1. Introduction

The global oil and gas industry, a cornerstone of the world economy, is navigating unprecedented challenges in the 21st century, characterized by volatile commodity markets, increasingly stringent environmental regulations, and the growing complexities of exploration and production (Yergin, 2020). Amidst this dynamic and demanding landscape, enhancing financial performance while simultaneously adopting sustainable and efficient operational practices has become paramount for industry survival and sustained growth (International Energy Agency, 2023; Ali et al., 2024). The critical role of the oil and gas sector in ensuring global energy supply and economic stability further underscores the urgency and relevance of addressing these challenges, making the improvement of financial performance and operational sustainability efficiency a matter of global importance in the face of evolving market dynamics and environmental concerns.

Artificial Intelligence (AI) has emerged as a transformative technology, offering revolutionary potential across various sectors, including the oil and gas industry (Russell and Norvig, 2021),(Khan et al., 2024; Czachorowski et al., 2023). With its capacity to process vast datasets, discern complex patterns, and automate intricate tasks, AI presents a suite of advanced tools promising significant enhancements in operational efficiency and, consequently, financial performance (Kaplan and Haenlein, 2019; Chen and Li, 2025) . From upstream exploration and drilling to mid-stream transportation and downstream refining and distribution, the oil and gas value chain is witnessing increasing exploration and implementation of AI applications (Ferreira, 2019).

This current study delves into the rapidly evolving field of AI adoption within the oil and gas industry, with a specific focus on its impact on financial performance. While the transformative potential of AI in this sector is increasingly acknowledged in both industry reports and academic discussions (Venkatesh et al., 2003) a significant gap remains in understanding the precise mechanisms through which AI investments are translated into tangible financial success. (Gilliland and Tashman, 2021), (Kuzmina et al., 2024; Mavlutova et al., 2025) Existing literature often discusses AI's broad applications and anticipated benefits nevertheless lacks a detailed examination of the mediating factors that facilitate this financial transformation.

Unlike previous studies that often examine the impact of AI on operations or finance in isolation, this study aims to bridge this gap by exploring the role of the mediator of operational performance. In this way, the aim is first to enrich the academic discourse on digital transformation in traditional industries (Mavlutova et al., 2022) by providing a focused and in-depth analysis of AI in the oil and gas context. Second, to provide practical, evidence-based insights for oil and gas companies looking to strategically use AI to improve financial performance, highlighting the critical role of the mediator of operational performance.

By exploring how AI-driven enhancements in operational processes directly contribute to financial gains, this re-search offers an innovative perspective on how AI's value is realized within the oil and gas sector.

The growing recognition of AI's transformative potential in oil and gas, aligning with previous research while highlighting the recent surge in publications on this topic. It uniquely emphasizes the mediating role of operational efficiency, clarifying how AI drives financial gains. Unlike prior studies that often-examined AI's impact on operations or finance separately, this study synthesizes findings to demonstrate the critical mediating role of operational efficiency. Furthermore, by pinpointing key research gaps, particularly concerning empirical validation and sustainability, this article builds upon existing literature and charts a course for future impactful research in this evolving field.

The study aims to investigate how AI adoption in the oil and gas industry translates into financial performance outcomes by explicitly testing the mediating role of operational efficiency between AI use and financial results.

The structure of this article is as follows: an introduction and a concise conceptual framework to structure the AI-financial efficiency nexus, bibliometric and thematic methodology were used to examine the body of evidence de-scribed, the results of the selected case studies are presented and interpreted in stages, the discussion concludes with suggested directions for further research, and conclusions are drawn on theoretical findings and management development.

2. Materials and Methods

Grounded in established theoretical frameworks, including technology adoption theory (Venkatesh et al., 2003) and the resource-based view (RBV) (Barney, 1991), the literature review synthesizes existing knowledge from over 201 scholarly scientific articles, industry reports, and case studies.

The literature review employed a systematic approach to identify, select, and synthesize relevant scholarly studies and industry publications focusing on AI adoption, operational efficiency, and financial performance within the oil and gas sector. The search for relevant literature was conducted using, Scopus database. Search terms included combinations of keywords such as (“Artificial Intelligence" OR "AI" OR "Machine Learning”) AND (“Oil and Gas" OR "Petroleum Industry”) AND ("Operational Efficiency" OR "Financial Performance" OR "Profitability").

The initial search yielded 201 articles. A recent bibliometric review highlights the growing trend and research focus on artificial intelligence in energy economics, indicating a substantial body of literature in this (Bitzenis et al., 2025). The application of artificial intelligence, machine learning, and big data in natural resource management has seen a significant surge in re-search since 2010, as evidenced by a bibliometric analysis of Scopus-indexed documents highlighting key research clusters and future agendas in this evolving field (Pandey et al., 2023). To refine the selection, the following inclusion criteria were applied:

• Relevance: Studies directly addressing the oil and gas industry and focusing on AI adoption, operational efficiency, or financial performance.

• Type of Publication: Peer-reviewed journal articles, reputable industry reports, conference papers, and books.

• Language: English language publications.

• Timeframe: Publications from 2010 to 2025 to ensure contemporary relevance, with some seminal works from earlier periods included for foundational context.

The selection process followed a systematic methodology, visualized in a PRISMA-style flow diagram (

