1. Introduction

The phenomenon of migration represents one of the most prominent realities of our time, with millions of people crossing borders each year in search of safety, economic opportunities, improved climate conditions, and a better future. By May 2024, the UNHCR reported that over 120 million individuals worldwide were forcibly displaced due to persecution, armed conflicts, violence, or violations of human rights. However, this process is often hindered by a multitude of challenges, including the protection of migrants’ rights, the management of their identities and documents, and limited access to financial services. When these challenges are addressed, individuals can achieve economic inclusion, which is defined as a state where “people not only have their basic subsistence needs met but also are productive, fulfilled, and fully empowered to make choices about their lives” (McKinsey, 2024).

In this context, Distributed Ledger Technology (DLT) such as blockchain emerges as a promising solution to address these challenges in an innovative and effective manner both in the field of identity management and financial inclusion (Ahad and Emon, 2023; Zhuo et al., 2023). Indeed, DLT, including blockchain and other decentralized network solutions, offers unique features that are particularly relevant for migrants. These include enhanced data security, transaction transparency, and robust identity verification, as well as opportunities for financial inclusion. Currently, corporations leverage DLT and blockchain technology applications to reduce credit risk, optimize supply chains, and increase data transparency (Bank of America Institute, 2023). Bank of America highlights blockchain’s potential to revolutionize value exchange and storage across all industries, not just finance. Similarly, the World Economic Forum’s 2024 report predicts that by 2027, 10% of the global GDP could be tokenized and secured through blockchain technology. Blockchain networks, akin to a new operating system for the Internet, offer an ideal foundation for applications where trust, data integrity, and transaction security are essential. Its suitability for managing digital identities and transferring value makes blockchain technology highly promising to revolutionize many sectors (Potts and Rennie, 2019).

For these reasons, the use of DLT solutions, such as blockchain-based ones, to address migration-related issues represents a path toward more robust and inclusive approaches. This article aims to examine the potential applications of blockchain for migrants, highlighting its role in improving identity management, transaction traceability, personal document security, and access to financial services. The blockchain infrastructure provides people with greater autonomy and control over their financial and personal data, while stablecoins are emerging as a key element of the new internet-based financial system. The combination of crypto-assets and self-sovereign identity (SSI) has the potential to enhance economic inclusion. In an ecosystem where digital transactions serve as identity claims, innovative business models could emerge. These might include identity insurance schemes and the use of stablecoins that function as global currencies.

This paper is organized as follows. The first section introduces the foundational innovations that paved the way for blockchain-based applications, highlighting their role in securing digital records and enabling online value transfers through Nakamoto’s creation of a native cryptocurrency—an essential component of blockchain’s incentive-based consensus mechanism and a core asset of the network. The second section explores how blockchain can empower migrants with more effective identity management tools. The third section examines blockchain’s potential to advance financial inclusion for migrants, drawing on concrete examples and initiatives. Finally, the conclusion summarizes the key findings and insights from these discussions.

2. Understanding Blockchain: How It Can Secure and Empower Migrants’ Real and Monetary Data

Blockchain is an application of DLT which can be defined as a digital set of records, or a database that is held by multiple participants in a network i.e., that is distributed in a P2P network.[1] Unlike traditional databases that have a centralized ledger, in a DLT system, transactions are recorded in multiple locations at once. Simply put, blockchain is a secure, decentralized, and distributed database. It is decentralized because no single entity controls it, and it is distributed because a copy of the ledger is stored on all nodes in the network. This decentralization and distribution make blockchain secure and resistant to tampering or revision.

This section presents the foundational concepts of blockchain. Just as the classical dichotomy divides the world into two spheres – the real economy and the monetary economy – blockchain technology is the outcome of advancements in both domains. In the real economy sphere, innovations by Haber and Stornetta focused on securing digital documents through cryptographic techniques. Their pioneering work established the foundation for blockchain to create immutable records, ensuring the existence and integrity of digital documents, such as those representing personal data of migrants. In the monetary sphere, Satoshi Nakamoto’s innovation with the Bitcoin network introduced bitcoin, the first decentralized digital currency. This cryptocurrency, as the pioneer category of crypto-assets, revolutionized the transfer of value. Note that Bitcoin (uppercase) refers to the decentralized network and protocol that enables the existence and operation of bitcoin (lowercase), the cryptocurrency unit that is exchanged and recorded on the Bitcoin blockchain, through individual transactions. The Bitcoin blockchain facilitates secure and transparent peer-to-peer transactions without intermediaries. These advancements highlight blockchain’s dual impact in enhancing both security and efficiency in digital document management, especially for refugee identity verification, as well as in facilitating monetary transactions through cryptocurrencies like Bitcoin and stablecoins for remittances and cross-border payments. Understanding these innovations provides a comprehensive view of how blockchain can secure and empower migrants in both real and monetary domains.

2.1. The Invention of Haber and Stornetta: A Solution for the Security and Integrity of Digital Documents in the Real Economy

The underlying technology of blockchain has its origins in the pioneering work of Stuart Haber and W. Scott Stornetta, two cryptographers who introduced a revolutionary mechanism in 1991 to ensure the security and integrity of digital documents. Their primary concern was to create a reliable and secure system for timestamping digital documents, preventing any alterations or falsifications.

2.1.1. The Challenge of Document Integrity in the Digital Age

With the advent of the digital era, the ease of modifying electronic documents posed a significant challenge for businesses and institutions seeking reliable ways to confirm that documents remained unaltered after creation. Conventional management systems lacked a robust mechanism for verifying the authenticity and integrity of stored information. This issue became even more pressing in the 1990s, as the widespread use of digital documents, which can be easily falsified or modified without leaving tangible traces, further complicated efforts to ensure their authenticity and reliability. In response to this challenge, computer scientists Stuart Haber and W. Scott Stornetta proposed an ingenious solution in their seminal 1991 paper, “How to Time-Stamp a Digital Document.” They outlined the attributes of a certification method, stating: “The growing use of text, audio, and video documents in digital form and the ease with which such documents can be modified creates a new problem: how can we certify when a document was created or last modified? Methods of certification, or time-stamping, must satisfy two criteria. First, they must time-stamp the actual bits of the document, making no assumptions about the physical medium on which the document is recorded. Second, the date and time of the time-stamp must not be forgeable.” (Haber et Stornetta, 1991, p109).

