Ekonomi, 8(2).

- Cogan, A., Pret, T., & Cardon, M. S. (2022). Everyday social support processes: Household members’ instrumental and emotional support of entrepreneurs. International Small Business Journal: Researching Entrepreneurship, 40(5), 537–563. [CrossRef]

- Darnihamedani, P., & Terjesen, S. (2022). Male and female entrepreneurs’ employment growth ambitions: the contingent role of regulatory efficiency. Small Business Economics, 58(1), 185–204. [CrossRef]

- Dhaliwal, A. (2021). The Mompreneurship Phenomenon. International Journal of Service Science, Management, Engineering, and Technology, 13(1), 1–17. [CrossRef]

- Elmobayed, M. G., Al-Hattami, H. M., Al-Hakimi, M. A., Mraish, W. S., & Al-Adwan, A. S. (2024). Effect of marketing literacy on the success of entrepreneurial projects. Arab Gulf Journal of Scientific Research, 42(4), 1590–1608. [CrossRef]

- Fatimah, F., & Kartikasari, R. D. (2018). STRATEGI BELAJAR DAN PEMBELAJARAN DALAM MENINGKATKAN KETERAMPILAN BAHASA. Pena Literasi, 1(2), 108. [CrossRef]

- Gil-Gomez, H., Guerola-Navarro, V., Oltra-Badenes, R., & Lozano-Quilis, J. A. (2020). Customer relationship management: digital transformation and sustainable business model innovation. Economic Research-Ekonomska Istraživanja, 33(1), 2733–2750. [CrossRef]

- Gupta, V. K., Wieland, A. M., & Turban, D. B. (2019). Gender Characterizations in Entrepreneurship: A Multi-Level Investigation of Sex-Role Stereotypes about High-Growth, Commercial, and Social Entrepreneurs. Journal of Small Business Management, 57(1), 131–153. [CrossRef]

- Higginson, & Nancy. (2009). Preparing the next generation for the family business: relational factors and knowledge transfer in mother-to-daughter succession. Journal of Management and Marketing Research, 1–18.

- Ilie, C., Monfort, A., Fornes, G., & Cardoza, G. (2021). Promoting Female Entrepreneurship: The Impact of Gender Gap Beliefs and Perceptions. Sage Open, 11(2). [CrossRef]

- Indonesia, B. R. (2021). Laporan Pencapaian SDGS 2021.

- Irwin, K., McDowell, W., & Ribeiro-Navarrete, S. (2025). How can women entrepreneurs overcome funding challenges: the role of digitalization and innovation. Venture Capital, 27(2), 225–247. [CrossRef]

- Kavuma, S. N., Muhanguzi, F. K., Bogere, G., & Cunningham, K. (2022). Entrepreneurial Literacy as a Pathway to Economic Empowerment of Rural Women in Uganda. In The Palgrave Handbook of Africa’s Economic Sectors (pp. 197–216). Springer International Publishing. [CrossRef]

- Laguía, A., Wach, D., Garcia-Ael, C., & Moriano, J. A. (2022). “Think entrepreneur – think male”: the effect of reduced gender stereotype threat on women’s entrepreneurial intention and opportunity motivation. International Journal of Entrepreneurial Behavior & Research, 28(4), 1001–1025. [CrossRef]

- Lewis, P., Rumens, N., & Simpson, R. (2022). Postfeminism, hybrid mumpreneur identities and the reproduction of masculine entrepreneurship. International Small Business Journal: Researching Entrepreneurship, 40(1), 68–89. [CrossRef]

- Love, I., Nikolaev, B., & Dhakal, C. (2024). The well-being of women entrepreneurs: the role of gender inequality and gender roles. Small Business Economics, 62(1), 325–352. [CrossRef]

- Makola, Z. S. (2022). Mumpreneurs’ experiences of combining motherhood and entrepreneurship: A netnographic study. Journal of Contemporary Management, 19(si1), 1–20. [CrossRef]

- Malaquias, F., Dos Santos Jacobi, L., & Hwang, Y. (2023). ICT adoption by mompreneurs during the COVID-19 pandemic: The role of entrepreneurial orientation. Human Technology, 19(3), 419–434. [CrossRef]

- Malinowska, M., & Seretna-Sałamaj, D. (2017). The Factors and Parameters Determining the Formation of the Target Capital Structure in Family Businesses (pp. 163–175). [CrossRef]

- Maula, F. ibadil, Saraswati, T. T., Wibowo, N. H. A., & Harwida, G. (2021). Implementation of Business Education and Digital Marketing Literacy to Improve Technopreneurship Competence in influencing strategies to maintain SMEs in the Pandemic Era. Jurnal Entrepreneur Dan Entrepreneurship, 10(1), 57–66. [CrossRef]

- Mazeed*, S. A., Rani, D. P. S., Raveendranath, R., Divya, P., & Sudharani, T. (2019). Effectiveness of Capital Structure on Profitability- IT Companies Perspective. International Journal of Innovative Technology and Exploring Engineering, 9(1), 726–728. [CrossRef]

- Nasir, M. M., & Shamim, S. (2025). Muslim women entrepreneurs: an exploratory study of the Nigerian “Mumpreneurs” perspective. International Journal of Organizational Analysis, 33(2), 416–433. [CrossRef]

- NJ, B., & Vethirajan, D. C. (2024). Business intelligence's impact on financial performance in connection with their financial literacy: A study based on Mompreneurs in Tamil Nadu. International Journal of Research in Management, 6(1), 421–426. [CrossRef]

- Rubio-Bañón, A., & Esteban-Lloret, N. (2016). Cultural factors and gender role in female entrepreneurship. Suma de Negocios, 7(15), 9–17. [CrossRef]

- She, L., Rasiah, R., Turner, J. J., Guptan, V., & Sharif Nia, H. (2022). Psychological beliefs and financial well-being among working adults: the mediating role of financial behaviour. International Journal of Social Economics, 49(2), 190–209. [CrossRef]

- Suaza Arcila, J. O. (2021). Habilidades gerenciales de empresarios pymes de la ciudad de Medellín, Colombia. Revista Venezolana de Gerencia, 26(6 Edición Especial), 592–606. [CrossRef]

- Sun, X., Huang, R., Jiang, Z., Lu, J., & Yang, S. (2024). On tacit knowledge management in product design: status, challenges, and trends. Journal of Engineering Design, 1–38. [CrossRef]

- Suseno, Y., & Abbott, L. (2021). Women entrepreneurs’ digital social innovation: Linking gender, entrepreneurship, social innovation and information systems. Information Systems Journal, 31(5), 717–744. [CrossRef]

- Theunissen, P. L. H. M. (2022). Challenges and opportunities of women in entrepreneurship [maastricht university]. [CrossRef]

- Ughetto, E., Rossi, M., Audretsch, D., & Lehmann, E. E. (2020). Female entrepreneurship in the digital era. Small Business Economics, 55(2), 305–312. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).