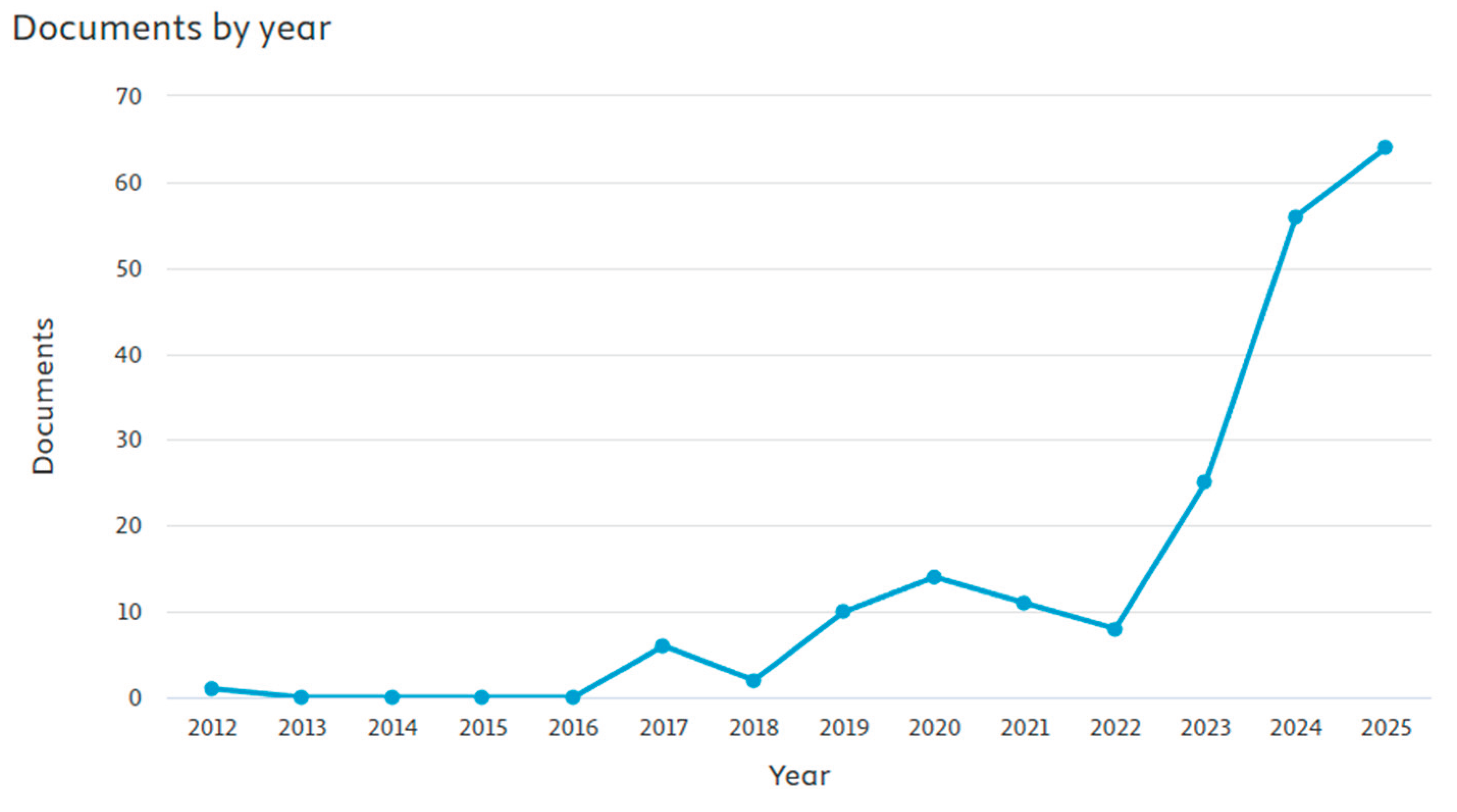

Figure 1), to ensure the replicability and rigor of the literature synthesis. The initial 201 documents identified via the Scopus search were subjected to screening based on the relevance, publication type, language, and timeframe criteria. While all 201 documents formed the basis of the quantitative bibliometric analysis (

Figure 2,

Figure 3,

Figure 4 and

Figure 5), a subsequent qualitative review was conducted to identify high-impact, highly cited, and empirically relevant studies for the in-depth thematic synthesis. This rigorous filtering resulted in the final selection of five articles for the thematic synthesis that directly provided measurable operational and financial outcomes.

3. Results

3.1. Bibliometrics and Oil & Gas industry

The initial search yielded 201 documents after applying the inclusion criteria in

Figure 2. Highlights core research themes (Artificial Intelligence centrality in literature). Traces the evolution of AI applications in oil and gas, emphasizing post-2020 acceleration in cost reduction and profitability studies.

The systematic search and filtering process, detailed in the PRISMA-style Flow Diagram (

Figure 1), yielded 201 Scopus-indexed documents which served as the population for bibliometric analysis.

Figure 2 illustrates a significant increase in the number of documents published annually, particularly showing a sharp rise in publications from 2022 to 2025, which traces the evolution of AI applications in oil and gas.

This study used a structured, variable-based analytical method to investigate the mediating role of operational efficiency in the relationship between financial performance and the use of artificial intelligence (AI). Adoption of AI is viewed as a technological capability, as evidenced by established uses throughout the oil and gas value chain, including data-driven optimization, process automation, and predictive maintenance. The mediating variable, operational efficiency, is assessed using quantitative metrics that are commonly accepted in both academia and industry: as-set utilization rates, production uptime, operating expenses (OPEX), and unit operating cost. Efficiency benefits brought about by AI-enabled process enhancements are captured by these measurements. Return on Average Capital Employed (ROACE), operating cash flow, EBIT, and other profitability and capital-return metrics are used to evaluate financial performance, the dependent variable.

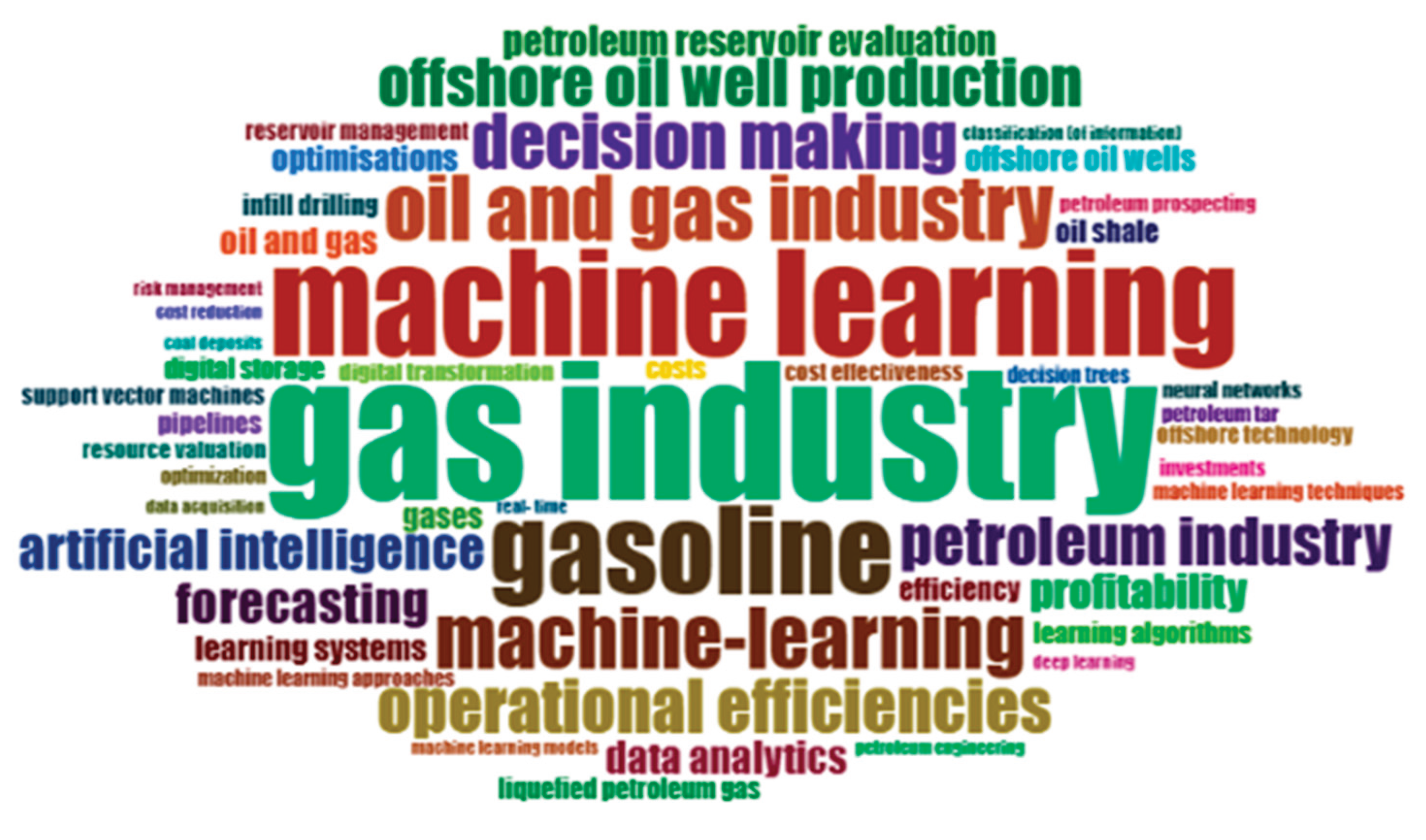

Keyword Clusters “Machine Learning”, “Artificial Intelligence”, “Operational Efficiency”, “Digital Transformation”, ” Decision Making” were generated using VOS viewer (5 occurrences = 51 keywords = 5 clusters) (See Fig. 2)

The keyword co-occurrence network in

Figure 3 illustrates the strong interconnections between artificial intelligence, machine learning, and key operational and financial aspects within the oil and gas industry research landscape from 2010 to 2025.