2.1.2. Haber and Stornetta’s Solution for Preventing Digital Document Falsification

In their 1991 paper, Haber and Stornetta presented a groundbreaking solution for ensuring the integrity of digital documents: using cryptographic chains of blocks to timestamp digital documents. Their approach was based on three fundamental concepts:

Cryptographic Hashing for Security

Cryptographic hashing employs hash functions to generate unique and tamper-proof digital fingerprints for each document. This ensures the integrity of documents by making them resistant to any unauthorized modifications. Each hash serves as a unique identifier for the document, and any alteration to the document would result in a completely different hash, thereby providing a robust mechanism to detect any tampering. For example, the MD5 hash function generates the output “5ae9b7f211e23aac3df5f2b8f3b8eada” for the input “crypto”, and a completely different output, “79ad4e0522a0a67a6e196be52357e60b”, for the input “Crypto”.[2]

Cryptographic Linking

Each time-stamped document is cryptographically linked to the previous one via a unique hash. To link each new document securely in the chain, a new, distinct hash is calculated based on the contents of the current document and the hash of the previous one. This new hash then becomes part of the next link in the chain. This chaining creates a continuous sequence of time-stamped documents, where each new entry depends on and is securely connected to the previous data, reinforcing the integrity of the entire sequence. Any attempt to modify an earlier document in the chain would be immediately detectable, as it would require recomputing all subsequent hashes. This method of secure linking, which creates an unalterable chronological chain of records, is a fundamental principle of blockchain that guarantees the order and immutability of data.

Secure Timestamping

Documents are time-stamped to create immutable proof of their existence at a specific point in time, preventing any falsification or modification of their creation date. Immutable timestamping of documents, which was one of Haber and Stornetta’s primary goals, is also an essential feature of modern blockchains. This allows for the guarantee of document authenticity by establishing irrefutable proof of their creation or modification date.

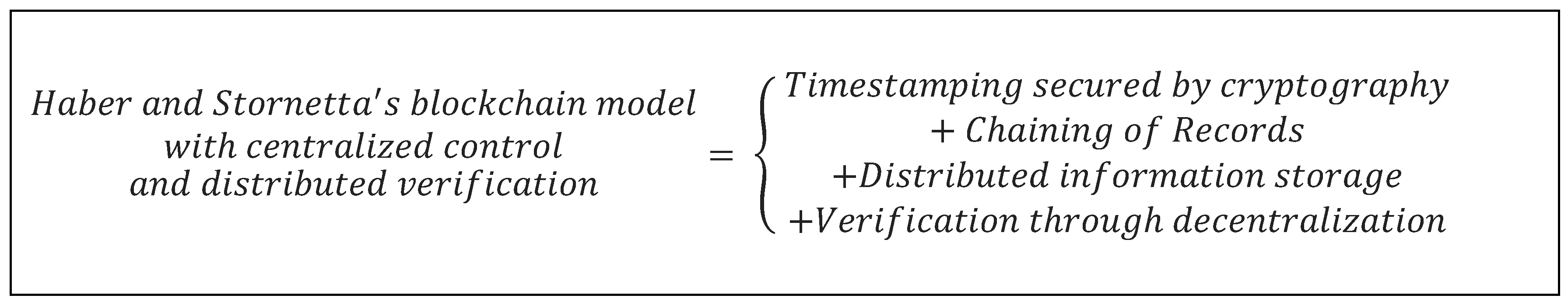

In 1994, Haber and Stornetta co-founded Surety, Inc., a company specialized in providing digital time-stamping services for notarizing and securing digital documents, ensuring their authenticity and integrity. In 1995, they introduced an innovative idea: publishing document fingerprints (the hashes of these timestamps) in the New York Times. This approach enabled readers to verify the integrity of records by comparing the hashes published in the journal with those from previous issues. By incorporating the previous hash into each new one, an unbroken chain of verification was established. If a hash corresponded with that of the previous edition, it confirmed that the records had not been altered. The innovative components of the 1995 blockchain, disseminated through a New York Times publication, where control over the choice of stored information remains centralized, can be summarized as follows (

Figure 1):

2.1.3. Leveraging Blockchain for Migrant Integration into the Real Economy

The concept of cryptographic blockchains, invented by Haber and Stornetta, not only ensures the integrity and immutability of digital documents but also offers practical applications for securing migrants’ personal data and documents. These documents are vital for migrants to reestablish economic activity in their new environment. They serve as proof of identity, property ownership, academic qualifications, and are essential for accessing education, healthcare, and employment. However, without a dependable means to verify these critical documents, migrants, and the parties interacting with them, face significant challenges.

The absence of reliable and authentic documentation creates an informational disadvantage for parties interacting with migrants, resulting in information asymmetry. As Akerlof’s seminal 1970 article demonstrated, such asymmetries can lead to adverse selection in markets, causing market dysfunctions and failures (Akerlof, 1970; Löfgren et al., 2002). If a party wishes to verify the authenticity of the information, it incurs transaction and verification costs due to the need to gather information and enforce contracts (Coase, 1937) as well as the necessity to verify the quality or authenticity of the information (Alchian and Demsetz, 1972). These increased costs of transacting can hinder migrants from finding employment or establishing residency in the receiving country. Consequently, the lack of reliable documentation not only raises transaction costs but also undermines trust between migrants and institutions in the receiving country. Providing reliable personal documents is crucial for fostering trust between migrants and institutions in their new country. However, the risk of encountering unreliable documents is higher when dealing with migrants, especially during forced migrations due to armed conflicts or humanitarian crises. Document falsification can occur during critical interactions with authorities, international organizations, or local institutions. Migrants may also lose their personal documents, making cryptographic security and blockchain recording essential.

In these situations, establishing trust based on an immutable source of information is essential. Haber and Stornetta’s method paved the way for ensuring the authenticity and security of identity documents, such as birth certificates, diplomas, and passports, in the real economy. It also guarantees the integrity of legal documents like contracts, wills, and property titles, preventing disputes arising from forgery. Furthermore, their mechanism safeguards medical records by protecting patients’ health data from unauthorized access or alteration.

By revolutionizing the security of digital documents, Haber and Stornetta laid the groundwork for a technology that not only safeguards critical information but also bolsters trust in the digital world. Trust has long been recognized as essential for contractual agreements. Researchers have acknowledged trust as a crucial determinant of economic prosperity in human societies noting that “high-trust societies exhibit higher rates of investment and growth” (Zak and Knack, 2001). For all these reasons, Haber and Stornetta’s work represents a significant advancement toward adopting blockchain for managing critical migrant information, ensuring the security and integrity of their personal and professional data. Subsequently, Nakamoto’s invention was pivotal in securing the digital transfer of value between parties who do not know each other by enabling the decentralization of control over the production of the information recorded.

2.2. The Invention of Nakamoto: A Solution for the Integrity of Financial Transactions in the Monetary Sphere of Economic Activities

In 2008, an individual or collective known by the pseudonym Satoshi Nakamoto published a groundbreaking white paper entitled “A Peer-to-Peer Electronic Cash System,” introducing bitcoin, a revolutionary digital currency based on blockchain technology. Nakamoto’s creation expanded upon the foundational work of Haber and Stornetta, addressing the critical challenges of financial transaction integrity and security. This innovation marked a significant advancement in the decentralized and secure management of financial data.