As

Table 1 indicates the keyword co-occurrence network, overall, illustrates a well-connected structure wherein the central nodes (AI, machine learning, etc.) are linked to both the operational-efficiency terms and the financial-performance terms. This confirms that in the literature, technical AI topics are frequently discussed in tandem with discussions of operational outcomes and financial implications. In other words, the field’s conceptual structure links “what AI is and does” (the techniques and the specific oil & gas applications) with “why it matters” (efficiency gains and financial results). Such a mapping validates the premise of current study: the interplay between AI, operational efficiency, and financial performance is indeed the crux of scholarly conversation. The fact that these concepts co-occur strongly in the bibliometric map provides evidence that researchers are actively examining how AI-driven improvements translate into performance and profitability gains.

Figure 4 visually represents the most prominent terms "machine learning" and "gas industry", signifying that the central topic is the application of machine learning within the gas sector. Other significant terms include "oil and gas industry", "decision making", "operational efficiencies", and "gasoline", highlighting the primary goals and areas of focus.

The word cloud also features a range of related concepts, including:

• Technologies and Methods: "artificial intelligence", "data analytics", "forecasting", "neural networks", and "learning algorithms".

• Business Objectives: "profitability", "cost effectiveness", and "cost reduction".

• Industry Applications: "offshore oil well production", "petroleum reservoir evaluation", "pipelines", and "digital transformation".

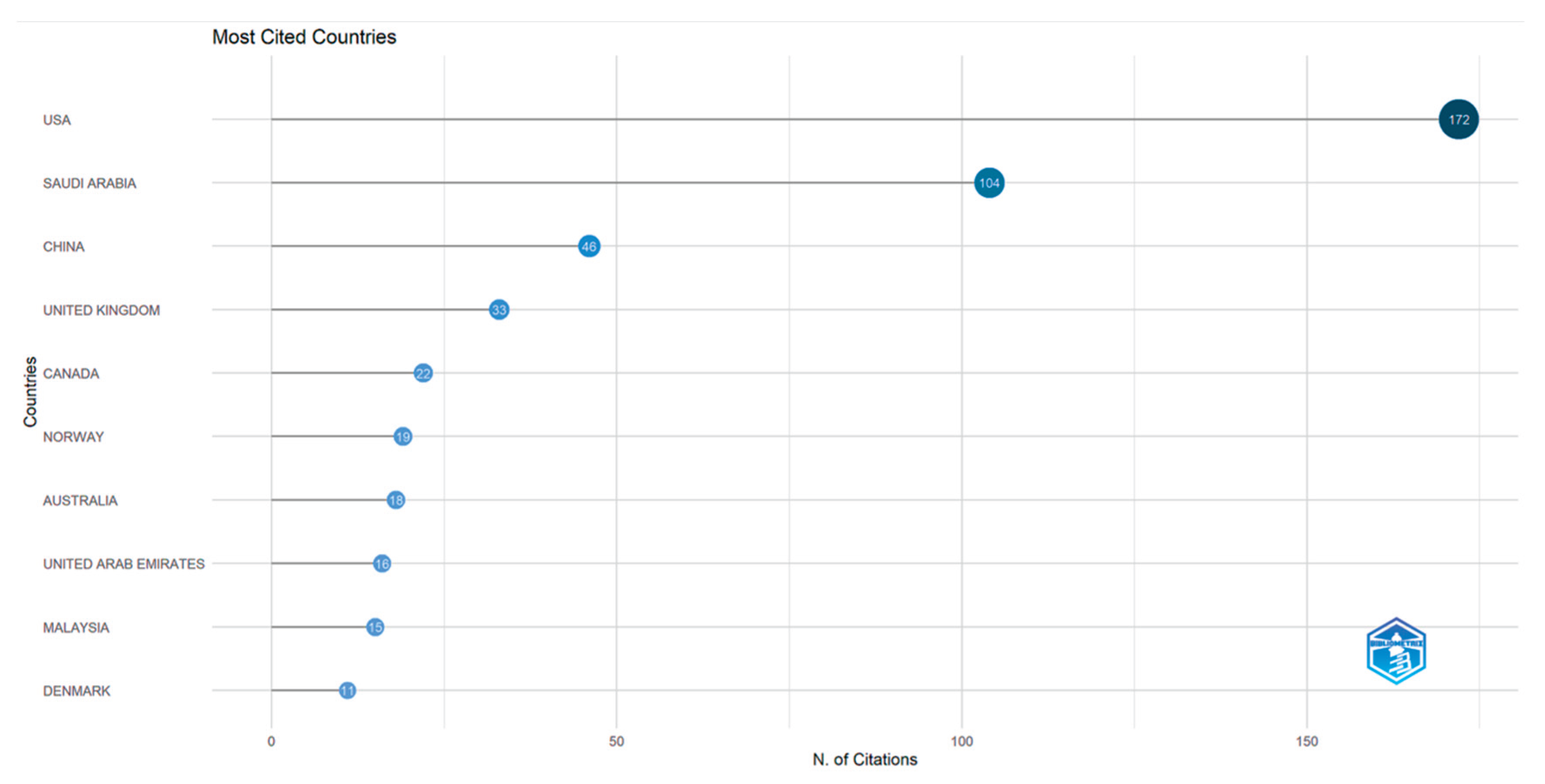

Figure 5 and

Table 2 highlight the countries whose authors have made the most significant contributions to the research field, as measured by the total number of citations (TC). The results reveal that US authors emerge as the dominant leader with 172 citations in total, indicating a significant amount of research in this area, followed by Saudi Arabian researchers with 104 citations and Chinese with 46 citations.

However, when examining the average citations per article as a measure of research impact, the United Kingdom research is the most influential with 16.50 citations per article. Saudi Arabia follows with an average of 11.60 citations, and the USA with 10.10 citations per article. This suggests that while the US produce a high volume of research, studies from the United Kingdom demonstrate a higher average citation impact in this field. Overall, figures highlight substantial academic contributions from a diverse set of countries across North America, Europe, the Middle East, and Asia. The findings suggest that research in this domain is not confined to a specific region but has garnered significant attention and impact globally.

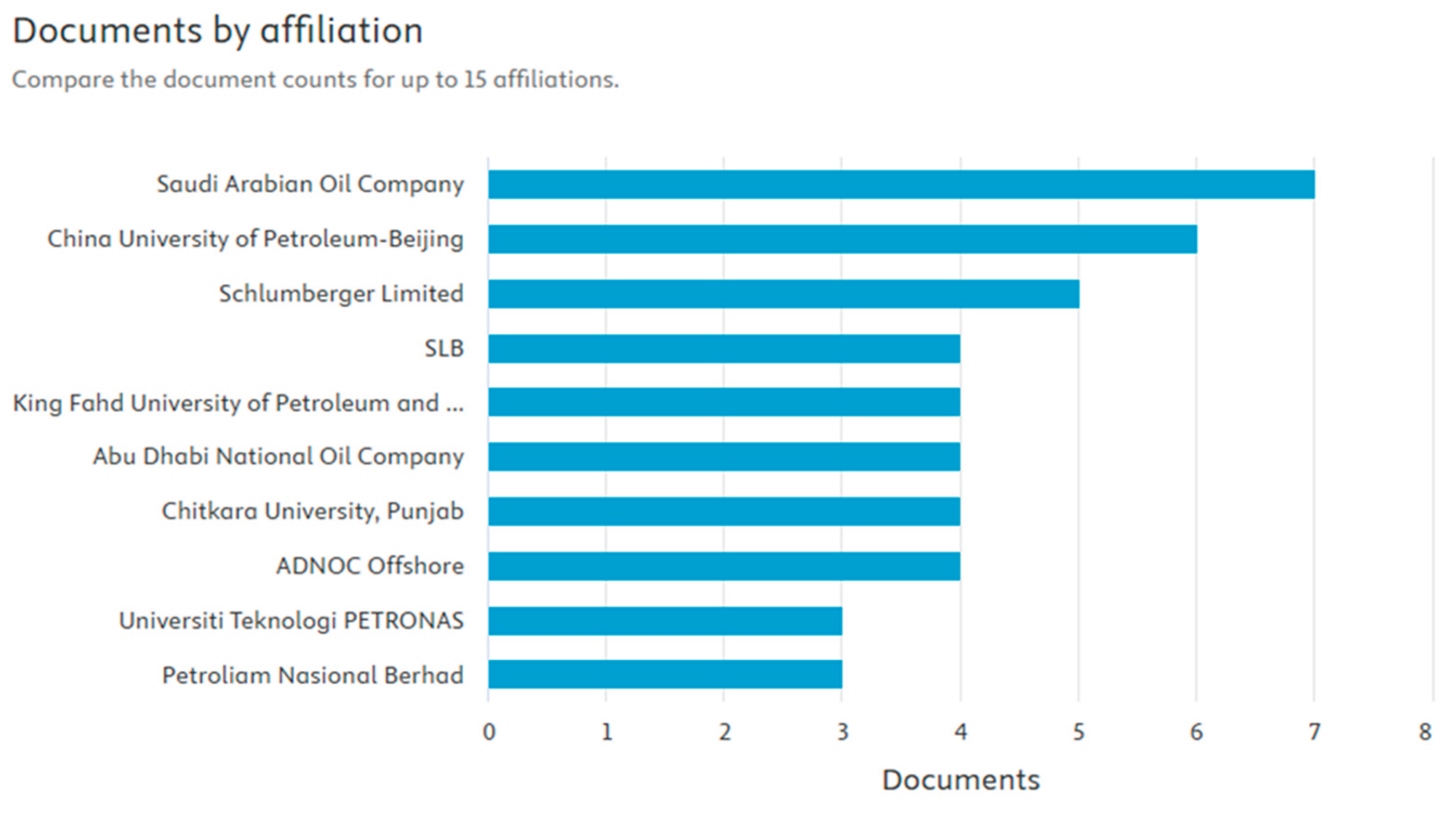

Figure 6 reveals a robust mix of both corporate and academic leadership. The 'Saudi Arabian Oil Company' leads the contributions with 7 documents, followed closely by the 'China University of Petroleum-Beijing' with 6 documents. This highlights a strong focus from both a major National Oil Company (NOC) and a specialized energy university. The international oilfield service giant 'Schlumberger Limited' (now 'SLB', which also appears separately) is a significant contributor, with 5 and 4 documents respectively. Other major NOCs, such as the 'Abu Dhabi National Oil Company' (and its 'ADNOC Offshore' arm) and 'Petroliam Nasional Berhad' (along with 'Universiti Teknologi PETRONAS'), also feature prominently. This landscape of affiliations underscores that the pursuit of AI-driven efficiency is a critical strategic priority shared by the industry's largest operators, its key service providers, and its dedicated academic partners.

BP and Shell were selected as case studies because they provide consistent, high-quality publicly reported operational and financial data that allows for reliable and comparable analysis of the outcomes of AI implementation. Their large-scale, mature digital programs, especially in the areas of predictive maintenance and digital twins, allow for the development of evidence on how AI implementation impacts operational efficiency improvements and financial performance, making them suitable empirical cases.

Thematic Synthesis of AI Applications and their Role in the Efficiency-Performance Relationship?

The 5 selected articles (see

Table 3) with high citations have been categorized and analyzed based on their position within the O&G value chain (Upstream Exploration, Upstream Drilling & Production, Mid/Downstream, and Strategic Context) to construct a comprehensive map of this mediation mechanism.

The application of automated machine learning for multi-variate prediction of well production Selected studies demonstrate how automated machine learning is applied in upstream production to analyze hundreds of wells and predict the optimal set of operational variables that will "maximize the production" (Maucec and Garni, 2019). Study by Maucec and Garni supports AI → OE → FP model by showing a specific AI tool enabling "process optimization" (the mediator) to directly achieve a stated financial performance goal (maximized revenue). Other study analizes the use of a (SVM) to automate the identification of depositional microfacies from well logs, a process that is conventionally manual, "time-consuming," and limited (Wang et al., 2019). This study also provides a clear link to AI → OE → FP model by showing an AI tool (AI) achieving "process automation" (OE) with 84% accuracy, thus, contributed to "cost-saving" and "sustainable profitability" (FP). The multi objectives optimization in petroleum refinery catalytic desulfurization using Machine learning approach this study details a hybrid-ML approach (SVMG) incorporates both support vector machine (SVM) and genetic algorithm (GA) that performs multi-objective optimization in a downstream refinery, finding the best configuration to simultaneously minimize sulfur, emissions, and the "HDS cost" (Al-Jamimi et al., 2022). This links to the framework by showing AI as the enabler for a complex "process optimization" (OE), where the financial performance ("profitability" via cost minimization) is a direct and measured component of the efficiency gain. A Review of Modern Approaches of Digitalization in Oil and Gas Industry (Al-Rbeawi, 2023) provides a strategic overview of digitalization technologies, including AI, arguing that their primary purpose is to "enhance operational efficiency and reduce the cost" through system-wide optimization and risk reduction. This study strengthens current researchthe main argument’s strategic context, as its core objective confirms that the AI → OE → FP pathway is the foundational goal of the industry's entire digital transformation.

A critical review of physics-informed machine learning applications in subsurface energy systems (Latrach et al., 2024) investigates the next generation of AI, Physics-Informed Machine Learning (PIML), integrated physics principles to make models more reliable and interpretable. This analysis gives the opportunity for a crucial link to the current study by showing that the evolution of AI technology is being driven by the need to make the AI → OE link more trustworthy, as PIML enables "more accurate and reliable predictions for resource management and operational efficiency".

This study is structured to empirically test and validate the central thesis. The analytical framework for this review is derived from the model proposed by authors which posits the causal chain: AI → OE → FP. According to this model, AI technologies (the independent variable) are deployed to enable specific operational improvements mechanisms such as "cost control, process optimization, and predictive maintenance" (the mediating variable, OE) which, in turn, are the direct drivers of improved financial outcomes such as "increased return on investment", "return on average capital employed" and "long-term resilience" (the dependent variable, FP). The author’s research demonstrate how specific AI and ML methodologies such as Artificial Neural Networks (ANNs), Support Vector Machines (SVMs), and Physics-Informed Machine Learning (PIML) are consistently applied to solve discrete operational challenges. By quantifying the improvements in efficiency (e.g., higher prediction accuracy, reduced non-productive time, optimized process parameters), previously analyzed studies provide the missing link, connecting the algorithm to the balance sheet. Ultimately, this synthesis will show that the financial outcomes repeatedly cited in the literature, such as "increased profitability," "cost-saving," and "maximized NPV," are the direct and logical consequences of these AI-driven enhancements in operational efficiency. This table serves as an "at-a-glance" roadmap that visually confirms the central thesis: across the entire O&G value chain, operational efficiency is the consistent and indispensable mediator between AI adoption and financial performance.