2.2.1. Nakamoto’s Solution to Double-Spending: Ensuring Financial Transaction Integrity

Prior to Bitcoin, financial transactions predominantly relied on centralized institutions, such as banks and payment service providers, to serve as trusted intermediaries. While these institutions maintained the integrity of transactions, they also introduced inefficiencies, high costs, and vulnerabilities to fraud and systemic risks. The challenge was to develop a system where financial transactions could be securely and transparently verified and recorded without relying on a central authority. This decentralization required addressing the double-spending problem.

Building upon Haber and Stornetta’s work on securing digital documents, Nakamoto’s innovation decentralized control over the information recorded and combined it with an incentive-based consensus mechanism, tied to the issuance of the network’s native cryptocurrency, which incentivizes participants to secure the network and validate transactions, effectively resolving the double-spending problem in a peer-to-peer network. This ensured that each unit of digital currency could only be spent once. Double-spending problem refers to “ a potential flaw in a cryptocurrency or other digital cash scheme whereby the same single digital token can be spent more than once, and this is possible because a digital token consists of a digital file that can be duplicated or falsified.” (Chohan, 2021). The fundamental challenge with peer-to-peer (P2P) value transfer lies in the risk of double-spending, where the same unit of digital currency is spent more than once. This issue is inherent in decentralized digital currency systems, as there is no central authority to verify and authenticate transactions.

In a traditional system, a trusted third party, such as a bank, acts as an intermediary to record and validate each transaction. This ensures that each unit of currency is spent only once by centrally updating the account balances of the parties involved. However, in a decentralized system without a trusted third party, there is no central ledger to validate transactions. The challenge then becomes: how can we decentralize a system of digital currency while maintaining financial transaction integrity?

2.2.2. Nakamoto’s Decentralized Solution: Consensus Mechanism and Native Crypto-Asset

Haber and Stornetta’s blockchain concept was essentially a centralized timestamping service that employed cryptographic techniques and published document hashes in the New York Times for distribution. In contrast, modern blockchains like Bitcoin are fully distributed and decentralized ledgers. Blockchain technology represents a new category of institutional technology that reduces the cost of institutional entrepreneurship across economic systems, introducing a novel type of innovation process, relevant to the creation and advancement of institutions for economic governance and coordination (Allen et al., 2020).

Nakamoto solved the double-spending problem by decentralizing the control of what is recorded in the distributed ledger. This is achieved through a network of nodes (computers) that collaborate via a consensus mechanism to verify, record, and securely store each transaction transparently and immutably. This decentralization relies on a consensus mechanism that incentivizes nodes to collaborate honestly. The main innovation lies in this incentive mechanism that promotes collaboration around a common interest: ensuring the security of the Bitcoin blockchain network and enhancing the value of its associated native crypto-asset, bitcoin.

Bitcoin, the native crypto-asset of the Bitcoin public blockchain, is a crucial component. Node collaboration is driven by the shared goal of securing the Bitcoin network and thereby enhancing the value of the Bitcoin blockchain crypto-asset rewarding miners in the network. Thus, to solve the double-spending problem with a decentralized system, Nakamoto introduced: 1) a consensus mechanism based on incentives to encourage nodes to collaborate without cheating, and 2) this collaboration is essential to achieve the common goal of securing the network as a digital common good, thereby reinforcing the value of the blockchain’s native crypto-asset (Vasselin, 2024).

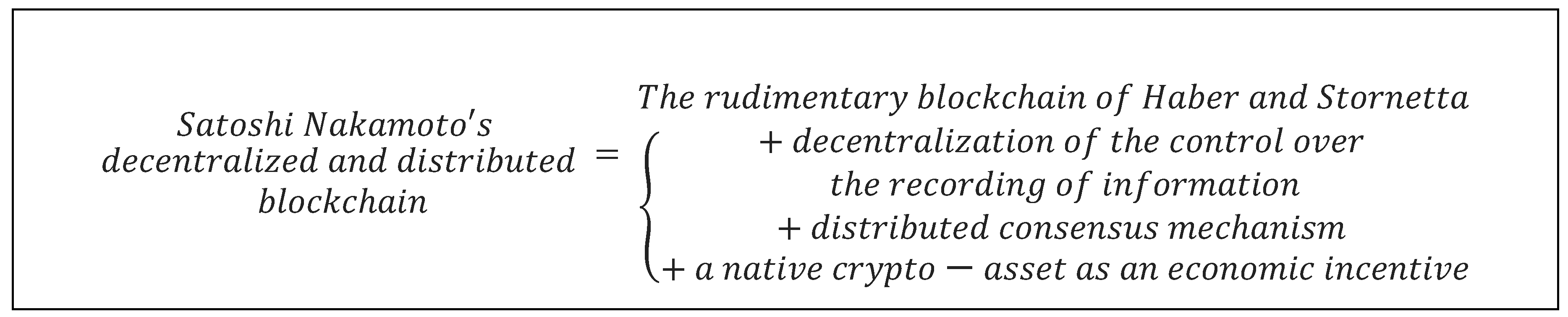

The Bitcoin blockchain builds on Haber and Stornetta’s foundational blockchain by adding three key elements: (1) a decentralized public ledger, or blockchain, which records all transactions across a network of computers known as nodes. Each node maintains a complete copy of the blockchain, ensuring transparency and preventing any single entity from controlling the data. (2) Bitcoin secures its network through a consensus mechanism called Proof of Work (PoW), which achieves agreement on transaction validation. In this system, miners compete to solve complex mathematical problems, and the first to find a solution earns the right to add the next block of transactions to the blockchain. This process, known as “mining,” proves that the miner has invested computational power to validate the transactions. By requiring this work, PoW ensures that participants agree on the state of the blockchain, thereby preventing fraudulent activities such as dou ble-spending. (3) Public blockchains inherently have a native crypto-asset, which serves as a reward to incentivize participants to secure the network and validate transactions. This crypto-asset, unique to each blockchain, is the network’s core asset and an essential tool for coordinating participants (Vasselin, 2024). The value of the native crypto-asset is directly linked to the network’s security, motivating miners to maintain the network’s integrity through honest behavior.

Figure 2 illustrates the key components of the Bitcoin blockchain and its evolution from the basic concept to crypto-assets.

Incentives, at the root of the consensus mechanism, focus on positive reinforcement by rewarding desired behaviors. They aim to align individual interests with the collective good, encouraging cooperation and trust without the need for coercion.

2.2.3. Nakamoto’s Blockchain for Migrants’ Financial Inclusion, Cross-Border Payments, and Remittances

Satoshi Nakamoto’s invention of Bitcoin and its underlying blockchain technology offers a powerful solution for securing financial transactions, bringing significant benefits to migrants. Firstly, blockchain facilitates secure and efficient cross-border remittances, enabling migrants to bypass expensive and slow traditional services. Secondly, blockchain fosters financial inclusion, allowing migrants without access to traditional banking systems to participate in saving, investing, and conducting transactions. Lastly, the transparent and immutable nature of blockchain technology minimizes the risk of fraud and corruption, providing migrants with a trustworthy platform for managing their finances.