Overall, the bibliometric analysis, began with 201 documents, indicates a significant acceleration in research output, particularly from 2022 to 2025, focusing on AI's role in enhancing oil and gas profitability. Keyword co-occurrence mapping confirms the study's premise, revealing strong thematic links between "Artificial Intelligence," "Operational Efficiency," and "profitability," which form the core of the scholarly conversation. Geographically, the research is led by the USA and the United Kingdom demonstrating broad global engagement. The most prolific contributors are key industry and academic players like the 'Saudi Arabian Oil Company' and the 'China University of Petroleum-Beijing', highlighting that AI-driven efficiency is a shared strategic priority. A thematic synthesis of highly cited authors like Maucec & Garni (2019) and Wang et al. (2019) further details this connection, providing specific case studies where AI tools like automated ML and SVMs are used to enable process optimization and automation, thus, consistently demonstrate that financial outcomes like "cost-saving" and "maximized production" are the direct results of these AI-driven enhancements in operational efficiency, which validates the authors' main AI → OE → FP model.

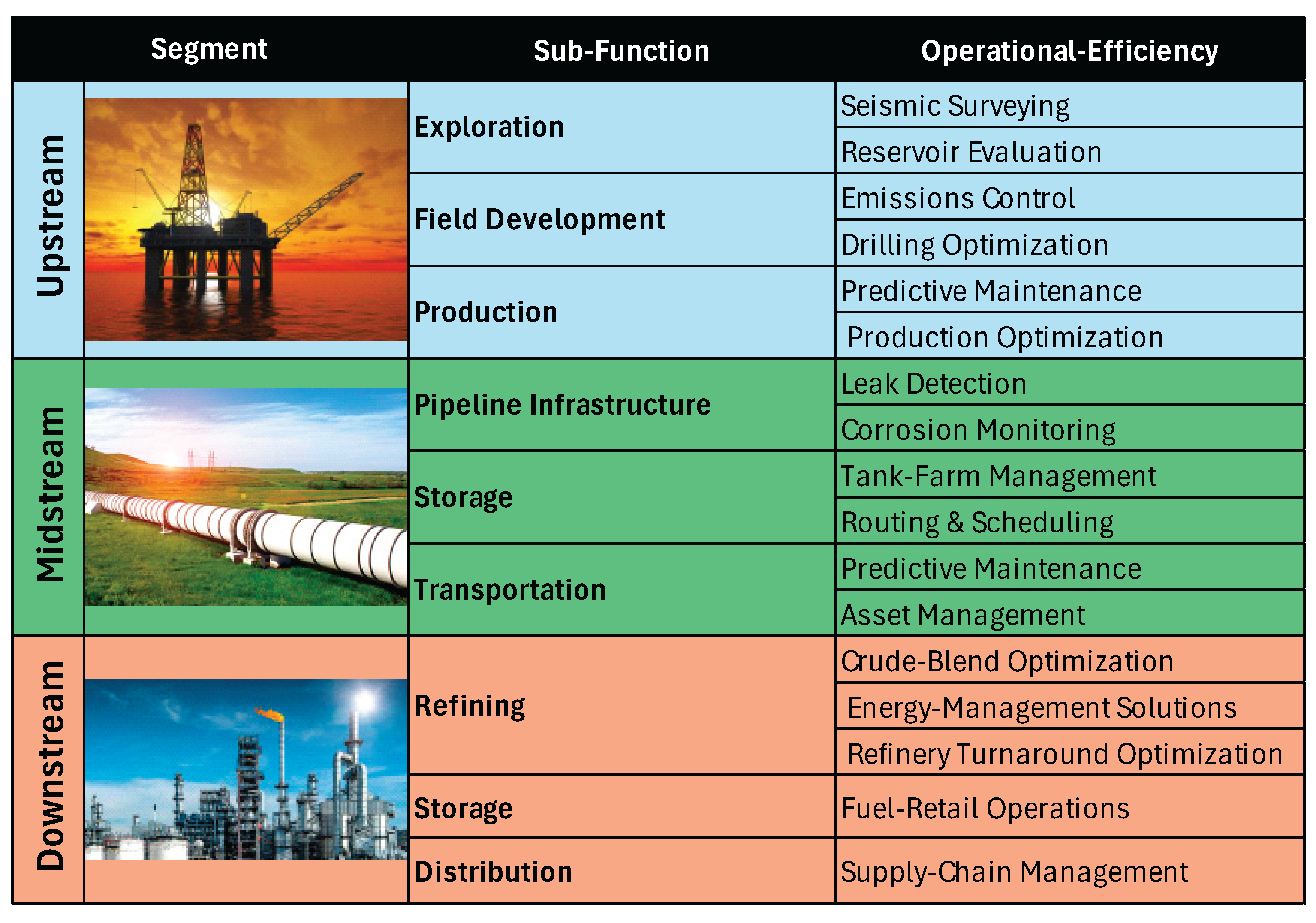

The oil and gas (O&G) industry underpins the modern economy by supplying a dominant share of global primary energy while enabling a vast array of downstream products from transportation fuels to petrochemical feedstocks. Its value creation rests on a tightly coupled, capital-intensive chain of activities that must operate reliably under geological uncertainty, price volatility, stringent safety requirements, and growing decarbonization pressures. In this context, companies continuously balance resource access, operational efficiency, and environmental stewardship to sustain competitiveness and financial performance.

3.2. Artificial Intelligence in the Oil and Gas Industry

The oil and gas industry is increasingly recognizing the transformative potential of AI to address long-standing challenges and unlock new opportunities (Mohan and Ramani, 2020). AI, encompassing machine learning, deep learning, natural language processing, and computer vision, offers sophisticated tools for data analysis, automation, and predictive modelling across the oil and gas value chain (LeCun et al., 2015).

Several studies highlight the diverse applications of AI in the sector. In upstream operations, AI is being utilized for seismic data processing and interpretation, enhancing the accuracy and efficiency of exploration activities (Pang et al., 2025). Machine learning algorithms can analyze vast datasets of seismic surveys to identify potential hydrocarbon reservoirs with greater precision, reducing exploration risks and costs (Dornadula and Ge, 2019). AI is also revolutionizing drilling operations through automated drilling systems, predictive maintenance of drilling equipment, and optimization of drilling parameters, leading to increased drilling speed, reduced downtime, and improved safety (Samuel and Mandal, 2018). Furthermore, AI-powered reservoir management tools are enhancing production optimization by predicting reservoir behavior, optimizing injection strategies, and improving enhanced oil recovery (EOR) techniques (Satter et al., 2008).

The oil and gas giant recently launched a fleet of low-impact, AI-powered robots that are capable of analyzing sea-bed conditions at depths of up to 6,000 meters. The robots minimize exploration risk while reducing harm to marine life.

In midstream operations, AI plays a crucial role in pipeline monitoring and integrity management. AI-driven systems can analyze sensor data from pipelines to detect anomalies, predict potential failures, and optimize pipeline maintenance schedules, ensuring safer and more efficient transportation of oil and gas (Jang et al., 2016). AI is also being applied to optimize logistics and supply chain management in the midstream sector, improving transportation routes, optimizing storage, and reducing operational costs (Simchi Levi et al., 2008).