This analysis of the benefits of blockchain for migrants is further illustrated by Williamson’s (1981) transaction cost theory, which helps explain how this technology can address specific challenges related to transaction costs and risks. Blockchain addresses three key challenges: (1) it reduces transaction costs associated with negotiation, contract drafting, and enforcement; (2) it eliminates the need for reliance on potentially unreliable intermediaries, especially when dealing with parties with conflicting interests or unequal access to information; and (3) the transparent and immutable nature of blockchain prevents opportunistic behavior, where parties might otherwise attempt to maximize personal gain at the expense of transactional partners through deception, information distortion, or exploiting contractual weaknesses.

Nakamoto’s blockchain aligns with Williamson’s (1981) transaction cost theory, which highlights how automated protocols, and the elimination of intermediaries not only reduce transaction costs but also mitigate the risk of opportunistic behavior. Bitcoin blockchain relies on automated protocols written in code, eliminating the need for lengthy negotiations and contract reviews, thereby reducing transaction costs. Additionally, blockchain technology facilitates peer-to-peer transactions without the need for intermediaries such as banks or money transfer services, which often impose high fees. This significantly reduces costs associated with traditional market relationships. Furthermore, blockchain transactions are transparent and immutable, allowing all network participants to view and verify each transaction. This transparency diminishes opportunities for deception and manipulation of information.

Subsequently, Nakamoto’s creation of Bitcoin introduced blockchain technology as a decentralized, secure, and transparent solution for financial transactions. This innovation is particularly valuable for migrants, as it reduces transaction costs, enhances security, and promotes greater financial inclusion. By leveraging blockchain technology, migrants can ensure the integrity and transparency of their financial transactions.

3. Blockchain and Self-Sovereign Identity (SSI) for Migrants’ Identity Management

In this section, we explore how blockchain technology can revolutionize identity management for migrants, emphasizing its critical importance, potential solutions, and real-world applications. Effective identity management for migrants is crucial for ensuring security and access to essential services, and blockchain-based self-sovereign identity (SSI) enhances this by providing superior security, control, and transparency. Blockchain technology’s potential to transform identity management is demonstrated by real-world initiatives such as Sovrin, IBM and Visa’s digital identity system, the ID2020 Alliance, and BanQu’s economic identity platform, all of which provide migrants with self-sovereign, secure, and verifiable identities, giving them greater control over their personal information.

3.1. The Importance of Identity Management for Migrants: Enhancing Data Privacy and Security with Self-Sovereign Identity (SSI)

Identity documentation poses a complex challenge for refugees and is crucial for host nations. A robust identity management system enhances security for both refugees and host nations, facilitating efficient service delivery by aid organizations and access to essential services in host countries (Ahad et al., 2023). Proper identification enables migrants to access services such as healthcare, education, housing, and other social services that rely on verifiable identity documentation. It also ensures recognition of migrants’ legal status, granting access to essential legal protection. Furthermore, secure identity documentation plays a crucial role in enabling migrants to participate in the economy, including the ability to seize economic opportunities, such as employment. It also allows access to banking and financial services, including the ability to open bank accounts, secure loans, and perform international money transfers, all of which rely on reliable identity verification.

Decentralized blockchain solutions offer significant advantages over centralized systems, particularly in terms of security, data control, resilience and transparency for managing self-sovereign identity (SSI). Unlike centralized storage, data is distributed across multiple nodes, eliminating a single point of failure vulnerable to attacks (Yeasmin et Baig, 2019). Robust cryptographic algorithms further enhance security, making it extremely difficult for unauthorized parties to alter or falsify information. This level of security is crucial for sensitive data, such as personal identities and financial transactions, which require the highest levels of protection.

Another key advantage of decentralized solutions is the control and ownership of data (Zhao et al., 2019). In centralized systems, users often relinquish control of their data to the service providers, who may have the authority to access, modify, or share this data with third parties (Shou et al., 2012). The increased use of the Internet has resulted in massive personal data generation, and declining costs for data storage and analytics have led to significant privacy concerns as data becomes a by-product of computing (Schneier, 2015). Furthermore, the Web 2.0 era brought greater centralization and corporate exploitation of personal data for economic gain, often without users’ full consent or control. This makes maintaining control and ownership of personal data more crucial than ever (Choi et al., 2019). For these reasons, blockchain is an ideal choice for implementing SSI in an environment increasingly concerned with data privacy and security.

With blockchain technology and self-sovereign identities (SSI), users retain full control over their personal information, deciding what to share and with whom. This autonomy enhances privacy, fosters trust by removing dependence on single entities for data protection, and ensures transparency and traceability of all transactions and data changes. Shoemaker et al. (2019) provide a comprehensive overview of the challenges faced by existing humanitarian identity systems, particularly in managing personal data for refugees across various countries. They identified numerous obstacles but also emphasized refugees’ active involvement in meeting their own needs. Their research indicates that blockchain technology can offer substantial benefits in multiple areas, including identity management and post-disaster assistance.

Consequently, while both centralized and decentralized solutions are available, migrants can significantly benefit from choosing decentralized options. This is especially true given their unique challenges related to data security, ownership, and resilience against systemic failures. In the context of Self-Sovereign Identity (SSI), blockchain solutions are preferable to traditional web 2.0 centralized systems for several compelling reasons.

Table 1 juxtaposes Web 2.0 centralized cloud solutions (e.g., Google Drive or Dropbox) with Web 3.0 decentralized blockchain solutions (e.g., Sovrin), focusing on specific variables. As illustrated in

Table 1, distributed ledger technologies (DLTs) such as blockchain offer enhanced security, control, and transparency for overseeing SSIs. These technologies empower individuals with increased autonomy over their personal data and establish a robust, trustworthy framework for managing their identity.

3.2. Blockchain-Based Solutions for Self-Sovereign Ident Ity (SSI): Concrete Examples and Initiatives

The rise of digital identities, fueled by our increasingly online lives, has triggered growing interest in identity management. This is particularly crucial for internet users and migrants who depend on secure and verifiable identities to access essential services and opportunities. A digital identity is defined as “a means for people to prove electronically that they are who they say they are and distinguish different entities from one another” (Mühle et al., 2018). SSI builds on this concept by allowing individuals to fully own and manage their digital identities (ibid). SSI offers a model where individuals control and own their own identity data. This paradigm gives users the ability to selectively share their information with third parties, while maintaining full control over who can access what data and in what context. SSI can be seen as a response to asymmetries of power and control in the information economy, rebalancing the relationship between users and businesses by giving individuals back ownership and control of their personal data.

Blockchain technology has the potential to revolutionize the way we manage migrants’ identities, offering solutions that prioritize security, privacy, and interoperability. Numerous projects and initiatives over the past decade have showcased the real-world impact of blockchain on empowering migrants and improving their lives. In a comparative analysis conducted by Kulabukhova et al. (2019), several self-sovereign identity (SSI) platforms, such as Sovrin, Civic, uPort, Jolocom, Ontology, Veres One, and Remme, were evaluated based on a set of defined criteria. Among these platforms, the Sovrin Network stands out as an open-source, decentralized identity network that enables the creation of self-sovereign identities. With Sovrin, migrants can securely and independently manage their identity data, providing them with greater control and autonomy.

Built on the Hyperledger Indy codebase, Sovrin is a unique blockchain system that offers robust support for storing metadata for Decentralized Identifiers (DIDs), DID documents, and Verifiable Credential (VC) schemas.

Table 2 summarizes the different initiatives. As a public-permissioned blockchain, Sovrin allows anyone to submit transactions, but only a select group of validators can operate the network. Notably, Sovrin was the first blockchain to support SSI, with its codebase open-sourced and released to the public under the Hyperledger Indy project (Satybaldy et al., 2024).

Moreover, several notable initiatives have emerged that harness blockchain to address identity management challenges faced by migrants. For instance, IBM and Visa have launched a digital identity system based on blockchain technology. This collaboration aims to provide secure and verifiable identities for individuals worldwide, including migrants. Another significant endeavor is the ID2020 Alliance, a global partnership dedicated to solving the issue of digital identity for underserved populations, such as migrants and refugees. By leveraging blockchain technology, ID2020 focuses on delivering secure, privacy-protecting, and user-controlled digital identities, ensuring that individuals can access essential services and exercise their rights. Furthermore, BanQu has developed a blockchain-based economic identity platform specifically designed to help refugees and migrants establish a digital identity linked to their transaction history. This innovative solution enables them to access financial services and demonstrate their creditworthiness, ultimately fostering greater financial inclusion.

4. Stablecoins, Cryptocurrencies and Blockchain: Revolutionizing Cross-Border Payments and Remittances for Migrant Financial Inclusion

Migrants often face significant challenges in sending and receiving money due to limited access to traditional financial services. However, blockchain technology, particularly through the issuance of crypto-assets like traditional unbacked cryptocurrencies and stablecoins, offers a promising solution for cross-border payments and remittances. Unlike traditional unbacked crypto-currencies such as bitcoin, stablecoins represent a unique category of crypto-assets designed to maintain a stable value by being pegged to reference assets such as fiat currencies, gold, commodities, or other cryptocurrencies. This innovative blockchain-based international payment system has the potential to free unbanked populations from geographical and logistical constraints, making financial transactions more accessible, affordable, and secure.

4.1. Current Challenges and Importance of Traceability for Financial Inclusion

Early research on financial exclusion treated it as a widespread issue affecting many emerging countries, considering it as a challenge closely linked to the economic development level. According to Conroy (2005), financial exclusion is “a process that prevents poor and disadvantaged social groups from gaining access to the formal financial systems of their countries” (p53). Over time, the focus shifted from merely recognizing the problem to actively seeking solutions to enhance financial inclusion. Terminology evolved to emphasize this new objective: improving access to financial services for unbanked and underbanked populations, thereby promoting broader economic participation and development. Financial inclusion refers to “a process that ensures the ease of access, availability and usage of the formal financial system for all members of an economy” (Sarma and Pais, 2011). An inclusive financial system offers numerous benefits, including the efficient allocation of productive resources, which can lead to a reduction in the cost of capital.

Global migration has significantly increased over recent years. According to the World Migration Report 2024, the global migrant population has reached 281 million, with 117 million people forcibly displaced by the end of 2022 due to conflict, violence, and disasters. In addition, international remittances have surged by 650% from USD 128 billion in 2000 to USD 831 billion in 2022, surpassing foreign direct investment in contributing to the GDPs of developing countries (IOM, 2024). This surge in population movement carries profound social, environmental, and economic implications, necessitating a proactive response from the financial sector to ensure adequate support for migrants’ financial inclusion needs (Boukhali and Dauner Gardiol, 2020).

Migrants encounter numerous challenges related to financial transactions, placing them within the scope of financial exclusion. Indeed, many migrants are unbanked or underbanked, which limits their ability to securely send and receive money. This lack of access to formal banking channels often forces them to rely on traditional remittance services that charge high fees, significantly reducing the amount of money that reaches their families. These costs can exceed 10% of the monetary value transferred and can take up to ten days to process (Cunliffe, 2020). This inefficiency stems from the conventional cross-border payment model, which relies on correspondent banking. Unlike domestic payments, this model has not benefited from the same level of innovation over recent decades (World Bank, 2021). It requires the physical presence of a bank in the destination country, which is often limited in emerging markets. This limitation necessitates partnerships with local banks, adding corresponding fees and creating a chain of transfers that increase transaction costs and cause delays (Zhuo et al., 2023).

Moreover, migrants face financial fraud and exploitation due to a lack of secure and transparent transaction methods. Additionally, their lack of financial history makes accessing credit and other financial services difficult. This situation underscores the importance of traceability in financial transactions for recording, transparency, and verification. These attributes protect migrants from fraud and help build their financial history, thus facilitating access to further financial services. However, the unbanked population primarily relies on cash, which contributes to the growth of the shadow economy (Medina and Schneider, 2017). Promoting financial inclusion is therefore essential, as it empowers migrants to envision long-term goals, which is crucial for reducing poverty (World Bank, 2022).

Prior to the emergence of blockchain solutions, Fintech’s potential to enhance financial inclusion in regions without robust banking infrastructure was largely dependent on electronic money and mobile payment systems (Bezhovski, 2016; Lotz and Vasselin, 2019; Vasselin, 2020). Today, public blockchain technology provides robust solutions for transferring money and accessing financial services without relying on traditional intermediaries. Blockchain promotes financial inclusion by significantly reducing transaction fees and settlement times while ensuring a transparent environment for cross-border payments (Rühmann et al., 2020). The transfer of value over the Internet is now possible with just a connected mobile device. Initially, bitcoin was the preferred method for settling transactions or transferring funds, despite the volatility of its market price. However, the significant growth in stablecoin issuance has introduced a lower-risk alternative to traditional unbacked cryptocurrencies. Additionally, the development of decentralized applications (dApps) in the decentralized finance (DeFi) sector, such as Uniswap, Aave, Compound, MakerDAO, and Sushiswap, further expands the capabilities of blockchain technology for financial transactions and services.

To underscore the growing importance of stablecoins, the BIS (2020) in its CPMI report highlights the need to investigate new payment infrastructures and arrangements to enhance cross-border payments. The report emphasizes the importance of exploring “the potential that new multilateral cross-border payment platforms and arrangements, […] so-called global ‘stablecoins’ could offer for enhancing cross-border payments” (p. 4). Stablecoins are designed to maintain a stable value by being pegged to stable assets like fiat currencies, other crypto-assets or commodities. This stability makes them ideal for international payments, offering faster settlement times and lower transaction costs compared to traditional banking systems.