Researchers have estimated that corrosion causes 15% to 25% of pipeline incidents (Jang et al., 2016). For instance, in the US alone, pipeline corrosion costs companies $1.4 billion annually according to a NACE (National Association of Corrosion Engineers) study (AMPP, 2025). AI-based corrosion analysis enables early detection of pipe corrosion, helping oil and gas companies optimize maintenance schedules and extend asset lifespan. Additionally, AI can help analyze pipeline characteristics and corrosion data to decide the best corrosion prevention mechanism.

Downstream operations are also experiencing significant AI integration. Refineries are leveraging AI for process optimization, predictive maintenance of refinery equipment, and improved energy efficiency (Ali and Niaz, 2021). AI-based process control systems can optimize refinery operations in real-time, maximizing throughput, improving product quality, and reducing energy consumption (Qin, 2014). Moreover, AI is being used in downstream marketing and sales, for demand forecasting, personalized customer service, and optimized pricing strategies (Iyer et al., 2025).

Advanced Process Control and AI help Taiwan Refinery Capture $4.2M in Operational Benefits. A unique combination of advanced process control (APC) and artificial intelligence (AI) technologies across critical application areas (like crude oil distillation) in order to cut costs (Ben, 2020).

In “

Figure 7.” is included visual summary of the extensive reach of AI applications across the oil and gas industry, targeting key areas for operational efficiencies.to expand.

3.3 Operational Efficiency in Oil and Gas through AI

Operational efficiency, defined as maximizing output with minimal input, is a critical performance metric in the capital-intensive oil and gas industry (Senses and Kumral, 2025). AI adoption is a pathway for significantly enhancing operational efficiency across various domains within the sector.

Enhanced Asset Management and Predictive Maintenance: AI-powered predictive maintenance is transforming as-set management in oil and gas. By analyzing sensor data, historical maintenance records, and operational parameters, AI algorithms can predict equipment failures with remarkable accuracy, allowing for proactive maintenance interventions (Mobley, 2002). This predictive approach minimizes unplanned downtime, reduces maintenance costs, extends asset lifespan, and improves overall equipment effectiveness (OEE) (Nachiappan and Anantharaman, 2018). For instance, AI can predict failures in critical equipment such as pumps, compressors, and turbines, enabling timely repairs and preventing costly operational disruptions.

Due to catastrophic failures of a multi-phase pump, British Petroleum (BP) deployed an AI-powered predictive maintenance solution to its unmanned platform in Tambar. After half a year, the AI software notified Aker British Petroleum (BP) about the possibility of the multi-phase pump failing. The solution used a normal behavior model, which tracked operational deviations (Numalis, 2024).

Previously, unplanned failures would cost more than $10 million in production. By predicting the failure, the pump malfunction was averted, resulting in sustained production.

Optimized Production Processes: AI is instrumental in optimizing production processes across the oil and gas value chain. In upstream operations, AI algorithms can optimize well placement, drilling trajectories, and production rates to maximize hydrocarbon recovery while minimizing operational costs (Davoodi et al., 2025). In refineries, AI-based process control systems can optimize process parameters such as temperature, pressure, and flow rates in real-time, leading to in-creased throughput, improved product yields, and reduced energy consumption (Noh et al., 2025). AI can also optimize energy usage across operations, reducing energy intensity and improving environmental performance (Guo et al., 2025).

The AI-powered drilling rig allows Shell to optimize drilling trajectories, which helps with better wellbore placement. The system is also armed with reinforcement learning to learn over time.

Improved Safety and Risk Management: Safety is paramount in the hazardous oil and gas industry. AI contributes to improved safety and risk management through various applications. AI-powered monitoring systems can detect safety hazards, predict potential accidents, and trigger timely alerts, enhancing workplace safety (Kim et al., 2024). AI is also used for risk assessment and mitigation, analyzing historical incident data, identifying risk factors, and developing proactive safety measures (Kulinan et al., 2025). Furthermore, AI-driven automation of hazardous tasks reduces human exposure to dangerous environments, further improving safety (Baek et al., 2025).

One notable instance was when the Keystone Pipeline in Kansas collapsed due to a faulty weld, spilling over 500,000 gallons of crude oil into a nearby creek.

3.4. Financial Performance Outcomes of AI Adoption

The improvements in operational efficiency driven by AI adoption are expected to translate into tangible financial performance gains for oil and gas companies. These monetary gains can take many different forms, such as greater profits, fewer expenses, and additional revenue (Ibishova et al., 2024).

Revenue Enhancement: AI-driven production optimization can lead to increased hydrocarbon production, boosting revenue for oil and gas companies (Mohaghegh, 2016). Improved exploration success rates through AI-powered seismic data analysis can also contribute to revenue growth by identifying new and commercially viable reserves (Yuan et al., 2025). Furthermore, AI-driven demand forecasting and optimized pricing strategies in downstream operations can enhance revenue generation (Kwon et al., 2022).

In the oil and gas sector an industry defined by its staggering capital intensity and long-duration, high-risk investments financial metrics are not created equal. While metrics such as EBIT (Earnings Before Interest, Taxes) or absolute Net Income are widely used, they are insufficient for capturing the true measure of corporate performance. These metrics effectively measure scale and profitability, but they inherently fail to account for the efficiency with which the enormous capital base is being utilized.

This critical gap is filled by Return on Average Capital Employed (ROACE) shows how well a company uses its money to make profits. ROACE has been established as a core financial indicator and one of the central target figures used by financial analysts for the benchmarking and valuation of international oil and gas companies since the late 1990s (Osmundsen et al., 2005).

The formal definition of ROACE, as provided in industry analyses, is a ratio that divides profitability by the capital used to generate it ( Formula 1):

The structure of this Formula 1 is the key to its strategic importance: the Numerator (Return) represents the total return on capital, specifically calculated before interest costs. It is the comprehensive measure of income generated by the business's operations; the Denominator (Average Capital Employed) calculates the capital has been put into the company the total value of assets deployed to generate the return.

Therefore, ROACE is not a simple measure of profit; it is the definitive measure of capital efficiency. It answers the most fundamental question for any capital-intensive business: for every dollar of capital invested in platforms, pipelines, refineries, and reserves, how big many cents of profit is the management team returning to the business?

This efficiency component is what elevates ROACE above all other metrics. It is the lingua franca of value that translates complex operational achievements such as improvements in production efficiency, asset uptime, or maintenance schedules into a single, standardized, and comparable percentage. This percentage is understood by C-suite executives, boards of directors, and financial analysts alike, serving as the essential bridge between performance in the oil field and valuation on the stock market.

3.5. Indicators for AI Implementation: Case Studies of BP

BP is using technology to drive innovation in its Gulf of America operations, with safety and efficiency top of mind.

Digital twin and predictive analytics in the Gulf of Mexico – BP has rolled out “digital twin” technology on its Gulf of America platforms. A digital replica of each platform allows remote teams to conduct corrosion inspections and valve checks using laser scan data and machine learning models, cutting the time and risk of manual offshore inspections (bp America, 2025a). BP also uses high performance computing and AI to optimize drilling trajectories, reducing a months long process to days

The technology enables maintenance work to be planned and executed more safely and efficiently, and the predictive models help prioritize areas needing attention (bp America, 2025b). This reduces unplanned downtime and maintenance costs in BP’s offshore operations (bp America, 2025c).