4.2. Blockchain-Based Solutions for Remittances and Cross-Border Payments: Concrete Examples and Initiatives Using Stablecoins and Cryptocurrencies

Migrant remittances represent a vital source of financial resources for developing countries, substantially enhancing the living conditions of poor families. The UN Global Compact for Migration acknowledges the significance of remittances as the largest source of private capital, surpassing all other international financial flows (Flore, 2018). The International Monetary Fund (IMF) classifies remittances into two components: transfers and income, categorized as “personal transfers” and “employee compensation.” Despite their importance, the high cost of sending money abroad continues to be a considerable obstacle. Money transfer agencies frequently impose exorbitant fees, disproportionately impacting financially vulnerable migrants.

Migrant remittances are undergoing a transformative change, thanks to the integration of blockchain technology. This innovation enables the use of two categories of crypto-assets: traditional unbacked cryptocurrencies, such as bitcoin, and stablecoins. Stablecoins are particularly valued for their perceived stability, making them a promising option for widespread adoption in payments compared to unbacked crypto-assets (Bank of England, 2022, p8). Beyond crypto trading or decentralized finance (DeFi), stablecoins are primarily adopted by niche groups for remittances and retail payments (Di Iorio et al., 2024). The relevance of remittances as a use case for stablecoins and other crypto-assets is further supported by various reports. For example, Chainalysis (2023) notes that approximately 5% of remittances to Mexico in 2022 were conducted using stablecoins or other crypto-assets, highlighting their growing role in the sector. Stablecoins, as a subset of the crypto-asset class, can be redeemed at par (1:1) with the value of their peg. To date, most stablecoins have been collateralized by a single asset, such as sovereign currencies (e.g., US dollar, euro), commodities (e.g., gold), or other crypto-assets.

Table 3 presents the four classes of stablecoins based on the type of collateral used to back their value.

Humanitarian organizations, such as the UNHCR and Binance Charity, are increasingly utilizing stablecoins to distribute aid to Ukrainian refugees. Refugees often favor stablecoins over cash due to their enhanced security, portability, and ease of use. The adoption of stablecoins is particularly significant in developing countries where access to traditional banking services is limited. In December 2022, the UN refugee agency (UNHCR), in partnership with the United Nations international computing center (UNICC) and the Stellar Development Foundation (SDF), successfully implemented a pilot project. This initiative aimed to distribute cash assistance to individuals displaced by the Ukrainian war using Circle Internet Financials’ USD Coin (USDC), a stablecoin pegged 1:1 to the US Dollar. Financial aid was transferred directly to recipients’ digital wallets, which are accessible via smartphones (UNHCR, 2023). The Stellar Network, a blockchain platform designed for cross-border transactions, facilitated this process by enabling low-cost, transparent, and secure remittances. This system simplifies the process for migrants to send money to their families, reducing the need for traditional intermediaries and lowering transaction fees.

In addition to stablecoins, traditional cryptocurrencies like bitcoin also contribute to enhancing financial inclusion. Today, several companies offer blockchain-based remittance services. For instance, BitPesa, headquartered in Kenya, operates in Nigeria, Tanzania, and Uganda with the slogan “Take Control of all your Payments.” The name “BitPesa” combines “Bit,” referring to bitcoin and other crypto-assets, and “Pesa,” which means “money” in Swahili. This Fintech company utilizes blockchain technology to transform cross-border payments in Africa. BitPesa empowers migrants to send money back home faster, cheaper, and with greater transparency compared to traditional remittance services. By leveraging blockchain, bitcoin, and other cryptocurrencies, BitPesa eliminates intermediaries, reduces fees, and provides a secure platform for international money transfers, thereby enhancing financial inclusion in Africa. The emergence of BitPesa and other mobile remittance services using bitcoin indicates that achieving a remittance cost of 3 percent is promising in the global effort to reduce remittance costs and promote financial inclusion (Jackson, 2015).

Several projects built on the Stellar blockchain focus on cross-border payments in Africa (Zhuo, 2023). One such FinTech startup is Cowrie, which operates in the UK and Nigeria, specializing in blockchain-based cross-border payments. Capitalizing on the high unbanked population and the support of the Central Bank of Nigeria, Cowrie introduced the Nigerian Naira Token (NGNT), a stablecoin pegged to the Nigerian Naira. This innovation enables seamless conversion between stablecoins and fiat currency through the Nigerian banking system. Cowrie primarily targets Nigerian businesses in need of affordable international payment solutions, particularly small and medium-sized enterprises (SMEs). SMEs play a crucial role in the Nigerian economy, accounting for 70% of industrial employment and 50% of manufacturing output. By connecting to the Nigerian Interbank Settlement System (NIBSS), Cowrie ensures easy redemption of NGNT. Moreover, Cowrie has partnered with Tempo, a French blockchain-based payment institution, to support the business expansion of Nigerian SMEs into Europe. This partnership opens new payment corridors, simplifying international transactions and promoting economic growth.

Similarly, Uhuru, a blockchain-based FinTech startup established in South Africa in 2020, offers a cost-effective and convenient solution for Zimbabwean immigrants and workers in South Africa to send money back to Zimbabwe. The economic turmoil in Zimbabwe has driven millions to seek work in South Africa, creating a large diaspora with a high demand for remittance services between the two nations (Ndlovu, 2022; Zhuo, 2023). Uhuru’s ZAR stablecoin, pegged to the South African Rand, enables Zimbabweans to send Rand directly to their families in Zimbabwe, who can then withdraw the money. To overcome technological barriers, Uhuru has integrated its wallet with WhatsApp, allowing users to interact with a bot to select services within the familiar chat app they use for family communication. Moreover, Uhuru facilitates the payment of utilities and services, such as electricity and cable TV, ensuring that funds are directly allocated for essential expenses. This feature promotes responsible use of remittances and enhances financial inclusion for Zimbabwean migrants and their families.

In the third section, it was established that migrants face challenges with cross-border payments due to inadequate identity documentation required for formal financial services. Even those with documents often struggle in remote areas where digital infrastructure is lacking, resorting to informal channels like Hawala operators for money transfers (Maimbo et al., 2003). Uhuru addresses this challenge by partnering with FlexID, a Zimbabwean startup specializing in self-sovereign identity (SSI), to provide users with digital identity credentials (TechPression, 2023). SSI utilizes blockchain technology to create secure digital identities that users can manage and share selectively. It allows individuals with official identity documents to digitize them securely, while alternative verification methods like community-based validation are employed for those lacking government-issued documents. This collaboration between Uhuru and FlexID aims to improve financial inclusion for migrants by offering a secure and accessible solution for identity verification in cross-border transactions.

The partnership between Uhuru Wallet (South Africa) and FlexID (Zimbabwe), two blockchain companies, showcases the potential of blockchain technology for addressing migrant challenges in cross-border money transfers. This collaboration marks the first documented cross-chain initiative between the two organizations. Their joint platform offers digital identity verification and remittance services specifically designed for migrants living and working in South Africa. This initiative aims to streamline the international money transfer process and overcome existing barriers.

5. Concluding Remarks

This paper has explored the transformative potential of blockchain technology in enhancing economic inclusion for migrants. We examined how blockchain empowers migrants in two key domains, corresponding to the traditional dichotomy of classical economists. In the real sphere of the economy, blockchain technology offers a secure and decentralized solution for managing migrants’ personal data, including identity documents and financial records. This fosters trust by providing tamper-proof evidence of authenticity, ownership, and control over personal information. We delved into the pioneering work of Haber and Stornetta in securing digital documents, highlighting how this innovation laid the foundation for modern blockchains. In the monetary sphere of the economy, we further explored Nakamoto’s invention of Bitcoin network and its impact on securing financial transactions. Blockchain technology, especially through stablecoins, presents a groundbreaking approach to cross-border value transfers. This innovation enables migrants by offering a faster, cheaper, and more secure method for sending and receiving funds. Additionally, we highlighted the persistent challenges of financial exclusion faced by migrants and how traditional remittance services are inefficient and expensive.

By leveraging blockchain technology, migrants can access reliable identity management through blockchain-based self-sovereign identity (SSI) solutions, enabling them to control and securely share their personal data. This facilitates access to essential services such as healthcare, education, and housing, where verifiable identity documentation is crucial. Moreover, migrants can reduce remittance costs using stablecoins, particularly those pegged to fiat currencies, enabling faster and more affordable cross-border payments compared to traditional remittance services. This capability allows migrants to send more money back home, supporting their families and promoting economic development in their communities.

Although this paper does not extensively cover financial services such as credit, decentralized exchanges (DEX), and asset management, blockchain technology shows significant promise as a solution. Blockchain can provide access to financial services for migrants, many of whom are unbanked or underbanked. By establishing a secure and transparent financial history, blockchain enables migrants to access credit and other financial products, thereby fostering economic integration. Decentralized applications (dApps) offering decentralized finance (DeFi) services are pivotal in this transformation. Furthermore, while we did not explore the potential for innovation clusters as developed by Schumpeter, Self-Sovereign Identity (SSI) presents opportunities for new business models where users can directly monetize their data with consent. This potential can drive innovation by creating markets and services focused on data self-management, particularly within the information economy.

Looking ahead, blockchain technology presents a compelling opportunity to empower migrants and foster their economic inclusion. By addressing the challenges of data security and financial access, blockchain can pave the way for a more inclusive and equitable global economy. However, further research is necessary to explore the scalability, regulation, and interoperability of blockchain solutions to ensure their widespread adoption and impact for the benefit of migrants worldwide.

| 1 |

“DLT is a set of technological infrastructure and applications. It allows simultaneous access, validation, and record updating in a secure and unchangeable way across a network spread across multiple entities or locations (as opposed to a central ledger, where a single entity records transactions and ownership). Cryptography is a technique for protecting information by transforming it into a secure format.” (Bank of England, 2022, p5) |

| 2 |

|

References

- Ahad, M. T., & Emon, Y. R. (2023), “Securing Refugee Identity: A Literature Review on Blockchain-based Smart Contract”, arXiv preprint arXiv:2310.19018.

- Akerlof, G.A. (1970), “The Market for Lemons: Quality Uncertainty and the Market Mechanism”, Quarterly Journal of Economics, Vol. 84, p. 488–500.

- Alchian, A. A., & Demsetz, H. (1972), “Production, information costs, and economic organization”, The American economic review, 62(5), p. 777-795. [CrossRef]

- Allen, D. W., Berg, C., Markey-Towler, B., Novak, M., & Potts, J. (2020). “Blockchain and the evolution of institutional technologies: Implications for innovation policy”, Research Policy, 49(1). [CrossRef]

- Auinger, A., & Riedl, R. (2018). “Blockchain and trust: Refuting some widely-held misconceptions”. https://web.archive.org/web/20200709120622id_/https://aisel.aisnet.org/cgi/viewcontent.cgi?article=1246&context=icis2018.

- Bank of America Institute. (2023). Beyond crypto: Tokenization. https://institute.bankofamerica.com/content/dam/bank-of-america-institute/transformation/beyond-crypto-tokenization.pdf.

- Bank of England. (2022), Financial Stability in Focus: Cryptoassets and decentralized finance. https://www.bankofengland.co.uk/financial-stability-in-focus/2022/march-2022.

- Bezovski, Z. (2016). “The future of the mobile payment as electronic payment system”, European Journal of Business and Management, 8(8), p. 127-132. ISSN 2222-1905.

- BIS, (2020). “Enhancing cross-border payments: Building blocks of a global roadmap”, Committee on Payments and Market Infrastructures, CPMI, ISBN 978-92-9259-399-5 (online): https://www.bis.org/cpmi/publ/d193.pdf.

- Boukhali, S., Dauner Gardiol, I., (2020). “Financial Inclusion of Migrants. Exploration paper”, Federal Department of Foreign Affairs FDFA, Swiss Agency for Development and Cooperation SDC.

- https://www.shareweb.ch/site/EI/Documents/FSD/Topics/Inclusive%20Finance/SDC%20-%20exploration%20paper%20-%20Financial%20inclusion%20of%20migrants%20-%202020-01%20(en).pdf.

- Chainalysis, (2023). The 2023 geography of cryptocurrency report, October.

- Chohan, U. W. (2021). “The double spending problem and cryptocurrencies”, c10.2139/ssrn.3090174.

- Choi, J. P., Jeon, D. S., & Kim, B. C. (2019). “Privacy and personal data collection with information externalities”, Journal of Public Economics, 173, p. 113-124. [CrossRef]

- Coase, R. 1937. “The Nature of the Firm”, Economica 16(4): P. 386-405. [CrossRef]

- Conroy, J. (2005). “APEC and financial exclusion: Missed opportunities for collective action?”, Asia Pacific Development Journal, 12(1), p. 53-80.

- https://econpapers.repec.org/RePEc:unt:jnapdj:v:12:y:2005:i:1:p:53-79.

- Cunliffe, J. (2020), “Cross-border payment systems have been neglected for too long”, Financial Times.

- https://www.ft.com/content/a241d7e0-e1de-4812-b214-b350cbb7d046.

- Dhananjay, S., Kumar, V., Agrawal, H., Patankar, P., & Jain, S. A. (2019). “Distributed Ledger Technology based data minimization of digital identities”, International Journal of Advance Research, Ideas and Innovations in Technology.

- Di Iorio, A., Kosse, A., & Mattei, I. (2024). “Embracing diversity, advancing together-results of the 2023 BIS survey on central bank digital currencies and crypto”. https://www.bis.org/publ/bppdf/bispap147.pdf.

- Flore, M. (2018). “How blockchain-based technology is disrupting migrants’ remittances: A preliminary assessment”, Luxembourg. [CrossRef]

- Haber, S., & Stornetta, W. S. (1991). “How to time-stamp a digital document”, p. 437-455. Springer Berlin Heidelberg.