By improving asset uptime and reducing capital tied up in equipment and maintenance, these AI projects enhance asset productivity and lower capital employed. BP’s 2024 financial results show a ROACE of 14.2 % (BP p.l.c., 2025). AI driven efficiency supports this metric by increasing returns (through higher production and cost savings) while limiting additional capital investment.

BP is using technology to drive innovation in its Gulf of America operations, with safety and efficiency top of mind.

Digital twin and predictive analytics in the Gulf of Mexico – BP has rolled out “digital twin” technology on its Gulf of America platforms. A digital replica of each platform allows remote teams to conduct corrosion inspections and valve checks using laser scan data and machine learning models, cutting the time and risk of manual offshore inspections (bp America, 2025a). BP also uses high performance computing and AI to optimize drilling trajectories, reducing a months long process to days

The technology enables maintenance work to be planned and executed more safely and efficiently, and the predictive models help prioritize areas needing attention (bp America, 2025b). This reduces unplanned downtime and maintenance costs in BP’s offshore operations (bp America, 2025c).

By improving asset uptime and reducing capital tied up in equipment and maintenance, these AI projects enhance asset productivity and lower capital employed. BP’s 2024 financial results show a ROACE of 14.2 % (BP p.l.c., 2025). AI driven efficiency supports this metric by increasing returns (through higher production and cost savings) while limiting additional capital investment.

Figure 8.

BP ROACE vs Average Brent Crude Price (USD/barrel)

Figure 8.

BP ROACE vs Average Brent Crude Price (USD/barrel)

The figure illustrates the historical correlation between BP's financial performance (BP annual report 2024, 2025), measured by ROACE, and global oil prices over a decade (2014–2024) . The data reveals a clear sensitivity of BP’s returns to crude oil price fluctuations, characterized by three distinct phases:

• Market Volatility (2014–2020): Following the price crash in 2015 ($52/ barrel) and the demand shock in 2020 ($42/ barrel), BP recorded negative ROACE values of -4.2% and -4.9%, respectively. This underscores the vulnerability of capital returns during periods of depressed commodity prices.

• Peak Performance (2022): A significant decoupling of historical efficiency is observed in 2022. While oil prices reached $100/ barrel comparable to 2014 levels ($99/ barrel the ROACE in 2022 surged to 30.5%, compared to only 2.2% in 2014. This suggests substantial improvements in operational efficiency or capital discipline over the decade.

• Stabilization (2023–2024): As oil prices stabilized in the $80–$82 range, ROACE moderated to 14.2% in 2023 and 6.9% in 2024, indicating a normalization of returns post-crisis.

These case studies demonstrate that sustained reductions in operating expenses and rising ROACE correspond to AI-enabled efficiency improvements. Monitoring ROACE therefore provides a practical way to evaluate the effectiveness of AI implementation and its contribution to operational efficiency and profitability

3.6. Indicators for AI Implementation: Case Studies of Shell

Shell has a long history in technology and innovation. Shell has a global network of R&D centres and work closely with our customers, suppliers and partners also collaborate with some of the world's leading technology companies to deploy digital solutions at scale across our business.

Shell (Netherlands/UK) – AI driven predictive maintenance and digital twins

AI implementation and operations – Shell deployed an AI predictive maintenance programme using machine learning models, digital twins and the C3 AI platform. The system monitors more than 10,000 pieces of equipment across upstream, manufacturing and integrated gas assets globally (Bhashyam, 2022). It ingests data from over three million sensor streams and runs thousands of ML models to detect anomalies in pumps, compressors, valves and other critical machinery. The programme is integrated with Shell’s digital twin environment, providing a virtual representation of assets and allowing engineers to simulate and address issues remotely

Operational efficiency outcomes – AI based predictive maintenance reduces unplanned downtime by using resources more efficiently and extending asset life (Bhashyam, 2022). According to Energies Media’s 2025 report on digital twins, Shell’s system monitors equipment in real time and cuts unplanned downtime by 35 %, while also reducing maintenance costs by 20 % (Energies Media, 2025).

Financial performance outcomes – Shell’s AI enabled maintenance programme yields substantial cost savings. Energies Media reports that reducing unplanned downtime and maintenance costs by 20 % leads to about US$2 billion in annual savings. The system also boosts equipment performance by about 15 % (Energies Media, 2025), translating into higher production and revenue. BP’s adoption of digital twin technology is credited with producing 30,000 extra barrels of oil in one year, illustrating the financial benefit of similar AI tools in the sector.

Shell’s Capital Markets Day 2025 guidance targets an increase in ROACE from 6 % in 2024 to around 10 % by 2030 (Shell plc, 2025). The company notes that trading & supply activities have historically added ~2 % ROACE uplift per year. AI enabled predictive maintenance and optimization, which reduce unplanned downtime and improve resource utilization (C3.ai, 2022), contribute to higher returns on existing assets and therefore support the improvement in ROACE.

Shell’s 2025 Capital Markets Day materials stated that the company aims for $5–7 bn of cumulative structural cost reductions from 2022 to 2028, partly through procurement & supply chain optimization, cost savings from technology & AI implementation and corporate center simplification