- IOM. (2024). World Migration Report 2024. International Organization for Migration. https://www.iom.int/world-migration-report-2024.

- Jackson, T. (2015). « Could Bitcoin ease the pain of Africa's migrant workforce? », BBC Business. https://www.bbc.com/news/business-31735976.

- Kosse, A., Glowka, M., Mattei, I., & Rice, T. (2023). “Will the real stablecoin please stand up?”, BIS Papers. https://www.bis.org/publ/bppdf/bispap141.pdf.

- Kuperberg, M. (2019). “Blockchain-based identity management: A survey from the enterprise and ecosystem perspective”, IEEE Transactions on Engineering Management, 67(4), p. 1008-1027.

- Kulabukhova, N., Ivashchenko, A., Tipikin, I., & Minin, I. (2019). “Self-sovereign identity for iot devices”, in Computational Science and Its Applications–ICCSA 2019: 19th International Conference, Saint Petersburg, Russia, July 1–4, Proceedings, Part II 19, p. 472-484. Springer International Publishing.

- Lotz, S., & Vasselin, F. (2019). “A New Monetarist Model of Fiat And E-Money”. Economic Inquiry, 57(1), 498-514. [CrossRef]

- Löfgren, K. G., Persson, T., & Weibull, J. W. (2002). Markets with asymmetric information: The contributions of George Akerlof, Michael Spence and Joseph Stiglitz, The Scandinavian Journal of Economics, p. 195-211. [CrossRef]

- Maimbo, M. S. M., El Qorchi, M. M., & Wilson, M. J. F. (2003). Informal Funds Transfer Systems: An analysis of the informal hawala system, IMF-World Bank occasional paper 222, International Monetary Fund, Washington, DC.

- McKinsey. (2024). “What is economic inclusion?”, https://www.mckinsey.com/featured-insights/mckinsey-explainers/what-is-economic-inclusion.

- Medina, L. & Schneider, F. (2017). “Shadow economies around the world: New results.

- for 158 countries over 1991-2015”, CESifo Working Paper, n° 6430. [CrossRef]

- Mühle, A., Grüner, A., Gayvoronskaya, T., & Meinel, C. (2018). “A survey on essential components of a self-sovereign identity”, Computer Science Review, 30, p. 80-86. [CrossRef]

- Nakamoto, S. (2008). “Bitcoin: A Peer-to-Peer Electronic Cash System”, www.bitcoin.org.

- Ndlovu, R. (2022). “Four out of five diasporan zimbabweans live in south africa.” Bloomberg. URL: https://www. bloomberg. com/news/articles/2022-09-06/four-out-of-fivediasporan-zimbabweans-live-in-south-africaxj4y7vzkg.

- Potts, J., & Rennie, E. (2019). “Web3 and the creative industries: How blockchains are reshaping business models”, in A research agenda for creative industries, p. 93-111, Edward Elgar Publishing.

- Rühmann, F., Konda, S. A., Horrocks, P., & Taka, N. (2020). “Can blockchain technology reduce the cost of remittances?”. https://www.oecd-ilibrary.org/content/paper/d4d6ac8f-en.

- Sarma, M., & Pais, J. (2011). “Financial inclusion and development”, Journal of international development, 23(5), p. 613-628. [CrossRef]

- Satybaldy, A., Ferdous, M. S., & Nowostawski, M. (2024). “A taxonomy of challenges for self-sovereign identity systems”, IEEE Access.

- Schneier, B. (2015). Data and Goliath: The hidden battles to collect your data and control your world. WW Norton & Company.

- Shoemaker, E., Kristinsdottir, G. S., Ahuja, T., Baslan, D., Pon, B., Currion, P., ... & Dell, N. (2019). “Identity at the margins: Examining refugee experiences with digital identity systems in Lebanon, Jordan, and Uganda”, in Proceedings of the 2nd ACM SIGCAS Conference on Computing and Sustainable Societies, p. 206-217.

- Shou, L., Bai, H., Chen, K., & Chen, G. (2012). « Supporting privacy protection in personalized web search”, IEEE transactions on knowledge and data engineering, 26(2), p. 453-467.

- TechPression, (2023). “Uhuru Wallet, Flexid offer Zimbabweans remittance services”. https://techpressionmedia.com/uhuru-wallet-flexid-offer-zimbabweans-remittance-services/.

- Tobin, A., & Reed, D. (2016). “The inevitable rise of self-sovereign identity. The Sovrin Foundation”, 29, 18. https://sovrin.org/wp-content/uploads/2018/03/The-Inevitable-Rise-of-Self-Sovereign-Identity.pdf.

- United Nations High Commissioner for Refugees (UNHCR). (2023). “UNHCR wins award for innovative use of blockchain solutions to provide cash to forcibly displaced in Ukraine”. https://www.unhcr.org/news/press-releases/unhcr-wins-award-innovative-use-blockchain-solutions-provide-cash-forcibly.

- Vasselin, F. (2020). “Analysis of the Competition Between Cash and Mobile Payments in Markets with Mobile Partnerships: A Monetary Search Model Point of View”, Bankers, Markets & Investors, 160(1), p. 2-15. [CrossRef]

- Wang, F., & De Filippi, P. (2020). “Self-sovereign identity in a globalized world: Credentials-based identity systems as a driver for economic inclusion”, Frontiers in Blockchain, 2, 28. https://ssrn.com/abstract=3524367.

- Williamson, O. E. (1981). “The economics of organization: The transaction cost approach”, American journal of sociology, 87(3), p. 548-577. [CrossRef]

- World Bank (2021). “Central bank digital currencies for cross-border payments: A review of current experiments and ideas”. https://documents1.worldbank.org/curated/en/369001638871862939/pdf/Central-Bank-Digital-Currencies-for-Cross-border-Payments-A-Review-of-Current-Experiments-and-Ideas.pdf.

- World Bank (2022), “Remittance prices worldwide”. https://remittanceprices.worldbank.org/corridor/South-Africa/Zimbabwe.

- Yeasmin, S., & Baig, A. 2019. “Unblocking the potential of blockchain”, in 2019 international conference on electrical and computing technologies and applications (ICECTA), p. 1-5. IEEE. [CrossRef]

- Zak, P. J., & Knack, S. (2001). “Trust and growth”, The economic journal, 111(470), p. 295-321. [CrossRef]

- Zhao, Z., & Liu, Y. (2019). “A blockchain based identity management system considering reputation”, in 2019 2nd International Conference on Information Systems and Computer Aided Education (ICISCAE), p. 32-36. IEEE. available: https://drive.google.com/file/d/1HE6541km1Dj0n7pZONJnNJEYCcBTTVUQ/view.

- Zhuo, X., Irresberger, F.,and Bostandzic, D., (2023). “Blockchain for Cross-border Payments and Financial Inclusion: The Case of Stellar Network”. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).