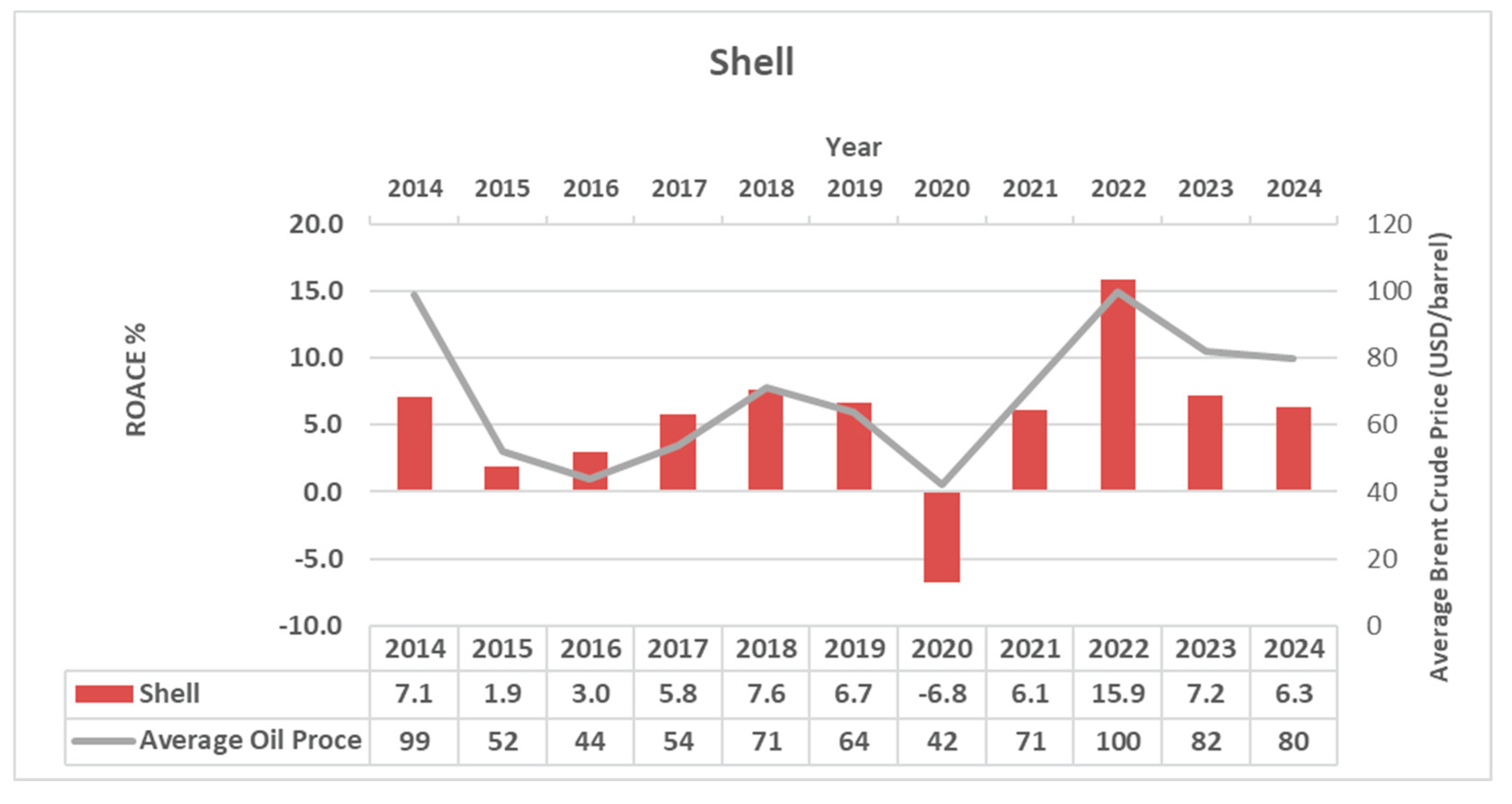

Figure 9.

Shell ROACE vs Average Brent Crude Price (USD/barrel)

Figure 9.

Shell ROACE vs Average Brent Crude Price (USD/barrel)

The analysis of Shell’s financial performance (Shell 2024, 2025) from 2014 to 2024 reveals a strong cyclical dependency on global crude oil prices, though with notable shifts in capital efficiency over time. Three key trends define this period:

• Impact of the 2020 Downturn: The data underscores the severity of the 2020 market collapse. As average oil prices fell to $42/barrel, Shell experienced its only negative performance in the dataset, with ROACE dropping to -6.8%, a sharp decline from the stable returns observed in 2018–2019.

• Efficiency Gains (2014 vs. 2022): A comparison of high-price environments indicates improved operational leverage. In 2014, an oil price of $99/ barrel yielded a ROACE of 7.1%. In contrast, when prices returned to a similar level in 2022 ($100/ barrel), ROACE more than doubled to 15.9%. This suggests that Shell has significantly lowered its breakeven point or optimized assets over the decade.

• Post-Peak Normalization: As oil prices moderated to the $80–$82 range in 2023 and 2024, ROACE stabilized between 6.3% and 7.2%, mirroring levels seen in 2018–2019 but achieving them at higher commodity price points.

The dataset shows a direct correlation between oil price and ROACE. Notably, the recovery slope post-2020 is steep, and the company achieved significantly higher returns in 2022 compared to 2014, despite nearly identical oil prices.

Case evidence from BP and Shell shows that AI particularly digital twins, predictive analytics, and large-scale machine-learning monitoring translates tangible operational gains into improved capital efficiency. Collectively, these cases justify employing OPEX, EBIT, and especially ROACE as headline indicators in an AI → OE → FP framework: AI-enabled efficiency raises returns while holding capital employed broadly constant, producing a clear, price-agnostic uplift in financial performance.

Therefore, operational efficiency acts as an intermediary variable that explains how AI adoption impacts financial performance. Understanding this mediating role is crucial for oil and gas companies seeking to strategically leverage AI to achieve tangible financial benefits. Companies need to focus not only on AI implementation but also on effectively leveraging AI to drive measurable improvements in operational efficiency to realize the desired financial outcomes (Teece et al., 1997). In the respective field many innovative solutions are introduced on a regular basis.

4. Discussion

Research world-wide are devoted to AI application in different fields examining different aspects of application of machine learning and artificial intelligence in oil and gas industry (Sircar et al., 2021), simulation (Wei, 2023) considering technology development (Castro et al., 2024), use of different materials (Shahzad et al., 2023) and different other aspects (Yao et al., 2023), (Salkovska et al., 2023, 2024) arranging discussions on scientific level where results of those research discussions could be usable for practical applications. Researchers have analysed important aspects of leveraging of AI models for enhanced operational efficiency in the oil and gas industry with special attention to driving production, many aspects of safety as well as cost optimization (Ljarwan et al., 2025) as all indicated aspects are on great importance. New ideas on revolutionizing AI and robotics in the oil and gas industry are discussed in academic community by deep analysis of digital innovations and implementation challenges in oil and gas industry (Baranidharan et al., 2025) with special attention to Harnessing technology and stressing the advantages and limitations. A lot of scientific investigations are devoted to case studies in different oil and petrol producing countries including Oman (Al Naamani and Elgeddawy, 2025) where the impact of management theories are analysed with emerging technologies to enhance operational efficiency in alignment with United Nation sustainable development goals in oil and gas industries. Results are included in the book (Al Naamani and Elgeddawy, 2025) where a lot of attention in included on research results on studies in systems, impact and results of decisions and very important aspect – control. Many researchers aspects of advancing predictive maintenance in the oil and gas industry including application of generative AI approach with GANs and LLMs for sustainable development are analysed in scientific community (Paroha, 2025) including international scientific conferences on communications in computer and information science (Paroha, 2025) where practical recommendations were suggested, Researchers have contributed to sustainability-based strategic framework development (Al-Hajri et al., 2025) for many aspects of digital transformation in the oil and gas industry (Al-Hajri et al., 2025) where significant innovations are proposed. Researchers have identified payable cluster distributions for improved reservoir characterization with a robust unsupervised machine learning strategy (Umar. et al., 2024) which is on great importance for oil and gas industry.

Despite the recognized potential of AI in the oil and gas industry, significant research gaps remain, particularly concerning the empirical quantification of operational efficiency's mediating role, industry and application-specific financial outcomes, integration with sustainability and ESG goals, and the influence of organizational and human factors, all of which necessitate further investigation even amidst ongoing global research into AI applications within this sector. While the literature highlights the significant potential of AI in the oil and gas industry, several research gaps and areas for future inquiry remain.

• Empirical Studies Quantifying the Mediating Effect: There is a need for more empirical research that directly quantifies the mediating role of operational efficiency in the AI-financial performance relationship. Future studies could employ statistical modelling and mediation analysis techniques to rigorously test this mediating effect using industry data (Baron and Kenny, 1986).

• Industry-Specific and Application-Specific Analysis: Further research is needed to examine the financial performance outcomes of AI adoption in specific segments of the oil and gas industry (e.g., upstream, midstream, downstream) and for specific AI applications (e.g., predictive maintenance, reservoir management, process optimization). This granular analysis can provide more targeted insights for companies considering AI investments (Ochieng et al., 2024). Those aspects are under research for academic researchers with practical involvement of practitioners.

• Integration with Sustainability and ESG Goals: Future research should explore the intersection of AI adoption, operational efficiency, financial performance, and sustainability goals in the oil and gas industry. How can AI be leveraged to simultaneously improve financial performance and contribute to environmental, social, and governance (ESG) objectives? This is an increasingly important area given the global focus on energy transition and sustainable development (AlGhanem and Mendy, 2024).

Organizational and Human Factors: The literature could further explore the organizational and human factors that influence the successful adoption and implementation of AI in oil and gas. Factors such as organizational culture, workforce skills, change management, and ethical considerations are critical for realizing the full potential of AI (AlGhanem and Mendy, 2024)